Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the following question with writing all the steps Clearly , thank you PartIII :Questions and Calculations ( 10 marks 3=30 ) 1. A

please answer the following question with writing all the steps Clearly , thank you

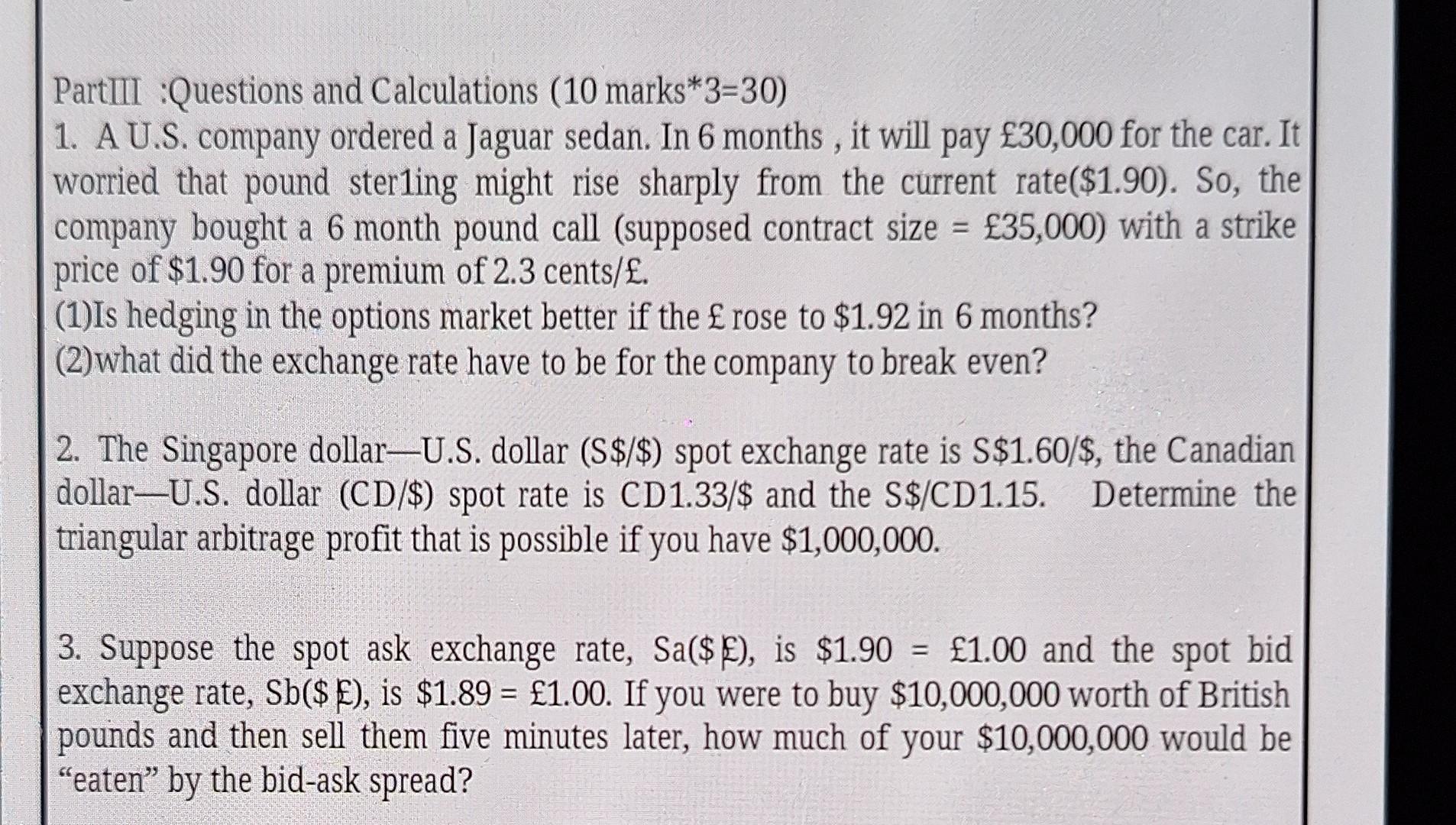

PartIII :Questions and Calculations ( 10 marks 3=30 ) 1. A U.S. company ordered a Jaguar sedan. In 6 months, it will pay 30,000 for the car. It worried that pound ster1ing might rise sharply from the current rate ($1.90). So, the company bought a 6 month pound call (supposed contract size =35,000 ) with a strike price of $1.90 for a premium of 2.3 cents/. (1)Is hedging in the options market better if the rose to $1.92 in 6 months? (2)what did the exchange rate have to be for the company to break even? 2. The Singapore dollar-U.S. dollar ( S/$ ) spot exchange rate is S$1.60/$, the Canadian dollar-U.S. dollar (CD/$) spot rate is CD1.33/\$ and the S\$/CD1.15. Determine the triangular arbitrage profit that is possible if you have $1,000,000. 3. Suppose the spot ask exchange rate, Sa($), is $1.90=1.00 and the spot bid exchange rate, Sb($E), is $1.89=1.00. If you were to buy $10,000,000 worth of British pounds and then sell them five minutes later, how much of your $10,000,000 would be "eaten by the bid-ask spreadStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started