Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following question using excel Please answer the question using excel Case 2 (15pts) LO-4: apply Calculation of Cost of Capital, Capital Budgeting

Please answer the following question using excel

Please answer the question using excel

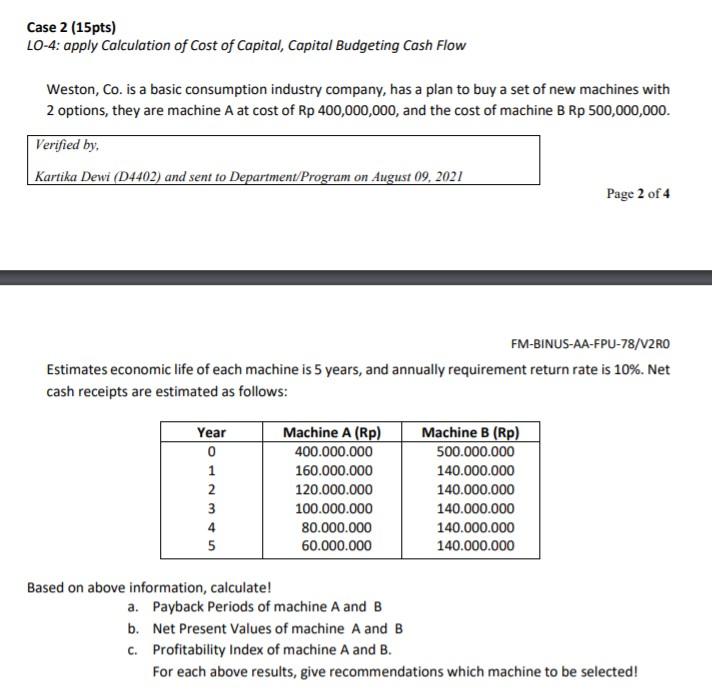

Case 2 (15pts) LO-4: apply Calculation of Cost of Capital, Capital Budgeting Cash Flow Weston, Co. is a basic consumption industry company, has a plan to buy a set of new machines with 2 options, they are machine A at cost of Rp 400,000,000, and the cost of machine B Rp 500,000,000. Verified by, Kartika Dewi (D4402) and sent to Department/Program on August 09, 2021 Page 2 of 4 FM-BINUS-AA-FPU-78/V2RO Estimates economic life of each machine is 5 years, and annually requirement return rate is 10%. Net cash receipts are estimated as follows: Year 0 1 2 3 4 5 Machine A (Rp) 400.000.000 160.000.000 120.000.000 100.000.000 80.000.000 60.000.000 Machine B (Rp) 500.000.000 140.000.000 140.000.000 140.000.000 140.000.000 140.000.000 Based on above information, calculate! a. Payback periods of machine A and B b. Net Present Values of machine A and B c. Profitability Index of machine A and B. For each above results, give recommendations which machine to be selectedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started