Please answer the following question with a clear explanation of the calculation.

Thank you in advance.

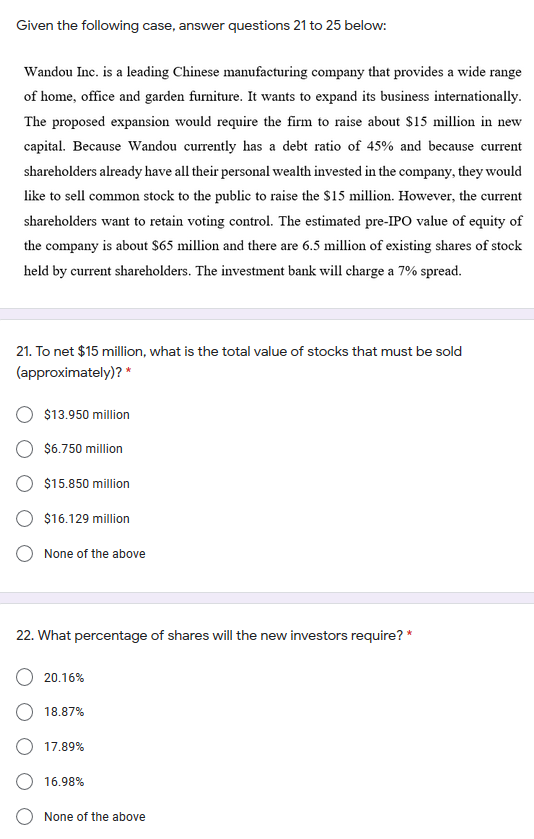

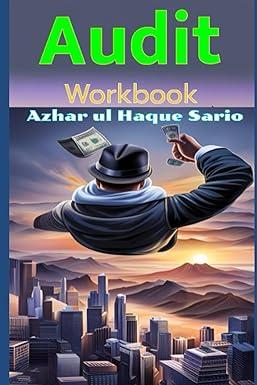

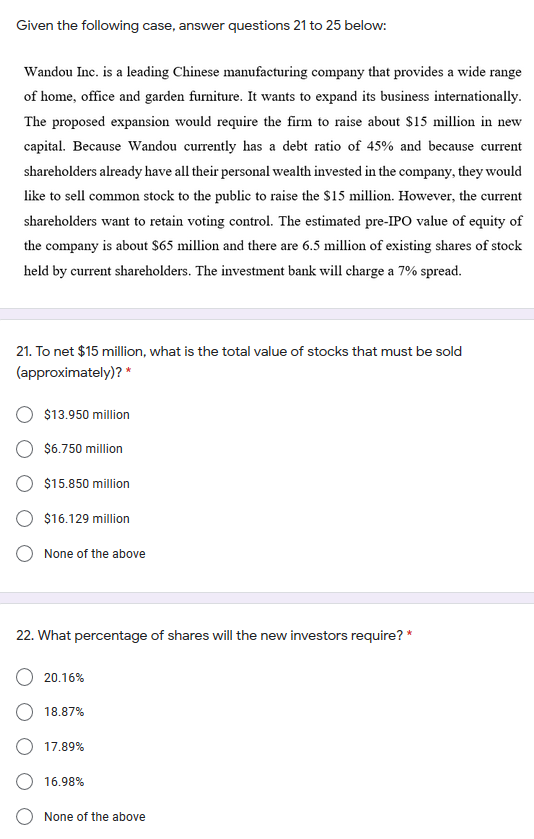

Given the following case, answer questions 21 to 25 below: Wandou Inc. is a leading Chinese manufacturing company that provides a wide range of home, office and garden furniture. It wants to expand its business internationally. The proposed expansion would require the firm to raise about $15 million in new capital. Because Wandou currently has a debt ratio of 45% and because current shareholders already have all their personal wealth invested in the company, they would like to sell common stock to the public to raise the $15 million. However, the current shareholders want to retain voting control. The estimated pre-IPO value of equity of the company is about $65 million and there are 6.5 million of existing shares of stock held by current shareholders. The investment bank will charge a 7% spread. 21. To net $15 million, what is the total value of stocks that must be sold (approximately)? * $13.950 million $6.750 million $15.850 million $16.129 million None of the above 22. What percentage of shares will the new investors require? * 20.16% 18.87% 17.89% 16.98% None of the above 23. How many shares will the new investors require (approximately)?* 1,641,414 shares 1,416,276 shares 1,850,450 shares 1,960,753 shares None of the above 24. What is the estimated offer price per share? * $8.50 $9.75 $4.77 $9.01 None of the above 25. What is the total post-IPO value of equity?* $80 million $78.95 million $86.23 million $75 million None of the above Given the following case, answer questions 21 to 25 below: Wandou Inc. is a leading Chinese manufacturing company that provides a wide range of home, office and garden furniture. It wants to expand its business internationally. The proposed expansion would require the firm to raise about $15 million in new capital. Because Wandou currently has a debt ratio of 45% and because current shareholders already have all their personal wealth invested in the company, they would like to sell common stock to the public to raise the $15 million. However, the current shareholders want to retain voting control. The estimated pre-IPO value of equity of the company is about $65 million and there are 6.5 million of existing shares of stock held by current shareholders. The investment bank will charge a 7% spread. 21. To net $15 million, what is the total value of stocks that must be sold (approximately)? * $13.950 million $6.750 million $15.850 million $16.129 million None of the above 22. What percentage of shares will the new investors require? * 20.16% 18.87% 17.89% 16.98% None of the above 23. How many shares will the new investors require (approximately)?* 1,641,414 shares 1,416,276 shares 1,850,450 shares 1,960,753 shares None of the above 24. What is the estimated offer price per share? * $8.50 $9.75 $4.77 $9.01 None of the above 25. What is the total post-IPO value of equity?* $80 million $78.95 million $86.23 million $75 million None of the above