Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following Income Tax Software (Profile) Questions. Which of the following statements regarding the reporting of business income on the corporate tax return

Please answer the following Income Tax Software (Profile) Questions.

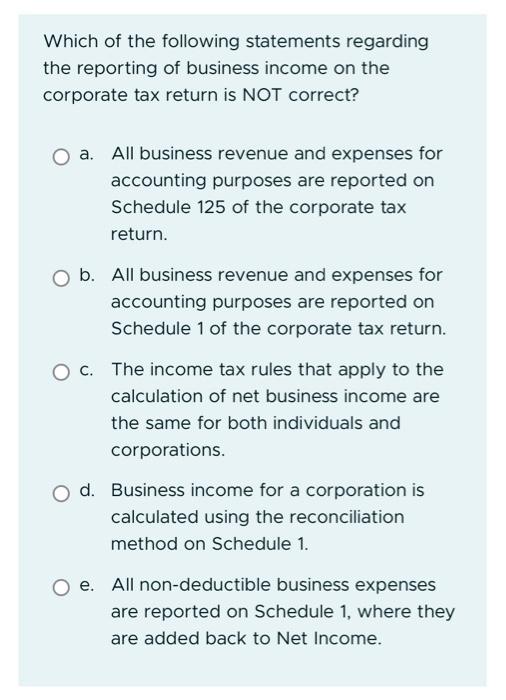

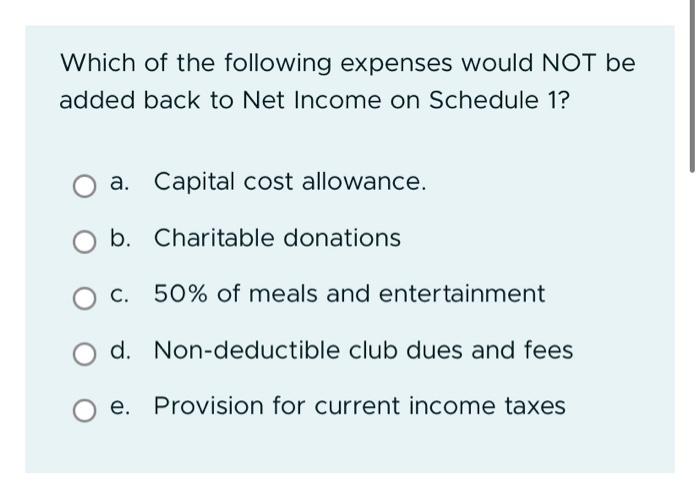

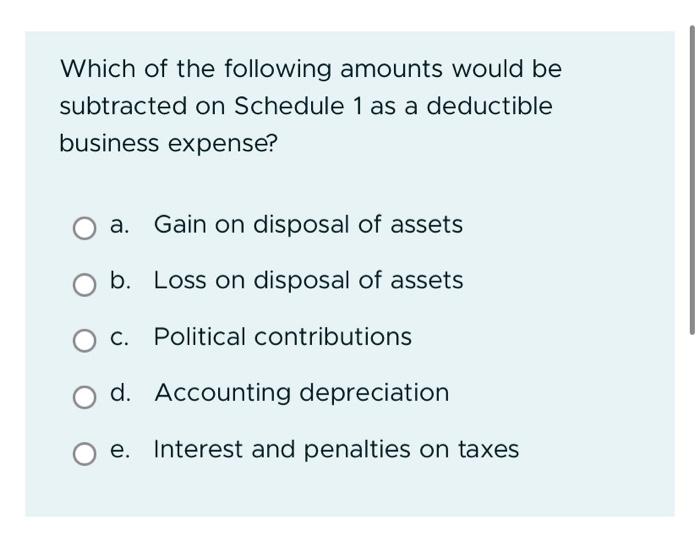

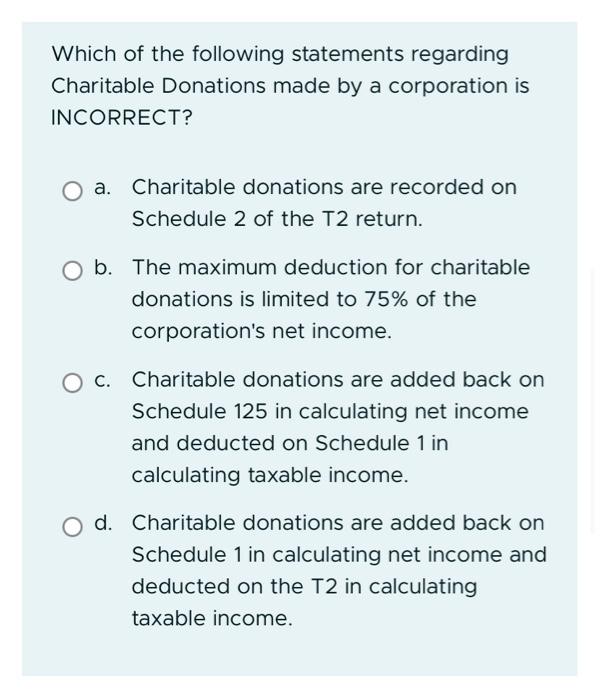

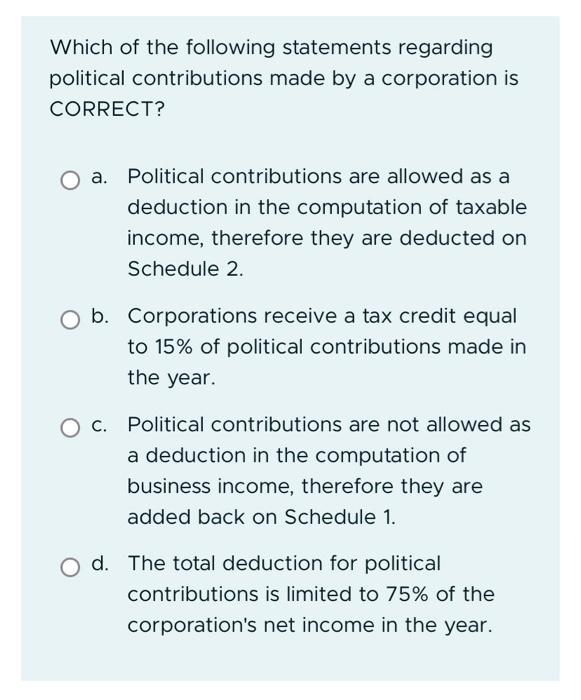

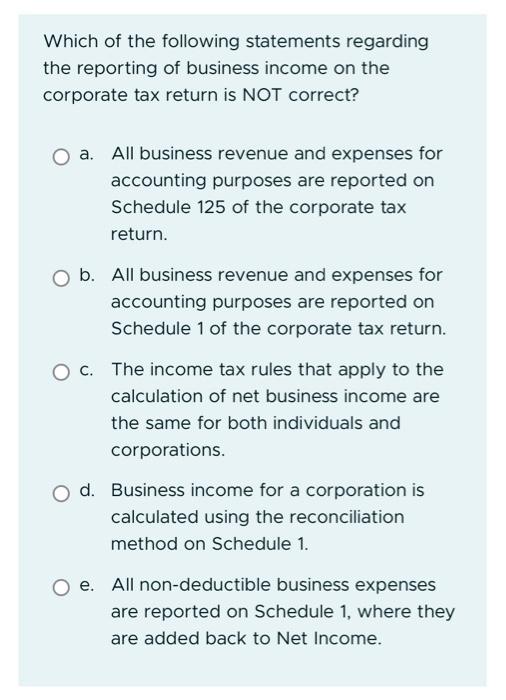

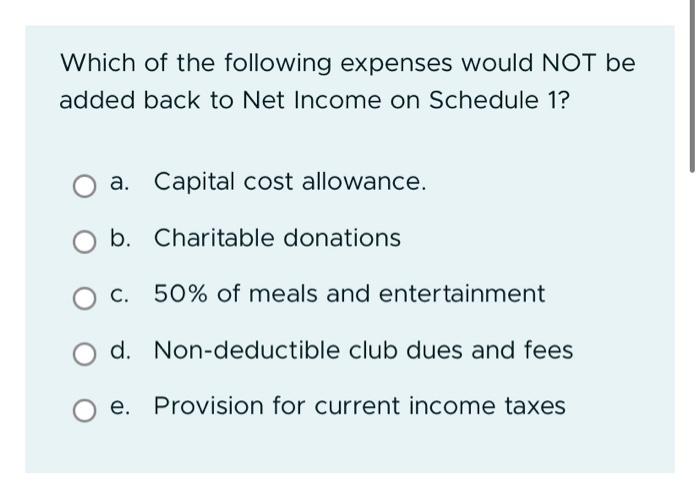

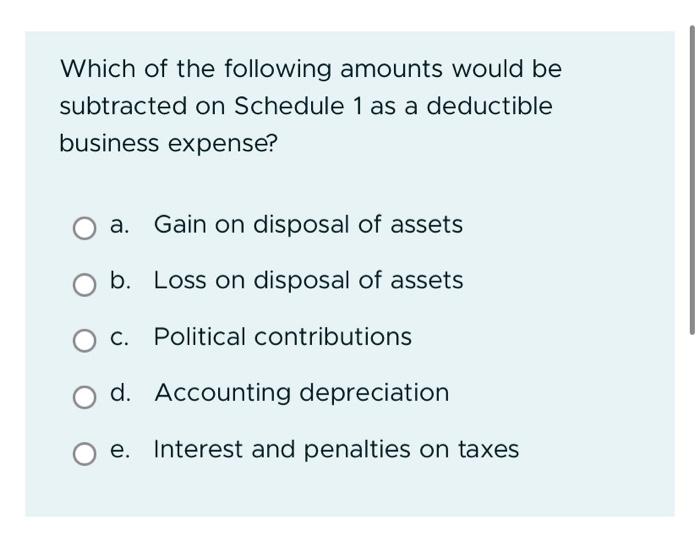

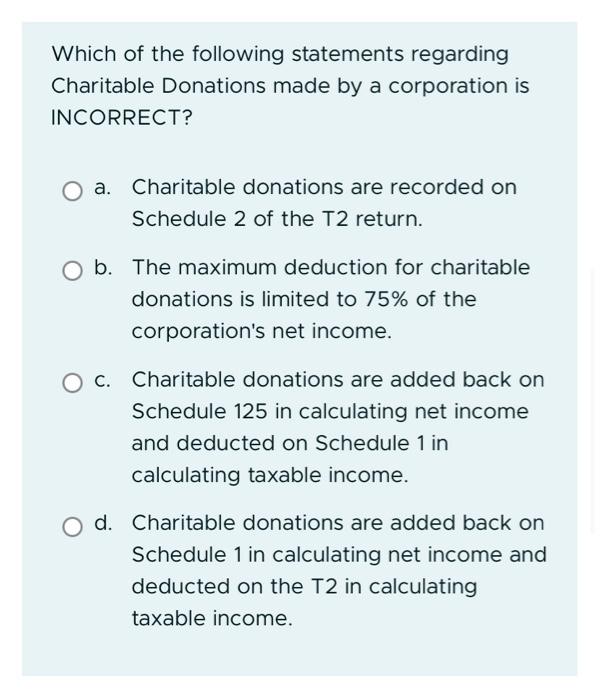

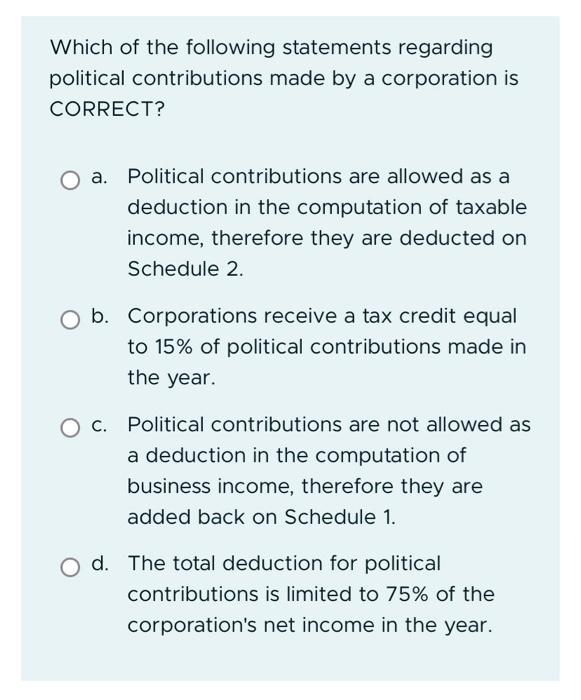

Which of the following statements regarding the reporting of business income on the corporate tax return is NOT correct? a. All business revenue and expenses for accounting purposes are reported on Schedule 125 of the corporate tax return. b. All business revenue and expenses for accounting purposes are reported on Schedule 1 of the corporate tax return. c. The income tax rules that apply to the calculation of net business income are the same for both individuals and corporations. d. Business income for a corporation is calculated using the reconciliation method on Schedule 1. e. All non-deductible business expenses are reported on Schedule 1, where they are added back to Net Income. Which of the following expenses would NOT be added back to Net Income on Schedule 1? a. Capital cost allowance. b. Charitable donations c. 50% of meals and entertainment d. Non-deductible club dues and fees e. Provision for current income taxes Which of the following amounts would be subtracted on Schedule 1 as a deductible business expense? a. Gain on disposal of assets b. Loss on disposal of assets c. Political contributions d. Accounting depreciation e. Interest and penalties on taxes Which of the following statements regarding Charitable Donations made by a corporation is INCORRECT? a. Charitable donations are recorded on Schedule 2 of the T2 return. b. The maximum deduction for charitable donations is limited to 75% of the corporation's net income. c. Charitable donations are added back on Schedule 125 in calculating net income and deducted on Schedule 1 in calculating taxable income. d. Charitable donations are added back on Schedule 1 in calculating net income and deducted on the T2 in calculating taxable income. Which of the following statements regarding political contributions made by a corporation is CORRECT? a. Political contributions are allowed as a deduction in the computation of taxable income, therefore they are deducted on Schedule 2. b. Corporations receive a tax credit equal to 15% of political contributions made in the year. c. Political contributions are not allowed as a deduction in the computation of business income, therefore they are added back on Schedule 1. d. The total deduction for political contributions is limited to 75% of the corporation's net income in the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started