Answered step by step

Verified Expert Solution

Question

1 Approved Answer

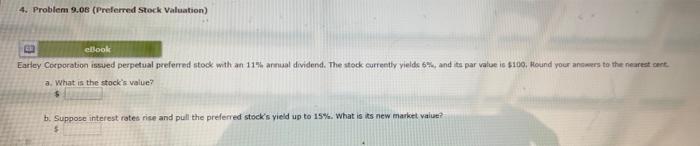

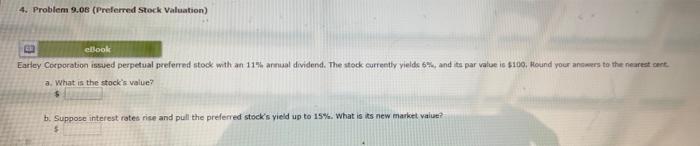

Please answer the following questions 4-6 :) 4. Problem 9.08 (Preferred Stock Valuation) 40 ellook Earley Corporation issued perpetual preferred stock with an 11% annual

Please answer the following questions 4-6 :)

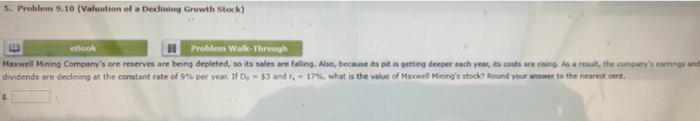

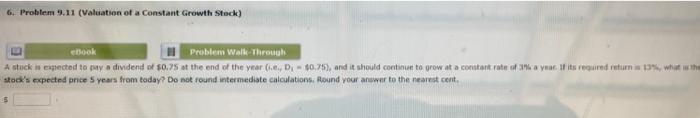

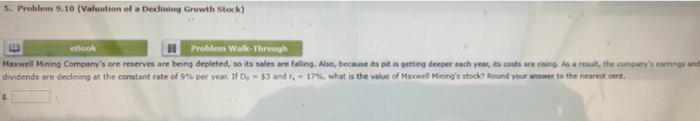

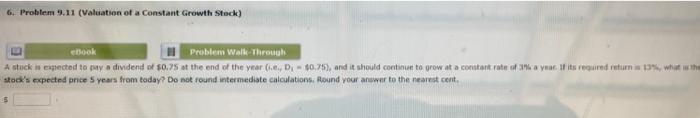

4. Problem 9.08 (Preferred Stock Valuation) 40 ellook Earley Corporation issued perpetual preferred stock with an 11% annual dividend. The stock currently yields 6%, and its par value is $100, Round your answers to the nearest cent a. What is the stock's value? b. Suppose interest rates rise and pull the preferred stock's yield up to 15%. What is its new market value? 5. Problem 9.10 (Valuation of a Declining Growth Stock) eflook Problem Walk-Through Maxwell Mining Company's ore reserves are being depleted, so its sales are falling. Also, because its pit is getting deeper each year, its costs are rising. As a result, the company's earnings and dividends are declining at the constant rate of 9% per year. If De-$3 and r, 17%, what is the value of Maxwell Mining's stock? Round your answer to the nearest cent. 6. Problem 9.11 (Valuation of a Constant Growth Stock) eBook Problem Walk-Through A stuck is expected to pay a dividend of $0.75 at the end of the year (i.e., D, $0.75), and it should continue to grow at a constant rate of 3% a year. If its required return is 13%, what is the stock's expected price 5 years from today? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started