Please answer the entire problem. will give thumbs up

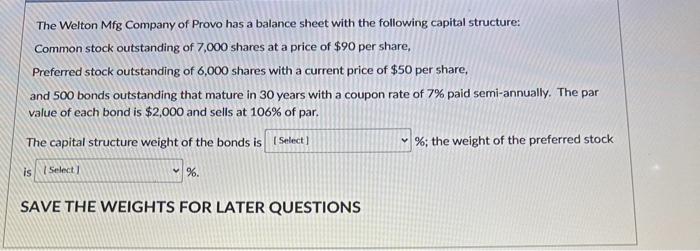

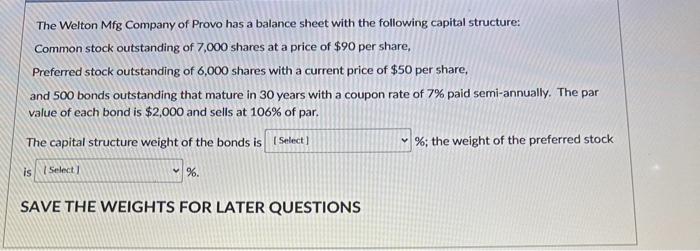

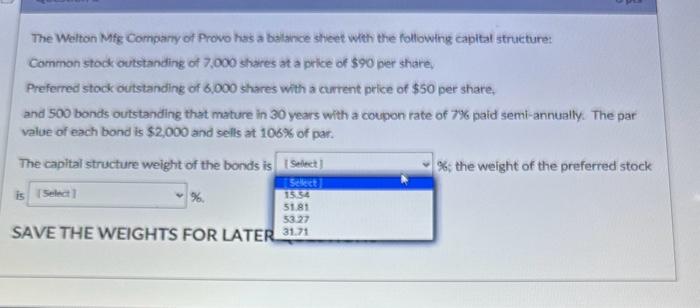

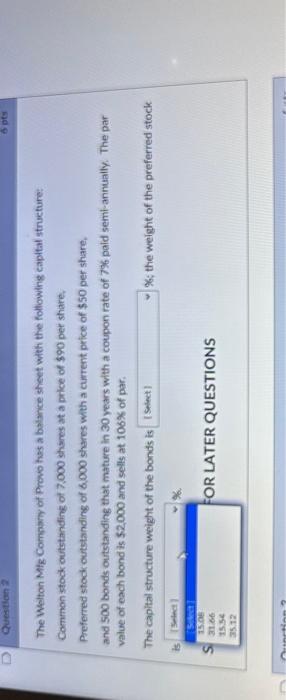

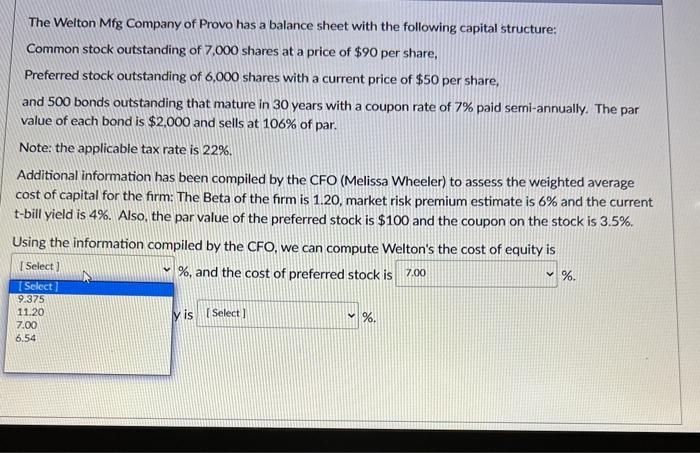

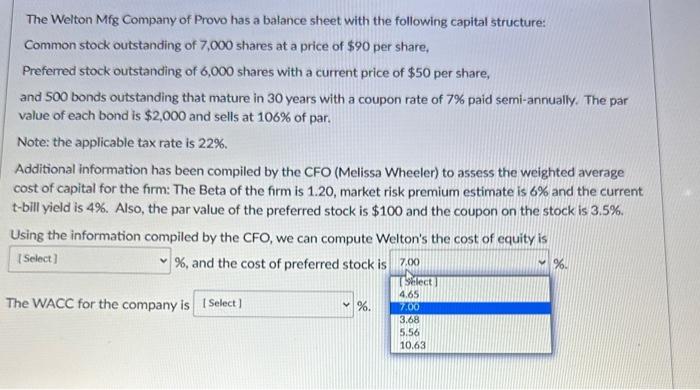

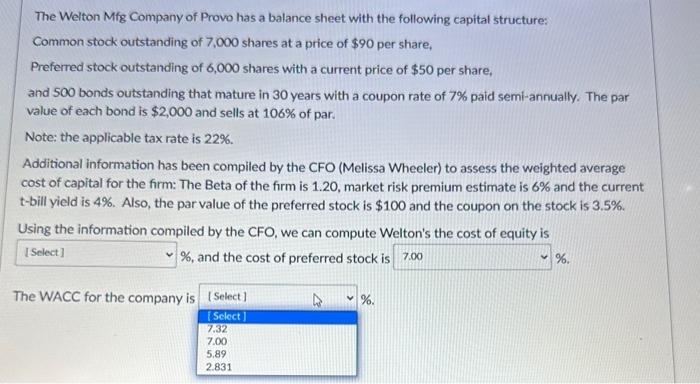

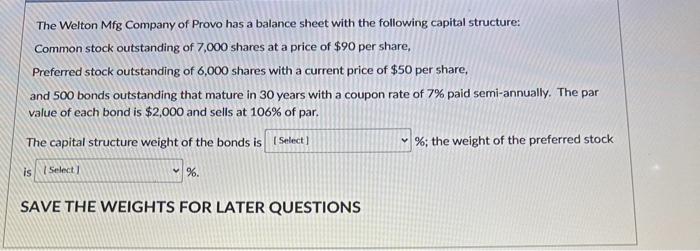

The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. The capital structure weight of the bonds is %; the weight of the preferred stock %. SAVE THE WEIGHTS FOR LATER QUESTIONS The Welton Mig Company of Provo has a balance sheet wth the following capital structure: Common stodk outstanding of 7,000 sheres at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a cumtent price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par velue of each bond is $2,000 and sells at 106% of par. The capitai structure weight of the bonds is \%; the weight of the preferred stock is SAVE THE WEIGHTS FOR LATEF The Welton Mig Comnary of Prows hus a balance sheet with the following caplal structure: Common stock outstanding of 7,000 sheres at a price of $90 per share. Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. The capital structure weight of the bonds is \%; the weight of the preferred stock R LATER QUESTIONS The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. Note: the applicable tax rate is 22%. Additional information has been compiled by the CFO (Melissa Wheeler) to assess the weighted average cost of capital for the firm: The Beta of the firm is 1.20, market risk premium estimate is 6% and the current t-bill yield is 4%. Also, the par value of the preferred stock is $100 and the coupon on the stock is 3.5%. Using the information compiled by the CFO, we can compute Welton's the cost of equity is %, and the cost of preferred stock is % ris % The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. Note: the applicable tax rate is 22%. Additional information has been compiled by the CFO (Melissa Wheeler) to assess the weighted average cost of capital for the firm: The Beta of the firm is 1.20 , market risk premium estimate is 6% and the current t-bill yield is 4%. Also, the par value of the preferred stock is $100 and the coupon on the stock is 3.5%. Using the information compiled by the CFO, we can compute Welton's the cost of equity is %, and the cost of preferred stock is %. The WACC for the company is %. The Welton Mfg Company of Provo has a balance sheet with the following capital structure: Common stock outstanding of 7,000 shares at a price of $90 per share, Preferred stock outstanding of 6,000 shares with a current price of $50 per share, and 500 bonds outstanding that mature in 30 years with a coupon rate of 7% paid semi-annually. The par value of each bond is $2,000 and sells at 106% of par. Note: the applicable tax rate is 22%. Additional information has been compiled by the CFO (Melissa Wheeler) to assess the weighted average cost of capital for the firm: The Beta of the firm is 1.20 , market risk premium estimate is 6% and the current t-bill yield is 4%. Also, the par value of the preferred stock is $100 and the coupon on the stock is 3.5%. Using the information compiled by the CFO, we can compute Welton's the cost of equity is %, and the cost of preferred stock is %. The WACC for the company is %