Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the first question.i am going to post the second one again 1. The following trial balance was extracted from the books of Mr.

please answer the first question.i am going to post the second one again

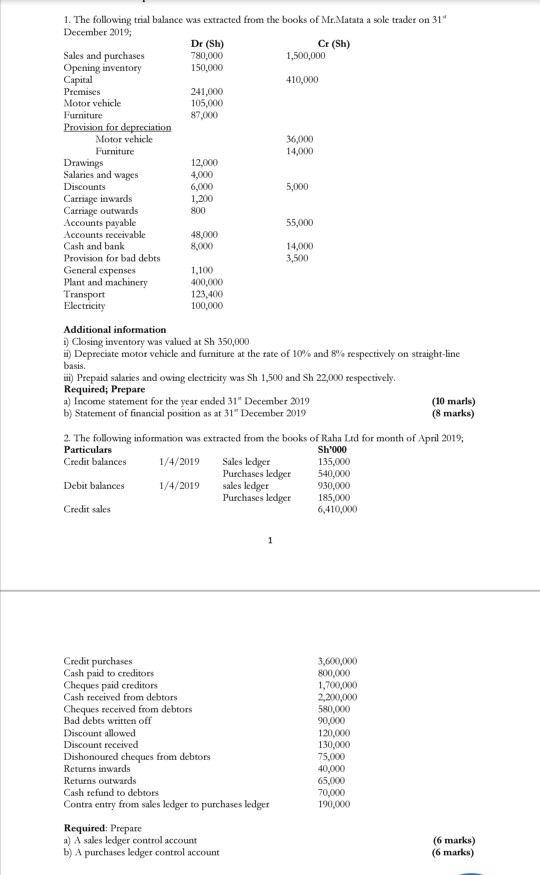

1. The following trial balance was extracted from the books of Mr. Matata a sole trader on 31" December 2019; De (Sh) Cr (Sh) Sales and purchases 780,000 1,500,000 Opening inventory 150,000 Capital 410,000 Premises 241,000 Motor vehicle 105,000 Furniture 87.000 Provision for depreciation Motor vehicle 36,000 Furniture 14,000 Drawings 12,000 Salaries and wages 4,000 Discounts 6.000 5,000 Carriage inwards 1,200 Carriage outwards Accounts payable 55,000 Accounts receivable 48,000 Cash and bank 8,000 14.000 Provision for bad debts 3,500 General expenses 1.100 Plant and machinery 400.000 Transport 123,400 Electricity 100,000 800 Additional information i) Closing inventory was valued at Sh 350,000 u Depreciate motor vehicle and furniture at the rate of 10% and 8% respectively on straight-line basis. 1) Prepaid salaries and owing electricity was Sh 1,500 and Sh 22,000 respectively. Required; Prepare a) Income statement for the year ended 31 December 2019 (10 marls) b) Statement of financial position as at 31 December 2019 (8 marks) 2. The following information was extracted from the books of Raha Ltd for month of April 2019, Particulars Sh'000 Credit balances 1/4/2019 Sales ledger 135,000 Purchases ledger 540,000 Debit balances 1/4/2019 sales ledger 930,000 Purchases ledger 185,000 Credit sales 6,410,000 Credit purchases Cash paid to creditors Cheques paid creditors Cash received from debtors Cheques received from debtors Bad debts written off Discount allowed Discount received Dishonoured cheques from debtors Returns inwards Returns outwards Cash refund to debtors Contra entry from sales ledger to purchases ledger 3,600,000 800,000 1,700,000 2,200,000 580,000 90,000 120,000 130,000 75,000 40,000 65,000 70,000 190.000 Required: Prepare a) A sales ledger control account b) A purchases ledger control account (6 marks) (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started