Please answer the following independent situations focused on Plant Assets, Natural Resources, and Intangible Assets.

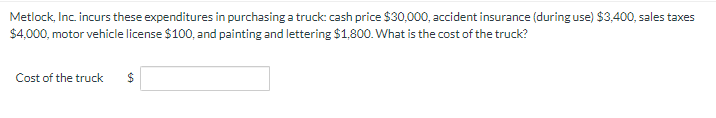

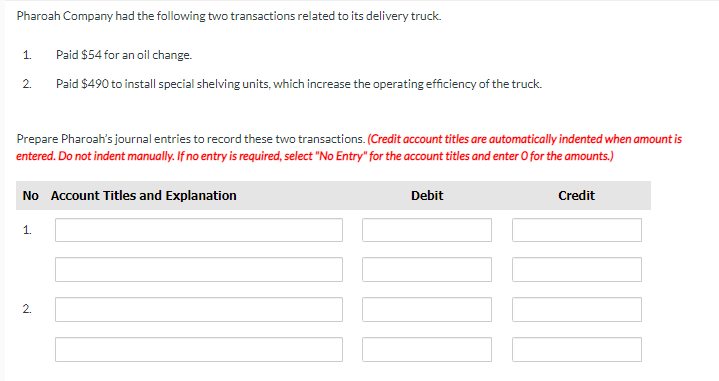

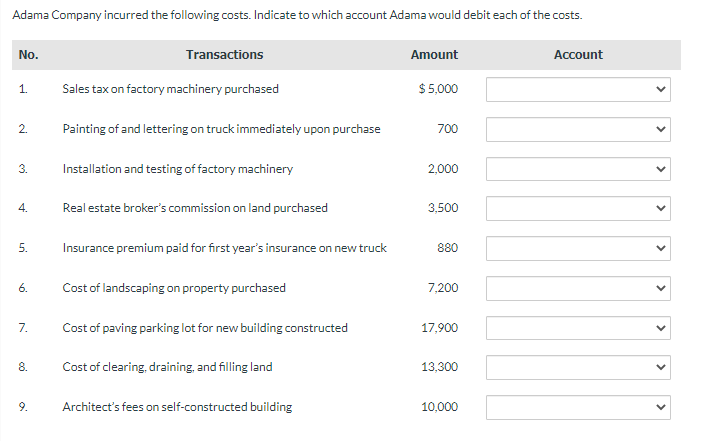

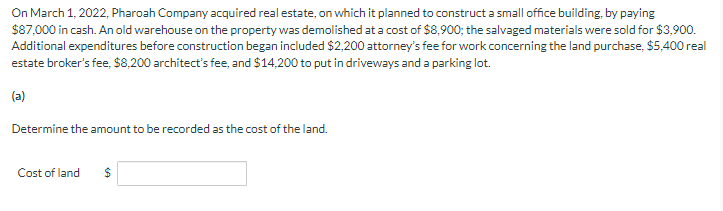

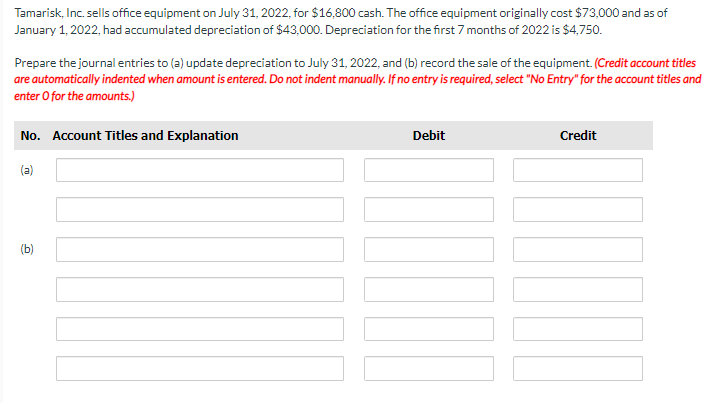

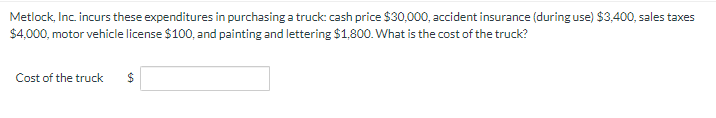

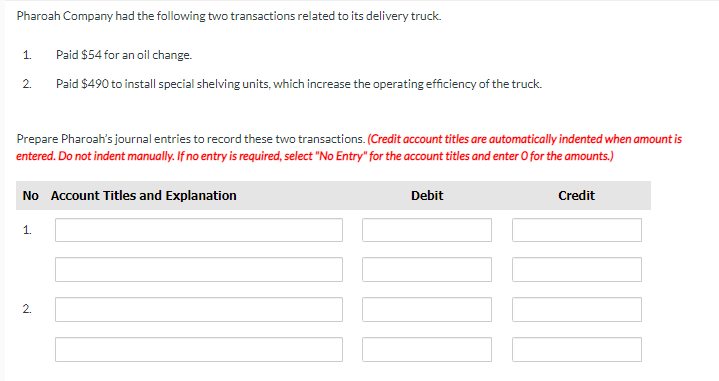

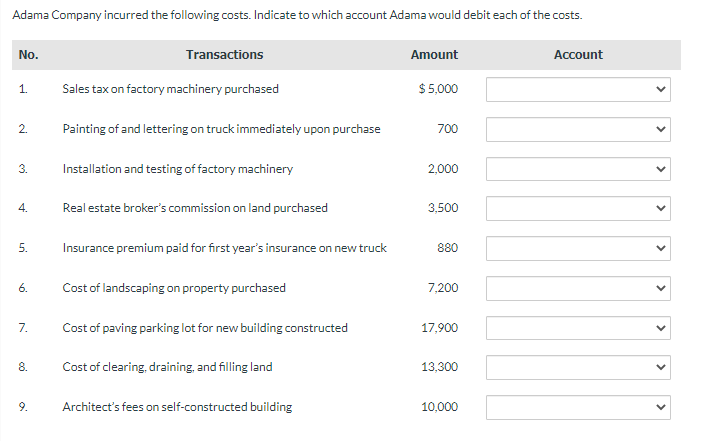

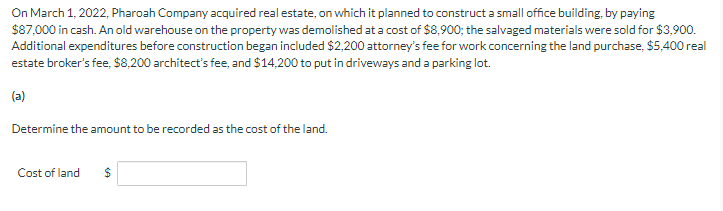

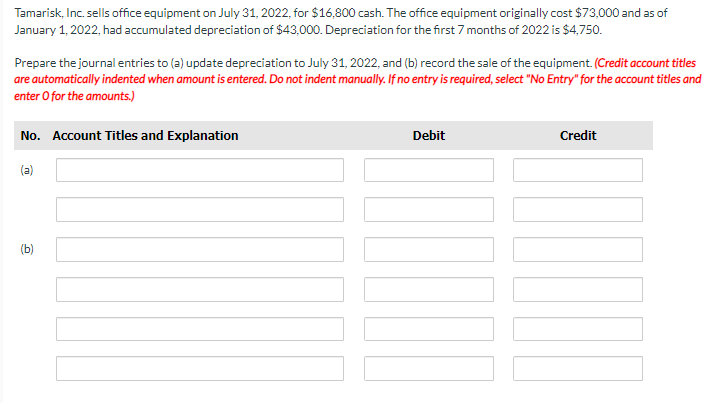

Metlock, Inc incurs these expenditures in purchasing a truck cash price $30,000, accident insurance (during use) $3,400, sales taxes $4,000, motor vehicle license $100, and painting and lettering $1.800. What is the cost of the truck? Cost of the truck $ Pharoah Company had the following two transactions related to its delivery truck 1 Paid $54 for an oil change. Paid $490 to install special shelving units, which increase the operating efficiency of the truck. 2. Prepare Pharoah's journal entries to record these two transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) No Account Titles and Explanation Debit Credit 1. 2. Adama Company incurred the following costs. Indicate to which account Adama would debit each of the costs. No. Transactions Amount Account 1 Sales tax on factory machinery purchased $5,000 2. Painting of and lettering on truck immediately upon purchase 700 V 3. Installation and testing of factory machinery 2,000 V 4. Real estate broker's commission on land purchased 3,500 5. Insurance premium paid for first year's insurance on new truck 880 6. Cost of landscaping on property purchased 7,200 V 7. Cost of paving parking lot for new building constructed 17,900 V 8. Cost of clearing, draining, and filling land 13,300 V 9. Architect's fees on self-constructed building 10,000 V On March 1, 2022, Pharoah Company acquired real estate, on which it planned to construct a small office building, by paying $87,000 in cash. An old warehouse on the property was demolished at a cost of $8,900; the salvaged materials were sold for $3,900. Additional expenditures before construction began included $2,200 attorney's fee for work concerning the land purchase. $5.400 real estate broker's fee, $8,200 architect's fee, and $14,200 to put in driveways and a parking lot. (a) Determine the amount to be recorded as the cost of the land. Cost of land $ Tamarisk, Inc. sells office equipment on July 31, 2022, for $16,800 cash. The office equipment originally cost $73,000 and as of January 1, 2022, had accumulated depreciation of $43.000. Depreciation for the first 7 months of 2022 is $4,750. Prepare the journal entries to (a) update depreciation to July 31, 2022, and (b) record the sale of the equipment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b)