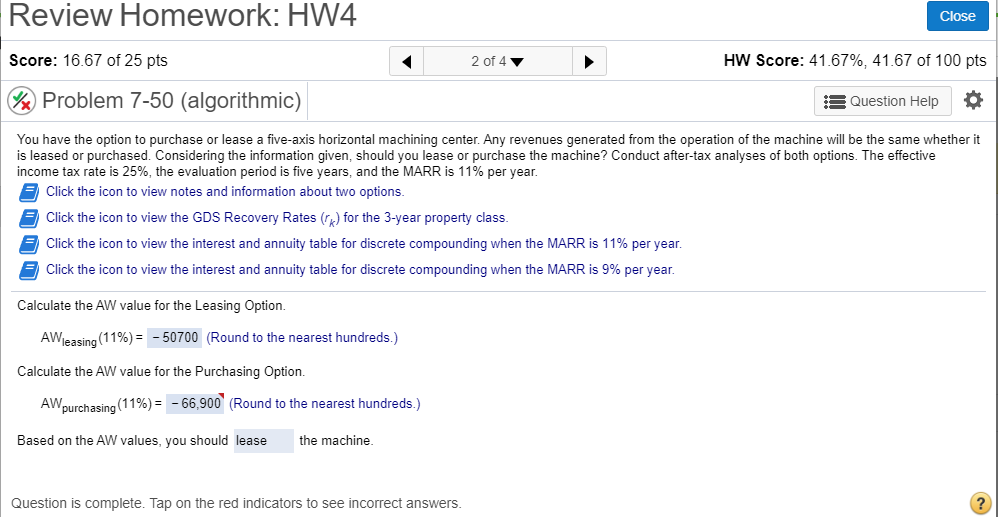

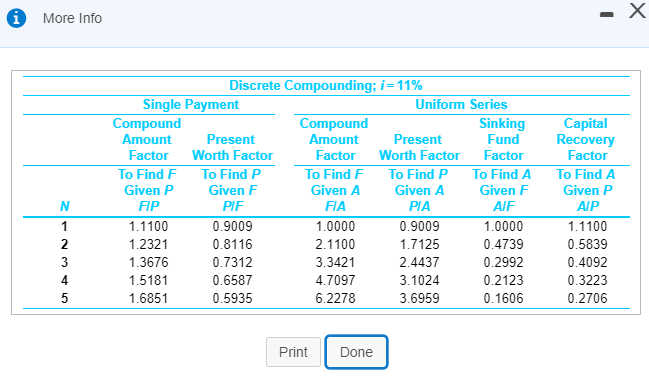

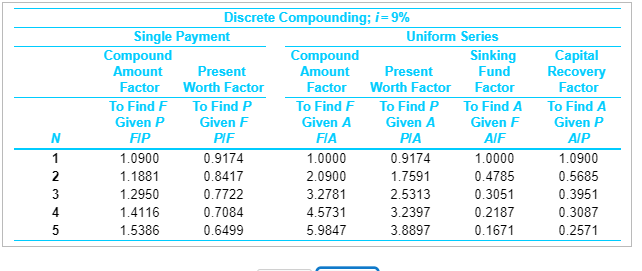

Please answer the AW (Annual Worth) for purchasing option and show work. If excel is used please show what formulas were used in each cell. The correct answer is shown and should be -66900.

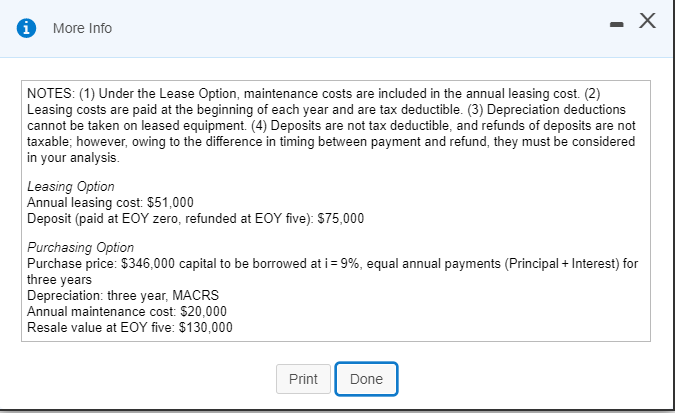

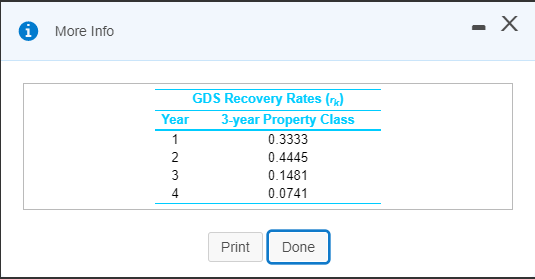

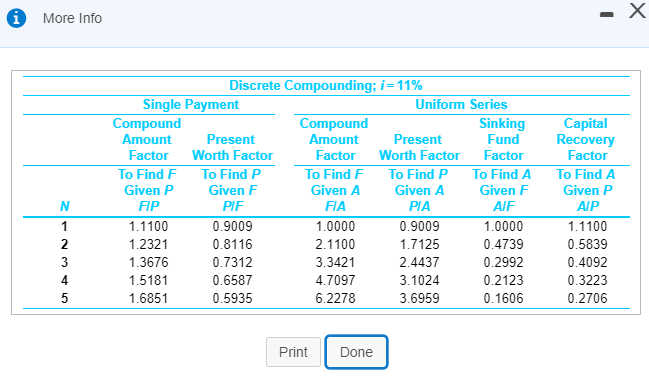

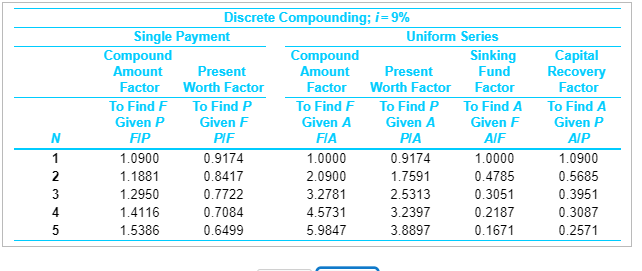

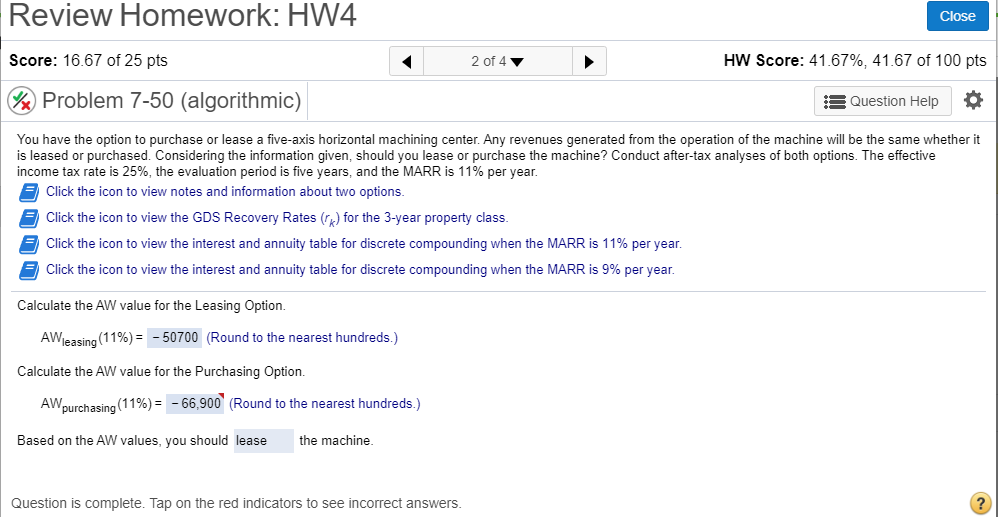

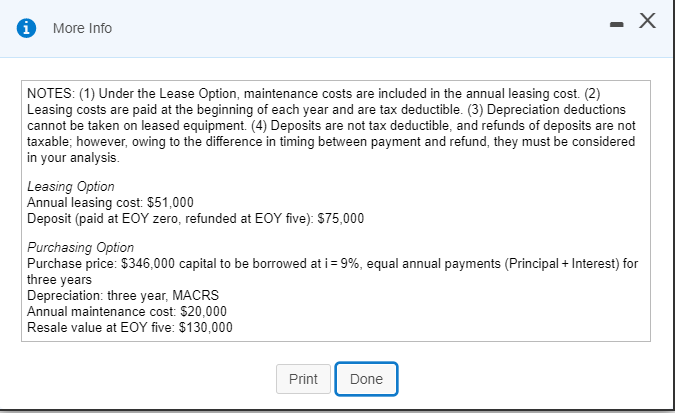

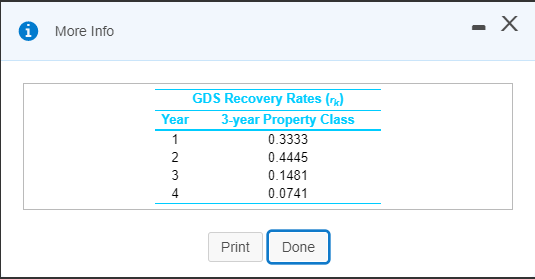

Review Homework: HW4 Close Score: 16.67 of 25 pts 2 of 4 HW Score: 41.67%, 41.67 of 100 pts % Problem 7-50 (algorithmic) s Question Help o You have the option to purchase or lease a five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the same whether it is leased or purchased. Considering the information given, should you lease or purchase the machine? Conduct after-tax analyses of both options. The effective income tax rate is 25%, the evaluation period is five years, and the MARR is 11% per year. Click the icon to view notes and information about two options. Click the icon to view the GDS Recovery Rates (K) for the 3-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 9% per year. Calculate the AW value for the Leasing Option. AWleasing (11%) = -50700 (Round to the nearest hundreds.) Calculate the AW value for the Purchasing Option AW purchasing (11%) = -66,900 (Round to the nearest hundreds.) Based on the AW values, you should lease the machine Question is complete. Tap on the red indicators to see incorrect answers. ? i - X More Info GDS Recovery Rates (nd Year 3-year Property Class 0.3333 2 0.4445 3 0.1481 4 0.0741 Print Done More Info Discrete Compounding; i=11% Single Payment Uniform Series Compound Compound Sinking Capital Amount Present Amount Present Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P FIP PIF FIA PIA AIF AIP 1.1100 0.9009 1.0000 0.9009 1.0000 1.1100 1.2321 0.8116 2.1100 1.7125 0.4739 0.5839 1.3676 0.7312 3.3421 2.4437 0.2992 0.4092 1.5181 0.6587 4.7097 3.1024 0.2123 0.3223 1.6851 0.5935 6.2278 3.6959 0.1606 0.2706 N 1 2 3 4 5 Print Done Discrete Compounding; i=9% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0900 0.9174 1.0000 0.9174 1.0000 1.1881 0.8417 2.0900 1.7591 0.4785 1.2950 0.7722 3.2781 2.5313 0.3051 1.4116 0.7084 4.5731 3.2397 0.2187 1.5386 0.6499 5.9847 3.8897 0.1671 N Capital Recovery Factor To Find A Given P AIP 1.0900 0.5685 0.3951 0.3087 0.2571 1 2 3 4 5 Review Homework: HW4 Close Score: 16.67 of 25 pts 2 of 4 HW Score: 41.67%, 41.67 of 100 pts % Problem 7-50 (algorithmic) s Question Help o You have the option to purchase or lease a five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the same whether it is leased or purchased. Considering the information given, should you lease or purchase the machine? Conduct after-tax analyses of both options. The effective income tax rate is 25%, the evaluation period is five years, and the MARR is 11% per year. Click the icon to view notes and information about two options. Click the icon to view the GDS Recovery Rates (K) for the 3-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 11% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 9% per year. Calculate the AW value for the Leasing Option. AWleasing (11%) = -50700 (Round to the nearest hundreds.) Calculate the AW value for the Purchasing Option AW purchasing (11%) = -66,900 (Round to the nearest hundreds.) Based on the AW values, you should lease the machine Question is complete. Tap on the red indicators to see incorrect answers. ? i - X More Info GDS Recovery Rates (nd Year 3-year Property Class 0.3333 2 0.4445 3 0.1481 4 0.0741 Print Done More Info Discrete Compounding; i=11% Single Payment Uniform Series Compound Compound Sinking Capital Amount Present Amount Present Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P FIP PIF FIA PIA AIF AIP 1.1100 0.9009 1.0000 0.9009 1.0000 1.1100 1.2321 0.8116 2.1100 1.7125 0.4739 0.5839 1.3676 0.7312 3.3421 2.4437 0.2992 0.4092 1.5181 0.6587 4.7097 3.1024 0.2123 0.3223 1.6851 0.5935 6.2278 3.6959 0.1606 0.2706 N 1 2 3 4 5 Print Done Discrete Compounding; i=9% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIF FIA PIA AIF 1.0900 0.9174 1.0000 0.9174 1.0000 1.1881 0.8417 2.0900 1.7591 0.4785 1.2950 0.7722 3.2781 2.5313 0.3051 1.4116 0.7084 4.5731 3.2397 0.2187 1.5386 0.6499 5.9847 3.8897 0.1671 N Capital Recovery Factor To Find A Given P AIP 1.0900 0.5685 0.3951 0.3087 0.2571 1 2 3 4 5