Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions! Its greatly appreciated!!! It is unimportant whether the acquirer uses the target's or its own weighted average cost of capital

Please answer the following questions! Its greatly appreciated!!!

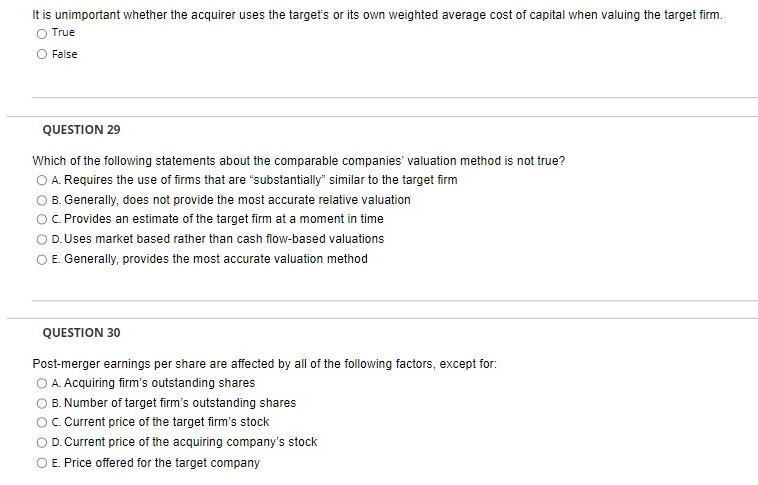

It is unimportant whether the acquirer uses the target's or its own weighted average cost of capital when valuing the target firm. True False QUESTION 29 Which of the following statements about the comparable companies' valuation method is not true? O A. Requires the use of firms that are "substantially" similar to the target firm B. Generally, does not provide the most accurate relative valuation OC. Provides an estimate of the target firm at a moment in time O D.Uses market based rather than cash flow-based valuations O E. Generally, provides the most accurate valuation method QUESTION 30 Post-merger earnings per share are affected by all of the following factors, except for: O A. Acquiring firm's outstanding shares OB. Number of target firm's outstanding shares OC Current price of the target firm's stock O D. Current price of the acquiring company's stock O E. Price offered for the target companyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started