Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts. Failure to do so will result in negative rating. Try answering on a piece of paper

Please answer the following questions and all its parts. Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

I have separated the first image in 2 parts. It should now be clearer. Thanks!

I HAVE ATTACHED 2 SEPARATE PICTURES WHERE THE IMAGE IS CLEARER. THANKS!

Do attempt the question! Thanks

I have separated the image into 2 parts. Kindly do see all the added images where it is clearer. Thanks.

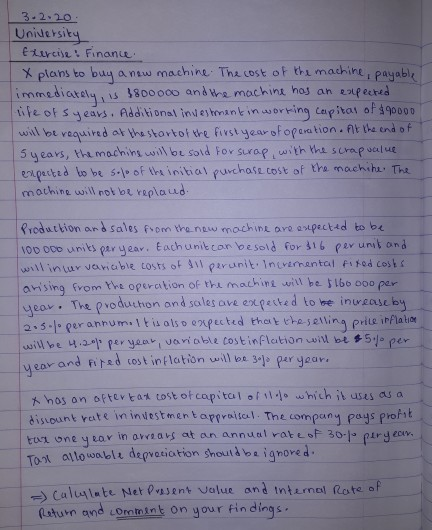

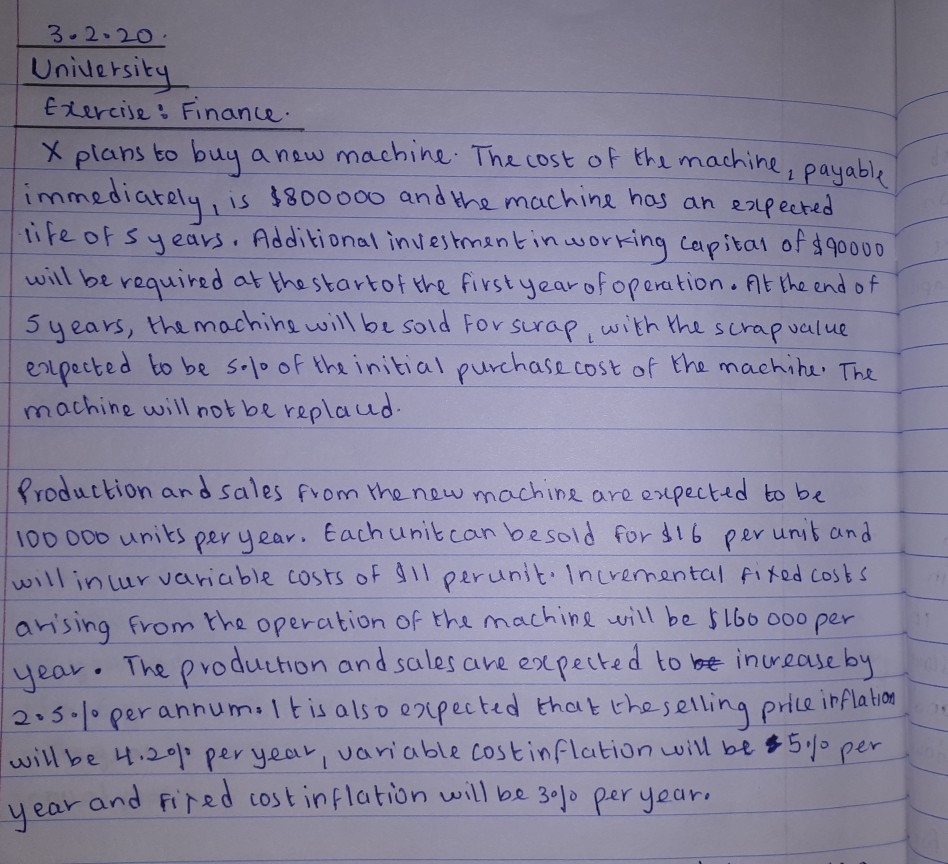

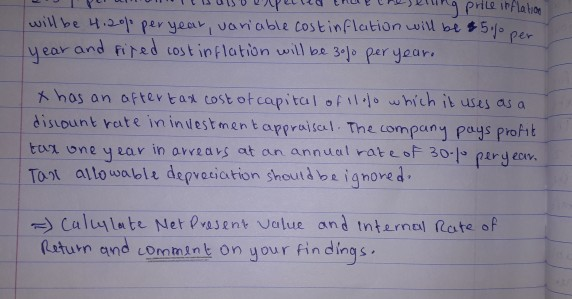

13.2. 20. University Etircile! Finance x plans to buy a new machine. The cost of the machine, payable immediately, is 1800000 and the machine has an expected life of years. Additional investment in working capital of $90000 will be required at the start of the first year of operation. At the end of syears, the machine will be sold for scrap, with the scrapualue. expected to be sole of the initial purchase cost of the machine. The machine will not be replaud. Production and sales from the new machine are expected to be 1000Do units per year. Each unit can besold for $16 per unit and will incurvariable costs of all perunit. Incremental fixed costs arising from the operation of the machine will be $160oooper year. The production and sales are expected to be increase by 2.5. per annum.lt is also onputed that the selling price inflation will be 4.200 per year, variable cost inflation will be a 5./o per year and tired cost inflation will be solo per year. x has an offertad cost of capital of lolo which it uses as a dispunt vote in investmen tappraisal. The company pays profit one 4 ROY in OWOS at an annual rato 30 per you Tant allowable depreciation should be ignored. - Calculate Net Present value and internal Rate of Return and comment on your findings. 3.2.20. University Exercise & Finance. x plans to buy a new machine. The cost of the machine, payable immediately, is $800000 and the machine has an expected life of years. Additional investment in working capital of $90000 will be required at the start of the first year of operation. At the end of 5 years, the machine will be sold for scrap, with the scrap value expected to be solo of the initial purchase cost of the machine. The machine will not be replaud. Production and sales from the new machine are expected to be 100000 units per year. Each unit can besold for $16 per unit and will incurvariable costs of all perunit. Incremental fixed costs arising from the operation of the machine will be $160000 per year. The production and sales are expected to be increase by 2050lo per annum. It is also expected that the selling price inflation will be 4.200 per year, variable costinflation will be a 5 %o per year and tired cost inflation will be solo per year. T u wewe TR URLSLU price inflation will be 4.2000 per year, variable cost inflation will be 5% een year and fired cost inflation will be solo per year. x has an aftertas cost of capital of 1lolo which it uses as a discount rate in investment appraisal. The company pays profit tax one year in arrears at an annual rate of 30-10 peryear. Tant allowable depreciation should be ignored. - Calculate Net Present value and internal Rate of Return and comment on your findings. 13.2. 20. University Etircile! Finance x plans to buy a new machine. The cost of the machine, payable immediately, is 1800000 and the machine has an expected life of years. Additional investment in working capital of $90000 will be required at the start of the first year of operation. At the end of syears, the machine will be sold for scrap, with the scrapualue. expected to be sole of the initial purchase cost of the machine. The machine will not be replaud. Production and sales from the new machine are expected to be 1000Do units per year. Each unit can besold for $16 per unit and will incurvariable costs of all perunit. Incremental fixed costs arising from the operation of the machine will be $160oooper year. The production and sales are expected to be increase by 2.5. per annum.lt is also onputed that the selling price inflation will be 4.200 per year, variable cost inflation will be a 5./o per year and tired cost inflation will be solo per year. x has an offertad cost of capital of lolo which it uses as a dispunt vote in investmen tappraisal. The company pays profit one 4 ROY in OWOS at an annual rato 30 per you Tant allowable depreciation should be ignored. - Calculate Net Present value and internal Rate of Return and comment on your findings. 3.2.20. University Exercise & Finance. x plans to buy a new machine. The cost of the machine, payable immediately, is $800000 and the machine has an expected life of years. Additional investment in working capital of $90000 will be required at the start of the first year of operation. At the end of 5 years, the machine will be sold for scrap, with the scrap value expected to be solo of the initial purchase cost of the machine. The machine will not be replaud. Production and sales from the new machine are expected to be 100000 units per year. Each unit can besold for $16 per unit and will incurvariable costs of all perunit. Incremental fixed costs arising from the operation of the machine will be $160000 per year. The production and sales are expected to be increase by 2050lo per annum. It is also expected that the selling price inflation will be 4.200 per year, variable costinflation will be a 5 %o per year and tired cost inflation will be solo per year. T u wewe TR URLSLU price inflation will be 4.2000 per year, variable cost inflation will be 5% een year and fired cost inflation will be solo per year. x has an aftertas cost of capital of 1lolo which it uses as a discount rate in investment appraisal. The company pays profit tax one year in arrears at an annual rate of 30-10 peryear. Tant allowable depreciation should be ignored. - Calculate Net Present value and internal Rate of Return and comment on your findingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started