Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the entire question (both pictures is one question) Which do you prefer a bank account that pays 5.7% per year (EAR) for three

please answer the entire question (both pictures is one question)

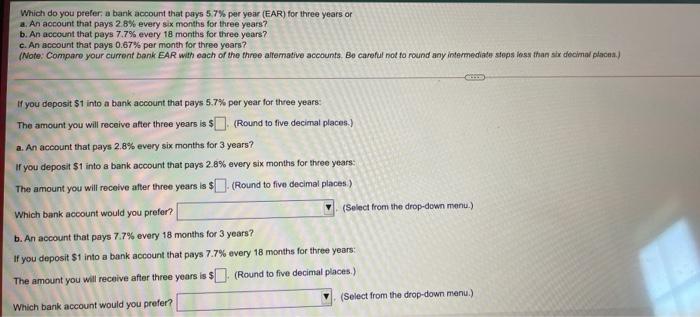

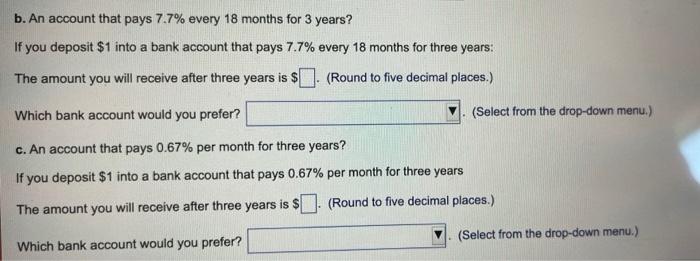

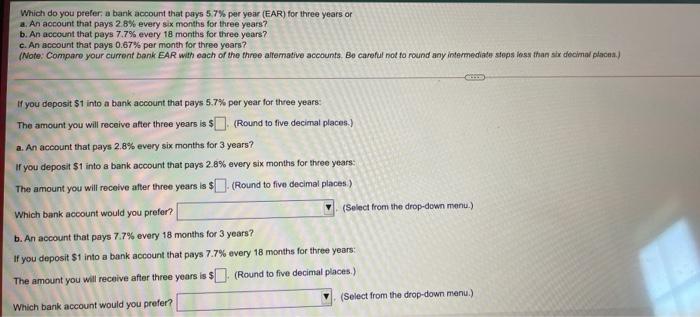

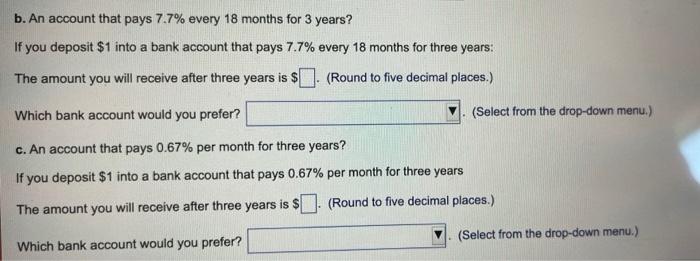

Which do you prefer a bank account that pays 5.7% per year (EAR) for three years or a. An account that pays 28% every six months for three years? b. An account that pays 7.7% every 18 months for three years? c. An account that pays 0.67% per month for three years? (Note: Compare your current bank EAR with each of the three alternative accounts. Be careful not to round any intermediate steps less than six decimal plana) if you deposit $1 into a bank account that pays 5.7% per year for three years: The amount you will receive after three years is $| (Round to five decimal places.) a. An account that pays 2.8% every six months for 3 years? If you deposit $1 into a bank account that pays 2.8% every six months for three years: The amount you will receive after three years is $1(Round to five decimal places) Which bank account would you prefer? (Select from the drop-down menu.) b. An account that pays 7.7% every 18 months for 3 years? If you deposit $1 into a bank account that pays 7.7% every 18 months for three years: The amount you will receive after three years is $(Round to five decimal places) $ Which bank account would you prefer? (Select from the drop-down menu.) b. An account that pays 7.7% every 18 months for 3 years? If you deposit $1 into a bank account that pays 7.7% every 18 months for three years: The amount you will receive after three years is $(). (Round to five decimal places.) Which bank account would you prefer? (Select from the drop-down menu.) c. An account that pays 0.67% per month for three years? If you deposit $1 into a bank account that pays 0.67% per month for three years The amount you will receive after three years is $ . (Round to five decimal places.) (Select from the drop-down menu.) Which bank account would you prefer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started