please answer the circled ones

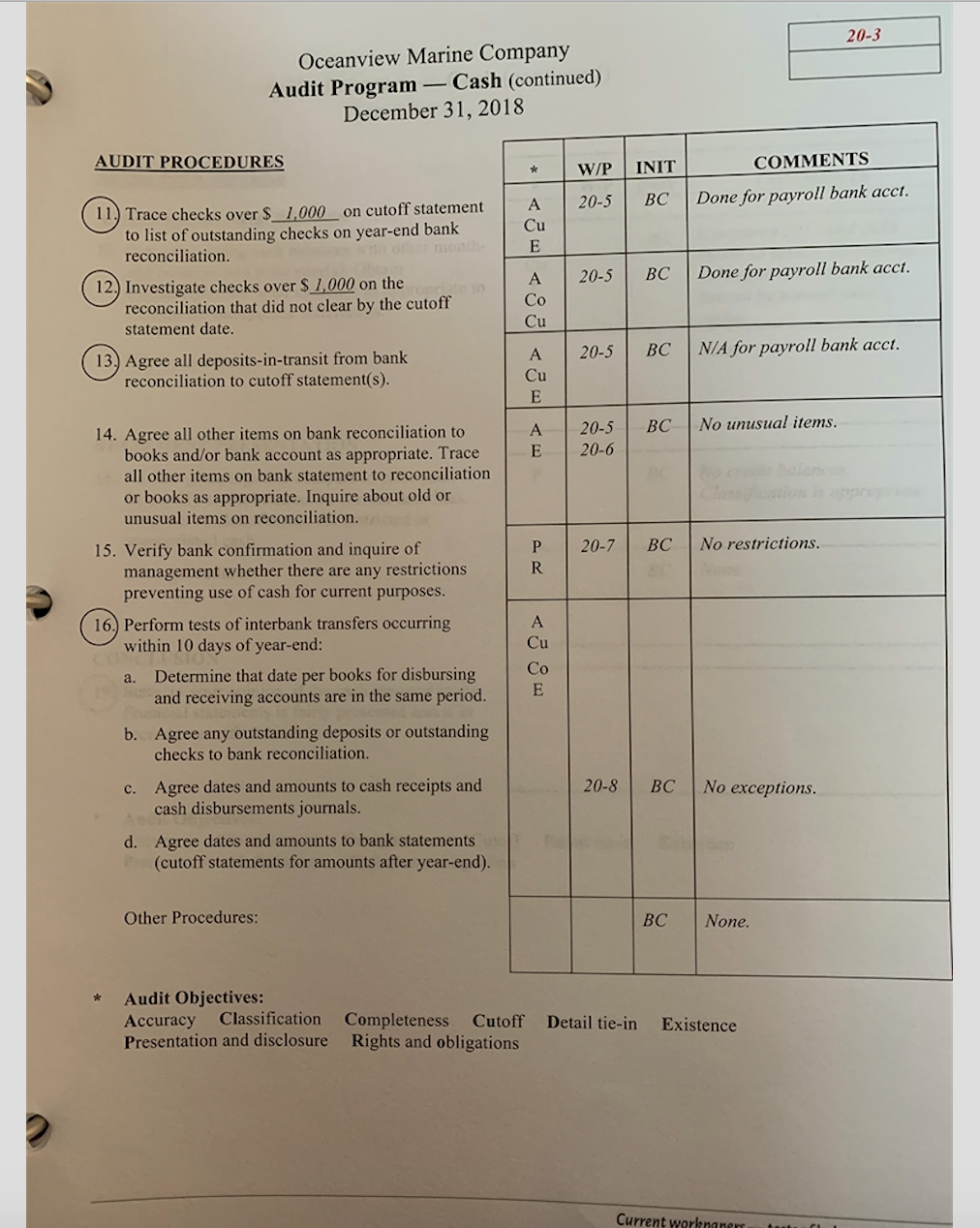

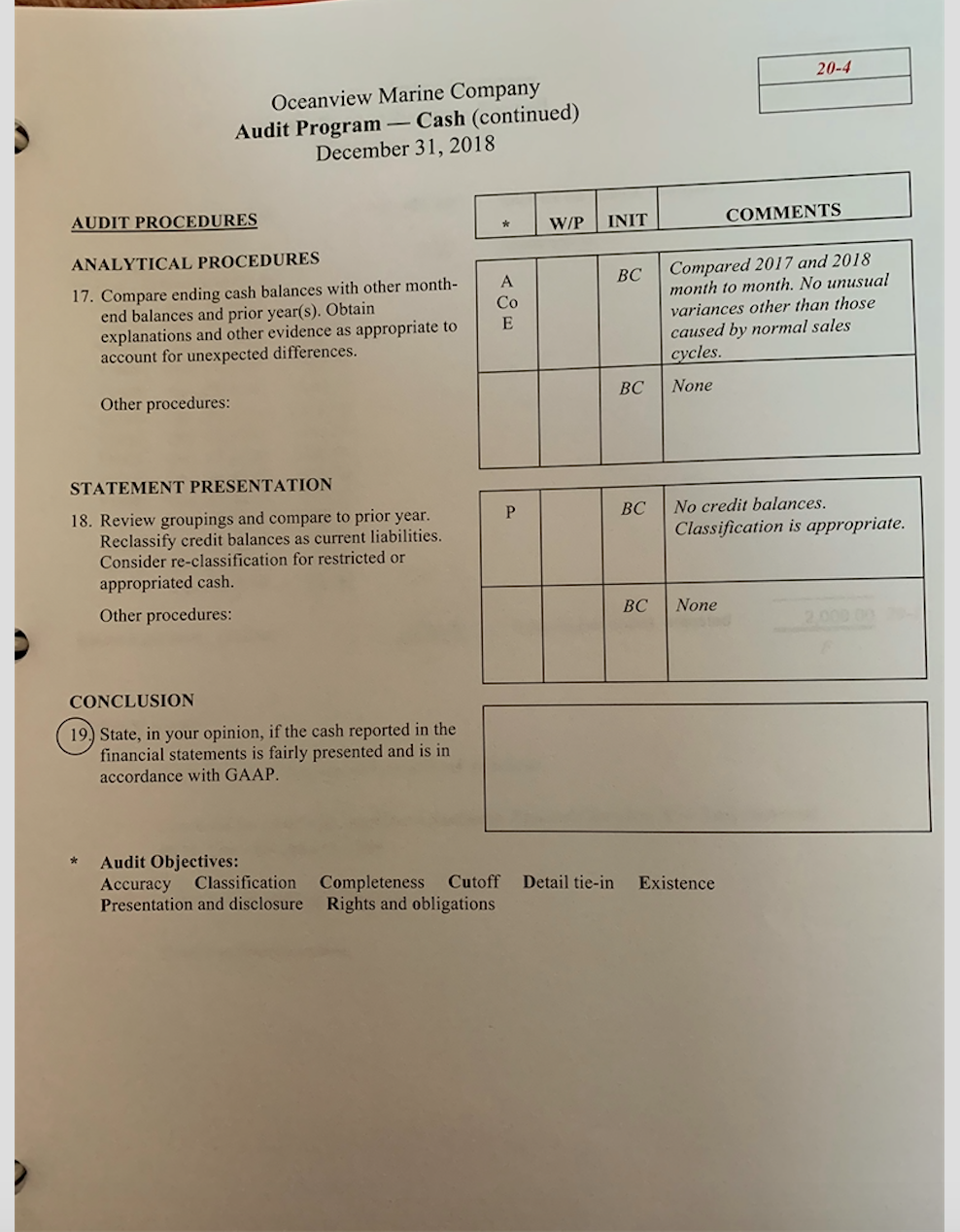

20-3 Oceanview Marine Company Audit Program Cash (continued) December 31, 2018 AUDIT PROCEDURES W/P INIT COMMENTS 20-5 BC Done for payroll bank acct. A Cu E 20-5 BC Done for payroll bank acct. 1. Trace checks over $_1,000_on cutoff statement to list of outstanding checks on year-end bank reconciliation 12. Investigate checks over $ 1,000 on the reconciliation that did not clear by the cutoff statement date. 13. Agree all deposits-in-transit from bank reconciliation to cutoff statement(s). A Cu 20-5 BC N/A for payroll bank acct. A Cu E BC No unusual items. A E 20-5 20-6 14. Agree all other items on bank reconciliation to books and/or bank account as appropriate. Trace all other items on bank statement to reconciliation or books as appropriate. Inquire about old or unusual items on reconciliation. 20-7 BC No restrictions. P R 15. Verify bank confirmation and inquire of management whether there are any restrictions preventing use of cash for current purposes. 16. Perform tests of interbank transfers occurring A Cu Co E within 10 days of year-end: a. Determine that date per books for disbursing and receiving accounts are in the same period. b. Agree any outstanding deposits or outstanding checks to bank reconciliation. c. Agree dates and amounts to cash receipts and cash disbursements journals. d. Agree dates and amounts to bank statements (cutoff statements for amounts after year-end). 20-8 BC No exceptions. Other Procedures: BC None. Audit Objectives: Accuracy Classification Presentation and disclosure Detail tie-in Completeness Cutoff Rights and obligations Existence Current warknaner 20-4 Oceanview Marine Company Audit Program - Cash (continued) December 31, 2018 AUDIT PROCEDURES W/P INIT COMMENTS BC ANALYTICAL PROCEDURES 17. Compare ending cash balances with other month- end balances and prior year(s). Obtain explanations and other evidence as appropriate to account for unexpected differences. A E Compared 2017 and 2018 month to month. No unusual variances other than those caused by normal sales cycles. BC None Other procedures: P BC No credit balances. Classification is appropriate. STATEMENT PRESENTATION 18. Review groupings and compare to prior year. Reclassify credit balances as current liabilities. Consider re-classification for restricted or appropriated cash. Other procedures: BC None CONCLUSION 19. State, in your opinion, if the cash reported in the financial statements is fairly presented and is in accordance with GAAP. Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Presentation and disclosure Rights and obligations Existence 20-3 Oceanview Marine Company Audit Program Cash (continued) December 31, 2018 AUDIT PROCEDURES W/P INIT COMMENTS 20-5 BC Done for payroll bank acct. A Cu E 20-5 BC Done for payroll bank acct. 1. Trace checks over $_1,000_on cutoff statement to list of outstanding checks on year-end bank reconciliation 12. Investigate checks over $ 1,000 on the reconciliation that did not clear by the cutoff statement date. 13. Agree all deposits-in-transit from bank reconciliation to cutoff statement(s). A Cu 20-5 BC N/A for payroll bank acct. A Cu E BC No unusual items. A E 20-5 20-6 14. Agree all other items on bank reconciliation to books and/or bank account as appropriate. Trace all other items on bank statement to reconciliation or books as appropriate. Inquire about old or unusual items on reconciliation. 20-7 BC No restrictions. P R 15. Verify bank confirmation and inquire of management whether there are any restrictions preventing use of cash for current purposes. 16. Perform tests of interbank transfers occurring A Cu Co E within 10 days of year-end: a. Determine that date per books for disbursing and receiving accounts are in the same period. b. Agree any outstanding deposits or outstanding checks to bank reconciliation. c. Agree dates and amounts to cash receipts and cash disbursements journals. d. Agree dates and amounts to bank statements (cutoff statements for amounts after year-end). 20-8 BC No exceptions. Other Procedures: BC None. Audit Objectives: Accuracy Classification Presentation and disclosure Detail tie-in Completeness Cutoff Rights and obligations Existence Current warknaner 20-4 Oceanview Marine Company Audit Program - Cash (continued) December 31, 2018 AUDIT PROCEDURES W/P INIT COMMENTS BC ANALYTICAL PROCEDURES 17. Compare ending cash balances with other month- end balances and prior year(s). Obtain explanations and other evidence as appropriate to account for unexpected differences. A E Compared 2017 and 2018 month to month. No unusual variances other than those caused by normal sales cycles. BC None Other procedures: P BC No credit balances. Classification is appropriate. STATEMENT PRESENTATION 18. Review groupings and compare to prior year. Reclassify credit balances as current liabilities. Consider re-classification for restricted or appropriated cash. Other procedures: BC None CONCLUSION 19. State, in your opinion, if the cash reported in the financial statements is fairly presented and is in accordance with GAAP. Audit Objectives: Accuracy Classification Completeness Cutoff Detail tie-in Presentation and disclosure Rights and obligations Existence