Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

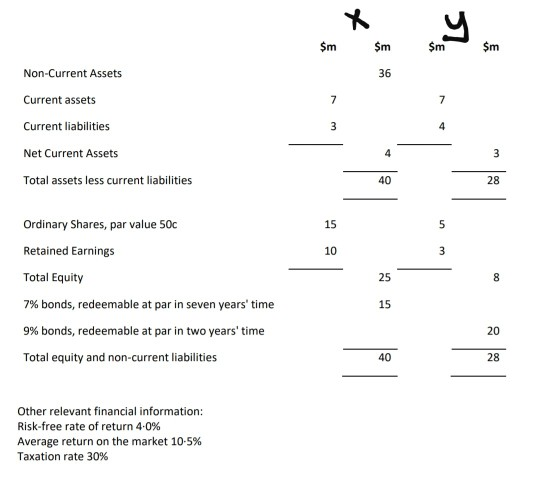

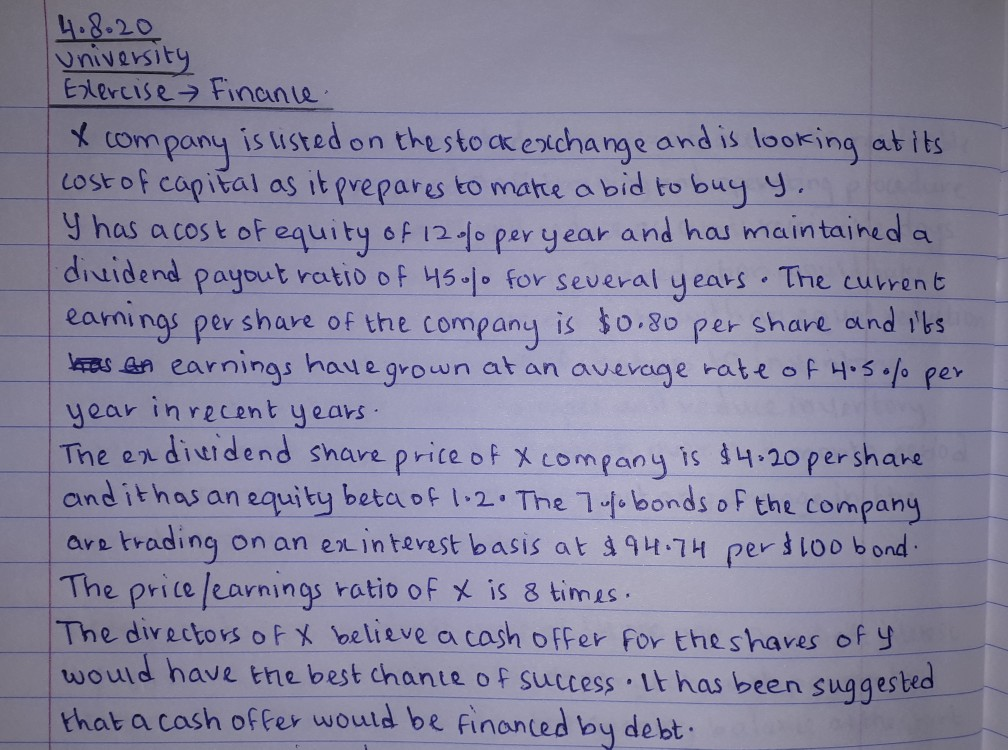

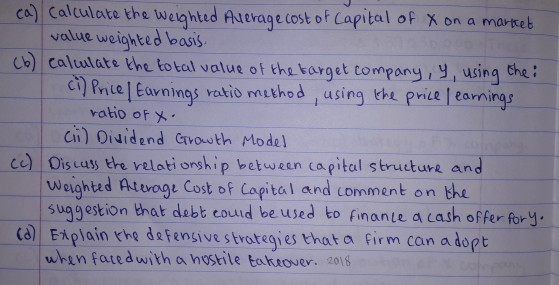

$m Non-Current Assets Current assets Current liabilities Net Current Assets Total assets less current liabilities Ordinary Shares, par value 500 wun Retained Earnings Total Equity 7% bonds, redeemable at par in seven years' time 9% bonds, redeemable at par in two years' time Total equity and non-current liabilities Other relevant financial information: Risk-free rate of return 4.0% Average return on the market 10-5% Taxation rate 30% 4.8.20 university Exercise Finance X company is listed on the stock exchange and is looking at its cost of capital as it prepares to make a bid to buy y. Plocal y has a cost of equity of 12 %0 per year and has maintained a dividend payout ratio of 450 for several years. The current earnings pershare of the company is $0.80 per share and its has an earnings have grown at an average rate of 4 solo per year in recent years. The endividend share price of a company is $4:20 pershane and it has an equity beta of 1-2 The 7 pobonds of the company are trading on an ex interest basis at $94.74 per $100 bond. The price/ earnings ratio of x is 8 times. The directors of t believe a cash offer for the shares of y. would have the best chance of success. It has been suggested that a cash offer would be financed by debt . ca) Calculate the weighted Average cost of capital of x on a market. value weighted basis. (6) calculate the total value of the target company, y, using the ci) Price/ Earnings ratio method, using the price learnings ratio of y. cii) Dividend Growth Model Discuss the relationship between capital structure and Weighted Anterage Cost of Capital and comment on the suggestion that debt could be used to finance a cash offer fory. (d) Explain the defensive strategies that a firm can adopt when faced with a hostile takeover. 2018 (c) $m Non-Current Assets Current assets Current liabilities Net Current Assets Total assets less current liabilities Ordinary Shares, par value 500 wun Retained Earnings Total Equity 7% bonds, redeemable at par in seven years' time 9% bonds, redeemable at par in two years' time Total equity and non-current liabilities Other relevant financial information: Risk-free rate of return 4.0% Average return on the market 10-5% Taxation rate 30% 4.8.20 university Exercise Finance X company is listed on the stock exchange and is looking at its cost of capital as it prepares to make a bid to buy y. Plocal y has a cost of equity of 12 %0 per year and has maintained a dividend payout ratio of 450 for several years. The current earnings pershare of the company is $0.80 per share and its has an earnings have grown at an average rate of 4 solo per year in recent years. The endividend share price of a company is $4:20 pershane and it has an equity beta of 1-2 The 7 pobonds of the company are trading on an ex interest basis at $94.74 per $100 bond. The price/ earnings ratio of x is 8 times. The directors of t believe a cash offer for the shares of y. would have the best chance of success. It has been suggested that a cash offer would be financed by debt . ca) Calculate the weighted Average cost of capital of x on a market. value weighted basis. (6) calculate the total value of the target company, y, using the ci) Price/ Earnings ratio method, using the price learnings ratio of y. cii) Dividend Growth Model Discuss the relationship between capital structure and Weighted Anterage Cost of Capital and comment on the suggestion that debt could be used to finance a cash offer fory. (d) Explain the defensive strategies that a firm can adopt when faced with a hostile takeover. 2018 (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started