Please answer the following question.

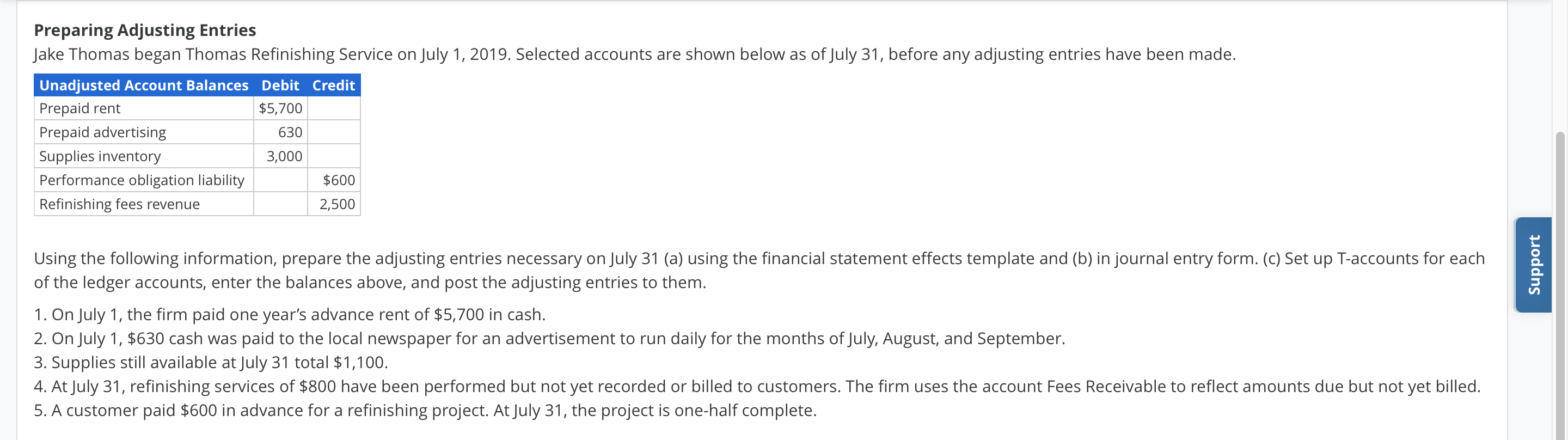

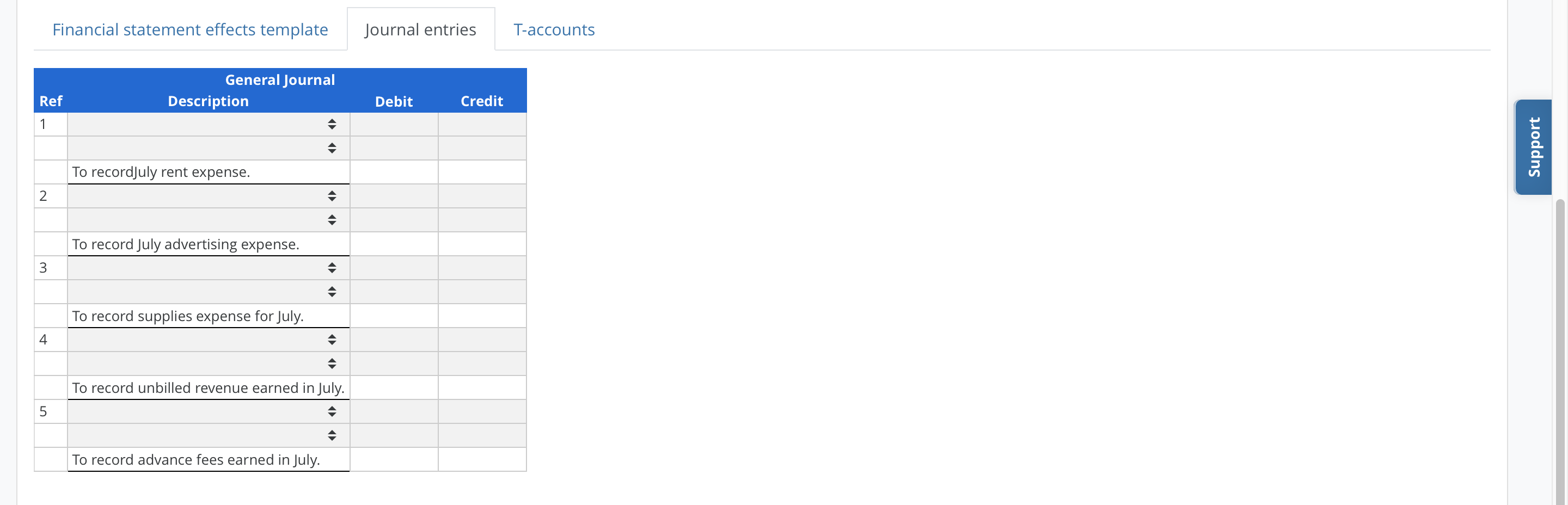

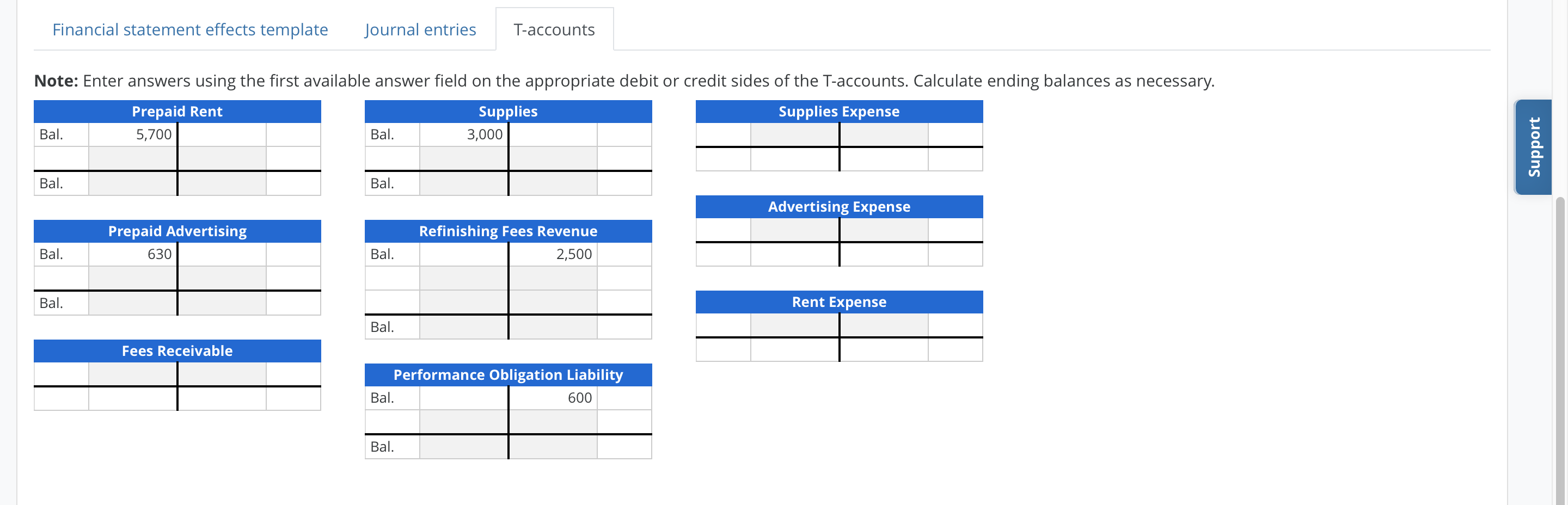

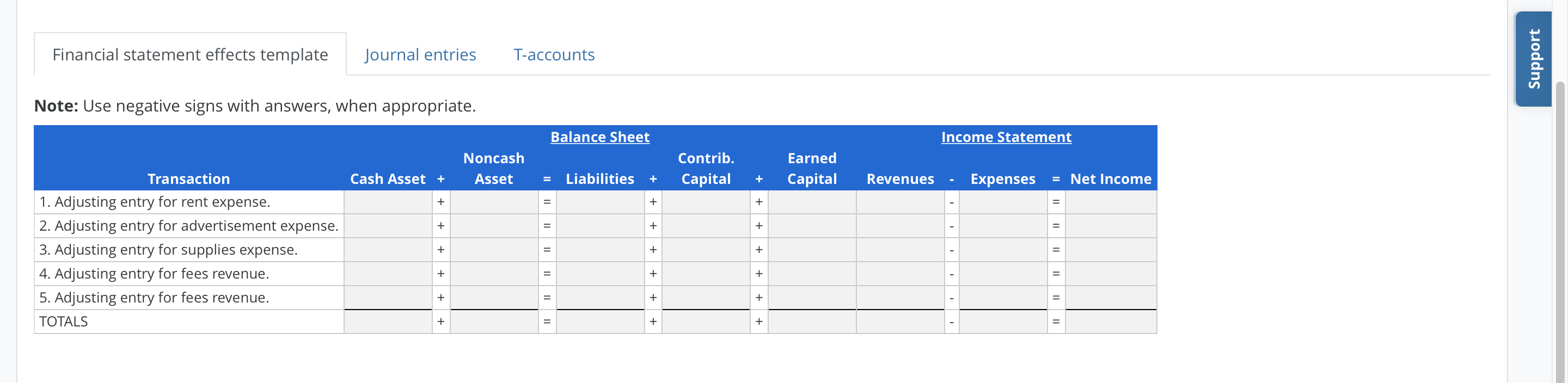

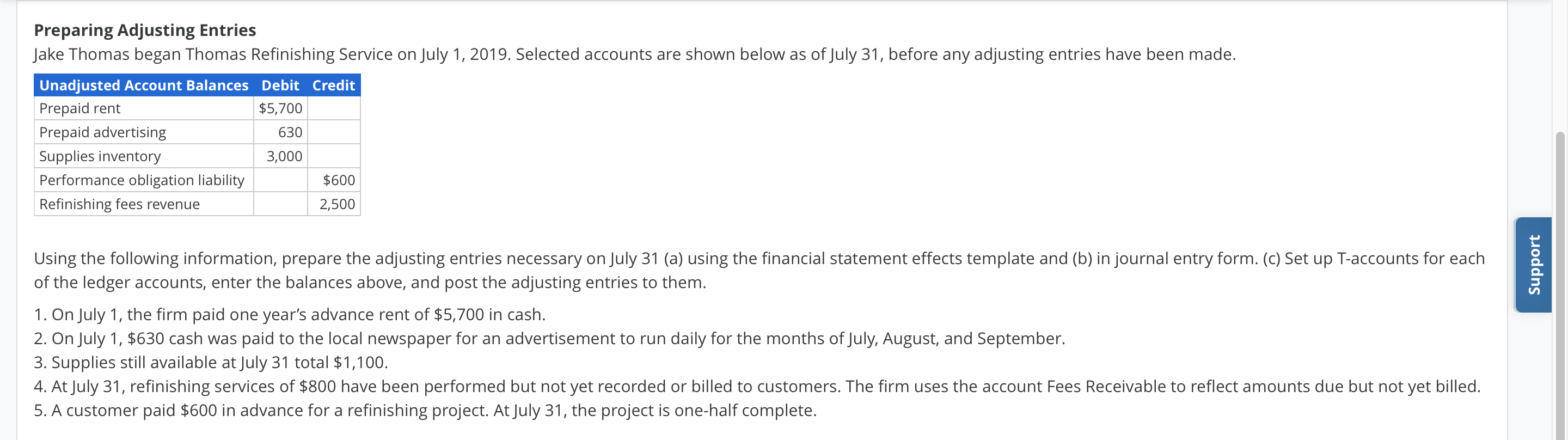

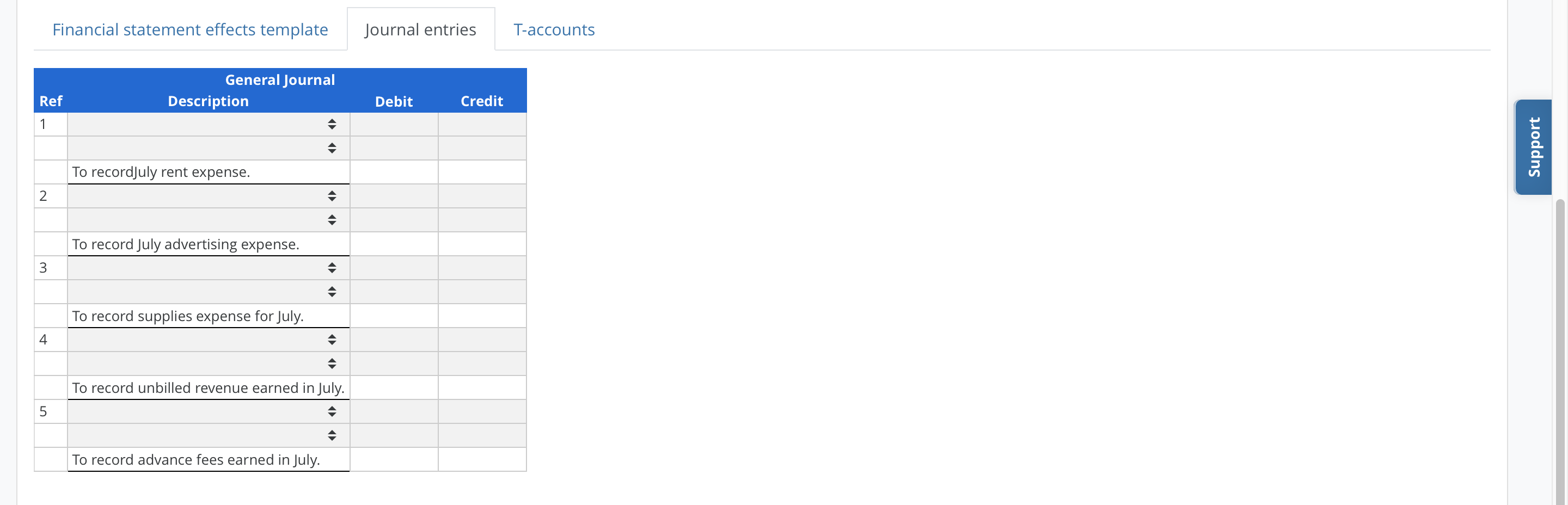

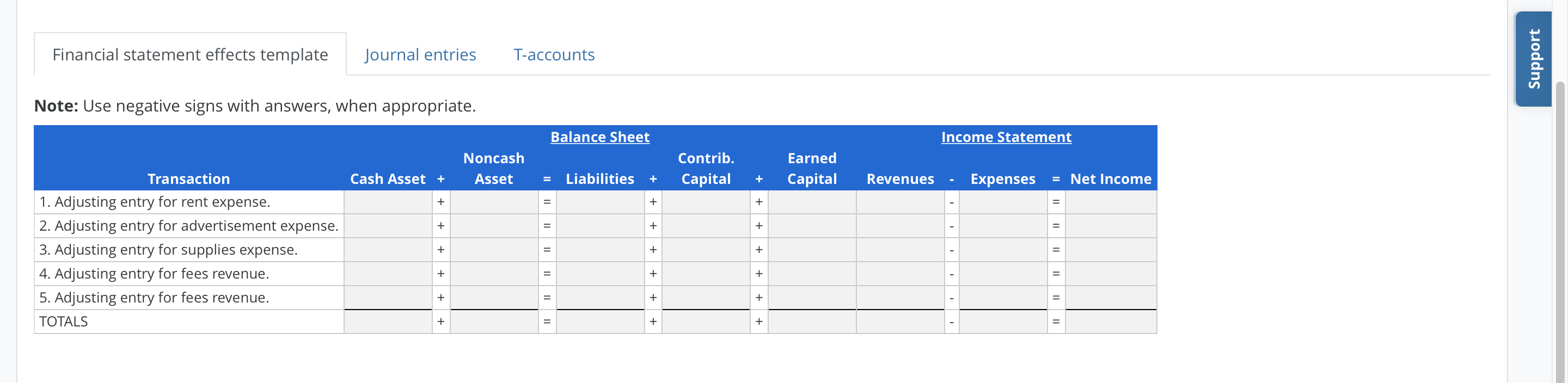

Preparing Adjusting Entries Jake Thomas began Thomas Refinishing Service on July 1, 2019. Selected accounts are shown below as of July 31, before any adjusting entries have been made. Unadjusted Account Balances Debit Credit Prepaid rent $5,700 Prepaid advertising 630 Supplies inventory 3,000 Performance obligation liability $600 Refinishing fees revenue 2,500 Support Using the following information, prepare the adjusting entries necessary on July 31 (a) using the financial statement effects template and (b) in journal entry form. (C) Set up T-accounts for each of the ledger accounts, enter the balances above, and post the adjusting entries to them. 1. On July 1, the firm paid one year's advance rent of $5,700 in cash. 2. On July 1, $630 cash was paid to the local newspaper for an advertisement to run daily for the months of July, August, and September. 3. Supplies still available at July 31 total $1,100. 4. At July 31, refinishing services of $800 have been performed but not yet recorded or billed to customers. The firm uses the account Fees Receivable to reflect amounts due but not yet billed. 5. A customer paid $600 in advance for a refinishing project. At July 31, the project is one-half complete. Financial statement effects template Journal entries T-accounts General Journal Description Ref Debit Credit 1 Support To recordJuly rent expense. 2 A To record July advertising expense. 3 To record supplies expense for July. 4 A To record unbilled revenue earned in July. 5 To record advance fees earned in July. Financial statement effects template Journal entries T-accounts Note: Enter answers using the first available answer field on the appropriate debit or credit sides of the T-accounts. Calculate ending balances as necessary. Prepaid Rent Supplies Supplies Expense 5,700 3,000 Bal. Bal. Support Bal. Bal. Advertising Expense Prepaid Advertising 630 Refinishing Fees Revenue 2,500 Bal. Bal. Bal. Rent Expense Bal. Fees Receivable Performance Obligation Liability Bal. 600 Bal. Financial statement effects template Journal entries T-accounts Support Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Noncash Asset Contrib. Capital Earned Capital Cash Asset + Liabilities + + Revenues Expenses = Net Income + + + = + Il + + Transaction 1. Adjusting entry for rent expense. 2. Adjusting entry for advertisement expense. 3. Adjusting entry for supplies expense. 4. Adjusting entry for fees revenue. 5. Adjusting entry for fees revenue. TOTALS + Il + + + II + + + + + = + II + + = Preparing Adjusting Entries Jake Thomas began Thomas Refinishing Service on July 1, 2019. Selected accounts are shown below as of July 31, before any adjusting entries have been made. Unadjusted Account Balances Debit Credit Prepaid rent $5,700 Prepaid advertising 630 Supplies inventory 3,000 Performance obligation liability $600 Refinishing fees revenue 2,500 Support Using the following information, prepare the adjusting entries necessary on July 31 (a) using the financial statement effects template and (b) in journal entry form. (C) Set up T-accounts for each of the ledger accounts, enter the balances above, and post the adjusting entries to them. 1. On July 1, the firm paid one year's advance rent of $5,700 in cash. 2. On July 1, $630 cash was paid to the local newspaper for an advertisement to run daily for the months of July, August, and September. 3. Supplies still available at July 31 total $1,100. 4. At July 31, refinishing services of $800 have been performed but not yet recorded or billed to customers. The firm uses the account Fees Receivable to reflect amounts due but not yet billed. 5. A customer paid $600 in advance for a refinishing project. At July 31, the project is one-half complete. Financial statement effects template Journal entries T-accounts General Journal Description Ref Debit Credit 1 Support To recordJuly rent expense. 2 A To record July advertising expense. 3 To record supplies expense for July. 4 A To record unbilled revenue earned in July. 5 To record advance fees earned in July. Financial statement effects template Journal entries T-accounts Note: Enter answers using the first available answer field on the appropriate debit or credit sides of the T-accounts. Calculate ending balances as necessary. Prepaid Rent Supplies Supplies Expense 5,700 3,000 Bal. Bal. Support Bal. Bal. Advertising Expense Prepaid Advertising 630 Refinishing Fees Revenue 2,500 Bal. Bal. Bal. Rent Expense Bal. Fees Receivable Performance Obligation Liability Bal. 600 Bal. Financial statement effects template Journal entries T-accounts Support Note: Use negative signs with answers, when appropriate. Balance Sheet Income Statement Noncash Asset Contrib. Capital Earned Capital Cash Asset + Liabilities + + Revenues Expenses = Net Income + + + = + Il + + Transaction 1. Adjusting entry for rent expense. 2. Adjusting entry for advertisement expense. 3. Adjusting entry for supplies expense. 4. Adjusting entry for fees revenue. 5. Adjusting entry for fees revenue. TOTALS + Il + + + II + + + + + = + II + + =