Answered step by step

Verified Expert Solution

Question

1 Approved Answer

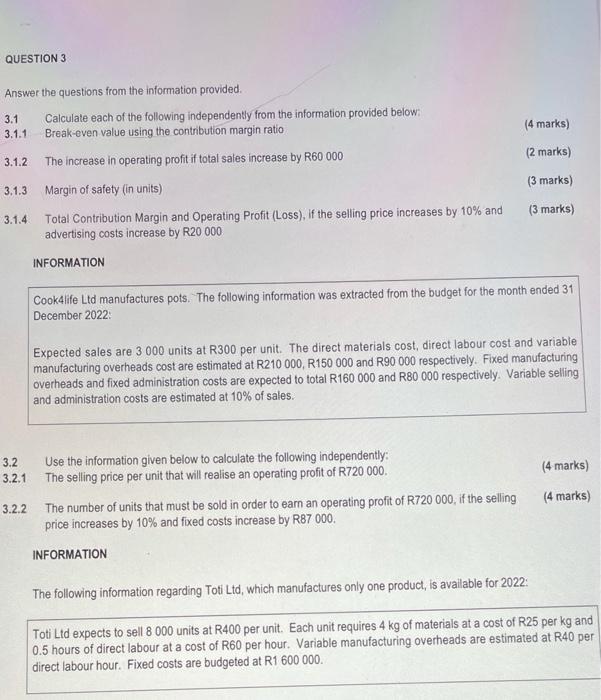

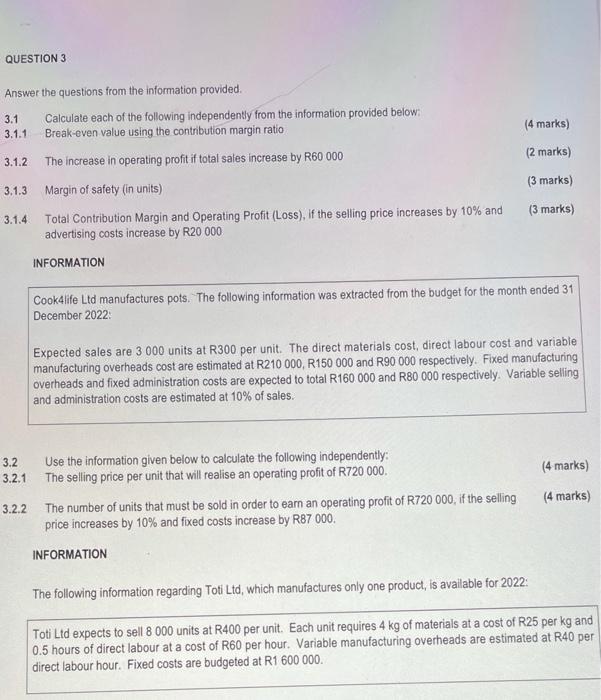

please answer the following questions in depth. QUESTION 3 (4 marks) (2 marks) Answer the questions from the information provided. 3.1 Calculate each of the

please answer the following questions in depth.

QUESTION 3 (4 marks) (2 marks) Answer the questions from the information provided. 3.1 Calculate each of the following independently from the information provided below: 3.1.1 Break-even value using the contribution margin ratio 3.1.2 The increase in operating profit if total sales increase by R60 000 3.1.3 Margin of safety (in units) 3.1.4 Total Contribution Margin and Operating Profit (Loss), if the selling price increases by 10% and advertising costs increase by R20 000 INFORMATION (3 marks) (3 marks) Cook4life Ltd manufactures pots. The following information was extracted from the budget for the month ended 31 December 2022 Expected sales are 3 000 units at R300 per unit. The direct materials cost, direct labour cost and variable manufacturing overheads cost are estimated at R210 000, R150 000 and R90 000 respectively. Fixed manufacturing overheads and fixed administration costs are expected to total R160 000 and R80 000 respectively. Variable selling and administration costs are estimated at 10% of sales. (4 marks) 3.2 Use the information given below to calculate the following independently: 3.2.1 The selling price per unit that will realise an operating profit of R720 000 3.2.2 The number of units that must be sold in order to earn an operating profit of R720 000, if the selling price increases by 10% and fixed costs increase by R87 000. (4 marks) INFORMATION The following information regarding Toti Ltd, which manufactures only one product, is available for 2022: Toti Ltd expects to sell 8 000 units at R400 per unit. Each unit requires 4 kg of materials at a cost of R25 per kg and 0.5 hours of direct labour at a cost of R60 per hour. Variable manufacturing overheads are estimated at R40 per direct labour hour. Fixed costs are budgeted at R1 600 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started