Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the Bullet points. Thank you Case study 1 Investment A project for an industrial settlement is under analysis, the expected monthly production in

Please answer the Bullet points. Thank you

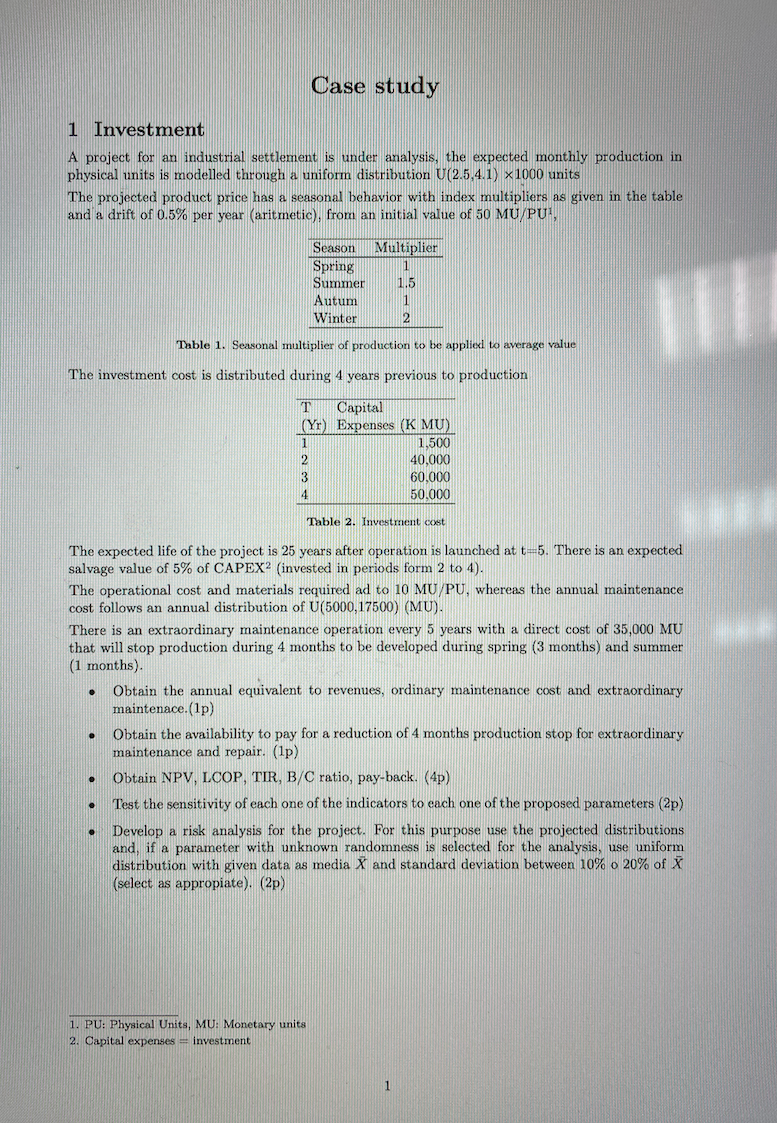

Case study 1 Investment A project for an industrial settlement is under analysis, the expected monthly production in physical units is modelled through a uniform distribution U(2.5.4.1) x1000 units The projected product price has a seasonal behavior with index multipliers as given in the table and a drift of 0.5% per year (aritmetic), from an initial value of 50 MU/PU, Season Multiplier Spring 1 Summer 1.5 Autum 1 Winter 2 Table 1. Seasonal multiplier of production to be applied to average value The investment cost is distributed during 4 years previous to production T Capital (Yr) Expenses (KMU) 1 1,500 2 40,000 3 60.000 4 50,000 Table 2. Investment cost The expected life of the project is 25 years after operation is launched at t=5. There is an expected salvage value of 5% of CAPEX (invested in periods form 2 to 4). The operational cost and materials required ad to 10 MU/PU, whereas the annual maintenance cost follows an annual distribution of U(5000,17500) (MU). There is an extraordinary maintenance operation every 5 years with a direct cost of 35,000 MU that will stop production during 4 months to be developed during spring (3 months) and summer (1 months). Obtain the annual equivalent to revenues, ordinary maintenance cost and extraordinary maintenace. (1p) Obtain the availability to pay for a reduction of 4 months production stop for extraordinary maintenance and repair. (1p) Obtain NPV, LCOP, TIR, B/C ratio, pay-back. (4p) Test the sensitivity of each one of the indicators to each one of the proposed parameters (2p) Develop a risk analysis for the project. For this purpose use the projected distributions and, if a parameter with unknown randomness is selected for the analysis, use uniform distribution with given data as media X and standard deviation between 10% o 20% of X (select as appropiate). (2p) 1. PU: Physical Units, MU: Monetary units 2. Capital expenses = investment 1 Case study 1 Investment A project for an industrial settlement is under analysis, the expected monthly production in physical units is modelled through a uniform distribution U(2.5.4.1) x1000 units The projected product price has a seasonal behavior with index multipliers as given in the table and a drift of 0.5% per year (aritmetic), from an initial value of 50 MU/PU, Season Multiplier Spring 1 Summer 1.5 Autum 1 Winter 2 Table 1. Seasonal multiplier of production to be applied to average value The investment cost is distributed during 4 years previous to production T Capital (Yr) Expenses (KMU) 1 1,500 2 40,000 3 60.000 4 50,000 Table 2. Investment cost The expected life of the project is 25 years after operation is launched at t=5. There is an expected salvage value of 5% of CAPEX (invested in periods form 2 to 4). The operational cost and materials required ad to 10 MU/PU, whereas the annual maintenance cost follows an annual distribution of U(5000,17500) (MU). There is an extraordinary maintenance operation every 5 years with a direct cost of 35,000 MU that will stop production during 4 months to be developed during spring (3 months) and summer (1 months). Obtain the annual equivalent to revenues, ordinary maintenance cost and extraordinary maintenace. (1p) Obtain the availability to pay for a reduction of 4 months production stop for extraordinary maintenance and repair. (1p) Obtain NPV, LCOP, TIR, B/C ratio, pay-back. (4p) Test the sensitivity of each one of the indicators to each one of the proposed parameters (2p) Develop a risk analysis for the project. For this purpose use the projected distributions and, if a parameter with unknown randomness is selected for the analysis, use uniform distribution with given data as media X and standard deviation between 10% o 20% of X (select as appropiate). (2p) 1. PU: Physical Units, MU: Monetary units 2. Capital expenses = investment 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started