Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering

Please answer the following questions and all its parts(max 4 parts according to chegg). Failure to do so will result in negative rating. Try answering on a piece of paper if possible and scan it please and i will give good rating. Thanks!

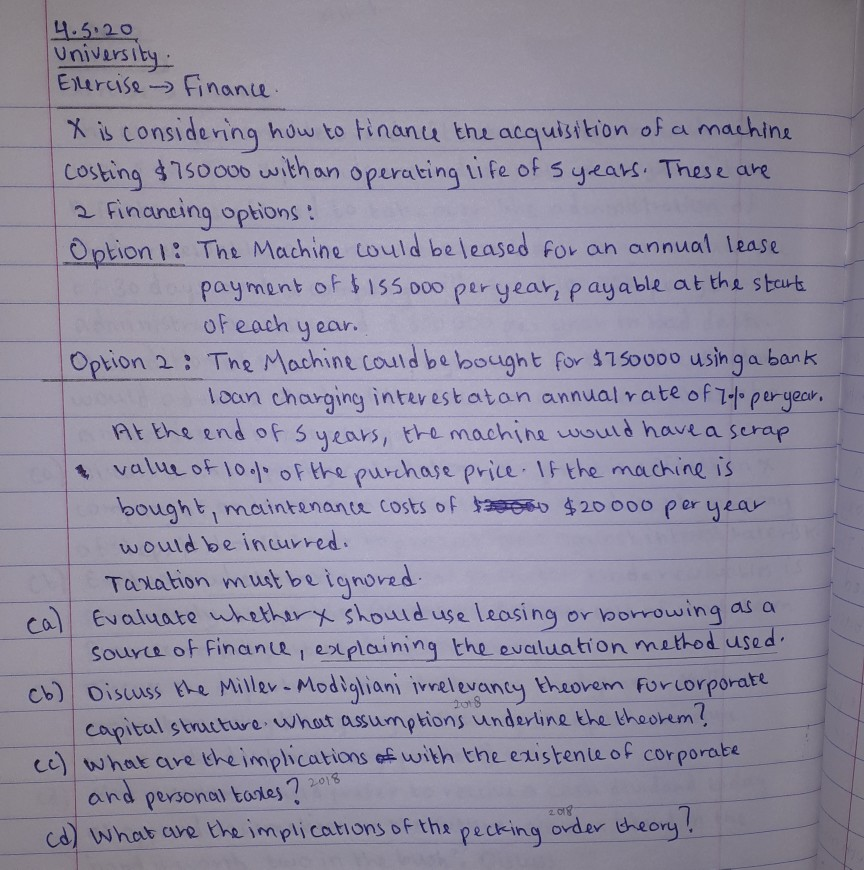

4.5.20 University Exercise - Finance. X is considering how to finance the acquisition of a machine costing $750 000 with an operating life of years. These are a financing options: Option: The Machine could be leased for an annual lease payment of 155 000 per year, payable at the start of each year. Option 2: The Machine could be bought for $750000 using a bank loan charging interest atan annual rate of Tolo per year. At the end of 5 years, the machine would have a scrap value of 10% of the purchase price. If the machine is. bought, maintenance costs of two $20000 per year. would be incurred. Taration must be ignored Evaluate whethery should use leasing or borrowing as a source of Finance, explaining the evaluation method used. (6) Discuss the Miller - Modigliani irrelevancy theorem for corporate capital structure what assumptions underline the theorem? (c) what are the implications of with the existence of corporate and personal taxes? 2016 cd) What are the implications of the pecking order theory! Sets 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started