please answer the blue boxes :) THANK YOU

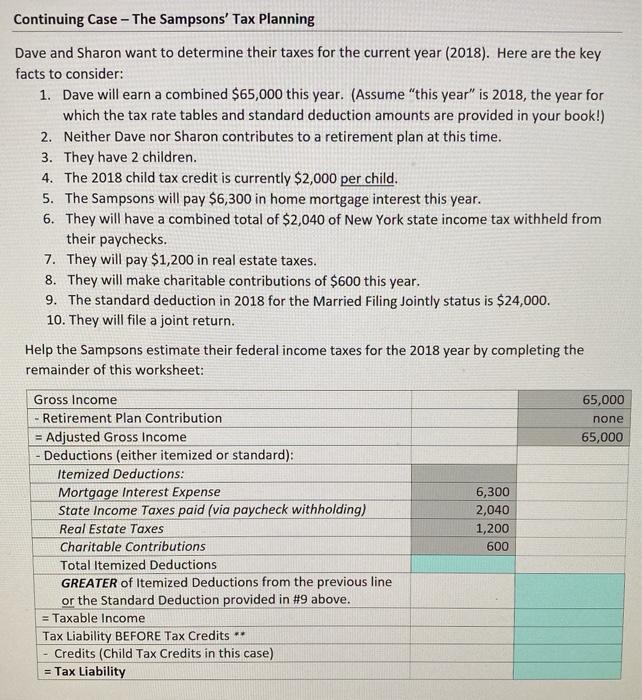

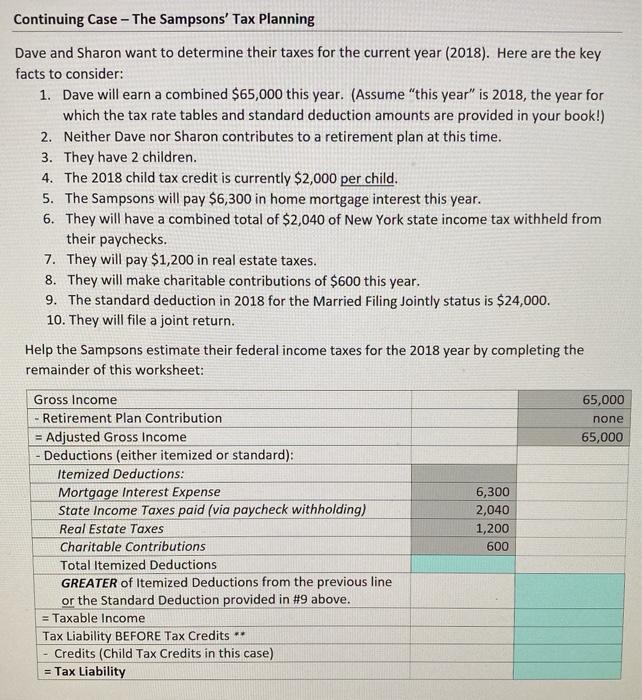

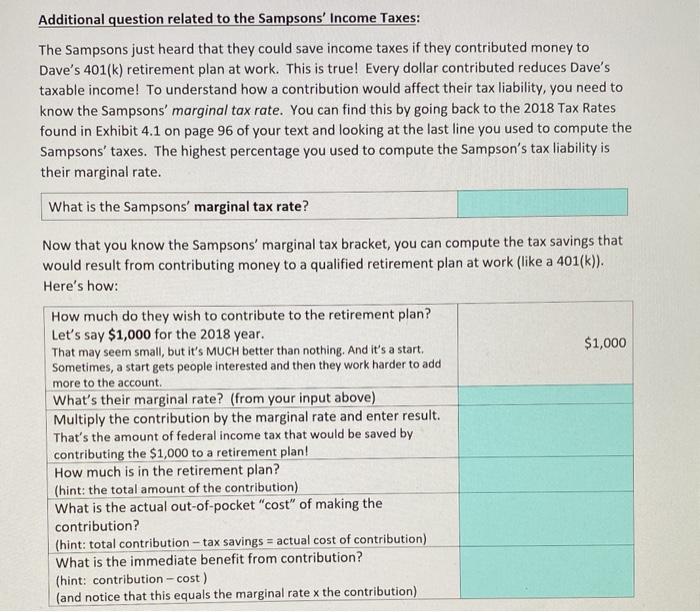

Continuing Case - The Sampsons' Tax Planning Dave and Sharon want to determine their taxes for the current year (2018). Here are the key facts to consider: 1. Dave will earn a combined $65,000 this year. (Assume "this year" is 2018, the year for which the tax rate tables and standard deduction amounts are provided in your book!) 2. Neither Dave nor Sharon contributes to a retirement plan at this time. 3. They have 2 children. 4. The 2018 child tax credit is currently $2,000 per child. 5. The Sampsons will pay $6,300 in home mortgage interest this year. 6. They will have a combined total of $2,040 of New York state income tax withheld from their paychecks. 7. They will pay $1,200 in real estate taxes. 8. They will make charitable contributions of $600 this year. 9. The standard deduction in 2018 for the Married Filing Jointly status is $24,000. 10. They will file a joint return. Help the Sampsons estimate their federal income taxes for the 2018 year by completing the remainder of this worksheet: 65,000 none 65,000 Gross Income Retirement Plan Contribution = Adjusted Gross Income - Deductions (either itemized or standard): Itemized Deductions: Mortgage Interest Expense State Income Taxes paid (via paycheck withholding) Real Estate Taxes Charitable Contributions Total Itemized Deductions GREATER of itemized Deductions from the previous line or the Standard Deduction provided in #9 above. = Taxable Income Tax Liability BEFORE Tax Credits ** - Credits (Child Tax Credits in this case) = Tax Liability 6,300 2,040 1,200 600 Additional question related to the Sampsons' Income Taxes: The Sampsons just heard that they could save income taxes if they contributed money to Dave's 401(k) retirement plan at work. This is true! Every dollar contributed reduces Dave's taxable income! To understand how a contribution would affect their tax liability, you need to know the Sampsons' marginal tax rate. You can find this by going back to the 2018 Tax Rates found in Exhibit 4.1 on page 96 of your text and looking at the last line you used to compute the Sampsons' taxes. The highest percentage you used to compute the Sampson's tax liability is their marginal rate. What is the Sampsons' marginal tax rate? Now that you know the Sampsons' marginal tax bracket, you can compute the tax savings that would result from contributing money to a qualified retirement plan at work (like a 401(k)). Here's how: How much do they wish to contribute to the retirement plan? Let's say $1,000 for the 2018 year. That may seem small, but it's MUCH better than nothing. And it's a start, $1,000 Sometimes, a start gets people interested and then they work harder to add more to the account What's their marginal rate? (from your input above) Multiply the contribution by the marginal rate and enter result. That's the amount of federal income tax that would be saved by contributing the $1,000 to a retirement plan! How much is in the retirement plan? (hint: the total amount of the contribution) What is the actual out-of-pocket "cost" of making the contribution? (hint: total contribution-tax savings = actual cost of contribution) What is the immediate benefit from contribution? (hint: contribution - cost) (and notice that this equals the marginal rate x the contribution) Continuing Case - The Sampsons' Tax Planning Dave and Sharon want to determine their taxes for the current year (2018). Here are the key facts to consider: 1. Dave will earn a combined $65,000 this year. (Assume "this year" is 2018, the year for which the tax rate tables and standard deduction amounts are provided in your book!) 2. Neither Dave nor Sharon contributes to a retirement plan at this time. 3. They have 2 children. 4. The 2018 child tax credit is currently $2,000 per child. 5. The Sampsons will pay $6,300 in home mortgage interest this year. 6. They will have a combined total of $2,040 of New York state income tax withheld from their paychecks. 7. They will pay $1,200 in real estate taxes. 8. They will make charitable contributions of $600 this year. 9. The standard deduction in 2018 for the Married Filing Jointly status is $24,000. 10. They will file a joint return. Help the Sampsons estimate their federal income taxes for the 2018 year by completing the remainder of this worksheet: 65,000 none 65,000 Gross Income Retirement Plan Contribution = Adjusted Gross Income - Deductions (either itemized or standard): Itemized Deductions: Mortgage Interest Expense State Income Taxes paid (via paycheck withholding) Real Estate Taxes Charitable Contributions Total Itemized Deductions GREATER of itemized Deductions from the previous line or the Standard Deduction provided in #9 above. = Taxable Income Tax Liability BEFORE Tax Credits ** - Credits (Child Tax Credits in this case) = Tax Liability 6,300 2,040 1,200 600 Additional question related to the Sampsons' Income Taxes: The Sampsons just heard that they could save income taxes if they contributed money to Dave's 401(k) retirement plan at work. This is true! Every dollar contributed reduces Dave's taxable income! To understand how a contribution would affect their tax liability, you need to know the Sampsons' marginal tax rate. You can find this by going back to the 2018 Tax Rates found in Exhibit 4.1 on page 96 of your text and looking at the last line you used to compute the Sampsons' taxes. The highest percentage you used to compute the Sampson's tax liability is their marginal rate. What is the Sampsons' marginal tax rate? Now that you know the Sampsons' marginal tax bracket, you can compute the tax savings that would result from contributing money to a qualified retirement plan at work (like a 401(k)). Here's how: How much do they wish to contribute to the retirement plan? Let's say $1,000 for the 2018 year. That may seem small, but it's MUCH better than nothing. And it's a start, $1,000 Sometimes, a start gets people interested and then they work harder to add more to the account What's their marginal rate? (from your input above) Multiply the contribution by the marginal rate and enter result. That's the amount of federal income tax that would be saved by contributing the $1,000 to a retirement plan! How much is in the retirement plan? (hint: the total amount of the contribution) What is the actual out-of-pocket "cost" of making the contribution? (hint: total contribution-tax savings = actual cost of contribution) What is the immediate benefit from contribution? (hint: contribution - cost) (and notice that this equals the marginal rate x the contribution)