Answered step by step

Verified Expert Solution

Question

1 Approved Answer

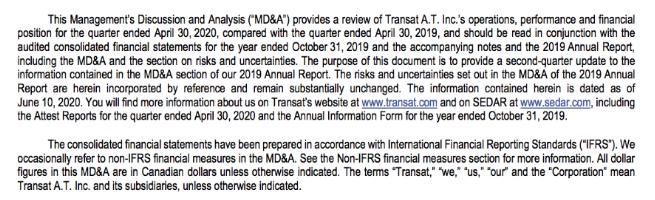

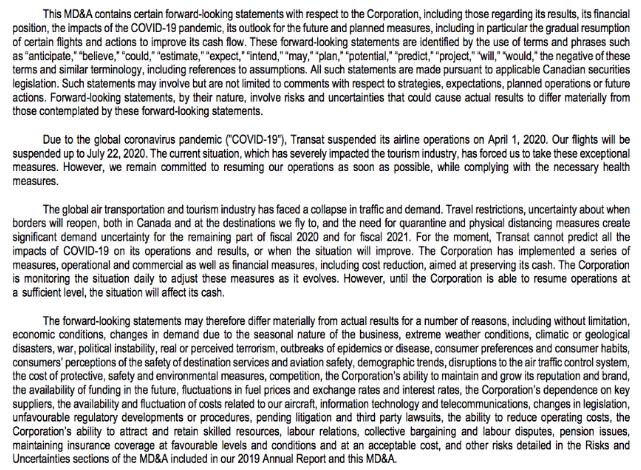

Net Income before Income Tax (do not consider comprehensive income) Total of Depreciation Expense (including Amortization) Property, Plant, and Equipment (net book value) Earnings per

- Net Income before Income Tax (do not consider comprehensive income)

- Total of Depreciation Expense (including Amortization)

- Property, Plant, and Equipment (net book value)

- Earnings per Share

- Current Assets

- When was the MD&A dated?

- Retained Earnings

- Who was the auditor?

- Who was the Chair of the Board of Directors at the time the audited annual financial statement was issued?

- What was the percentage change in total net Revenue during the year?

![As at As at April 30, 2020 October 31, 2019 Restated (note 3) $As at November 1, 2018 Restated [note 3] (in thousands of Can](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/11/6182170b71f78_1635915530061.jpg)

![TRANSAT A.T. INC. CONSOLIDATED STATEMENTS OF INCOME (Loss) Quarters ended April 30 2020 2019 Restated (note 3] $$ 571,298 89](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/11/61821731d00e8_1635915569479.jpg)

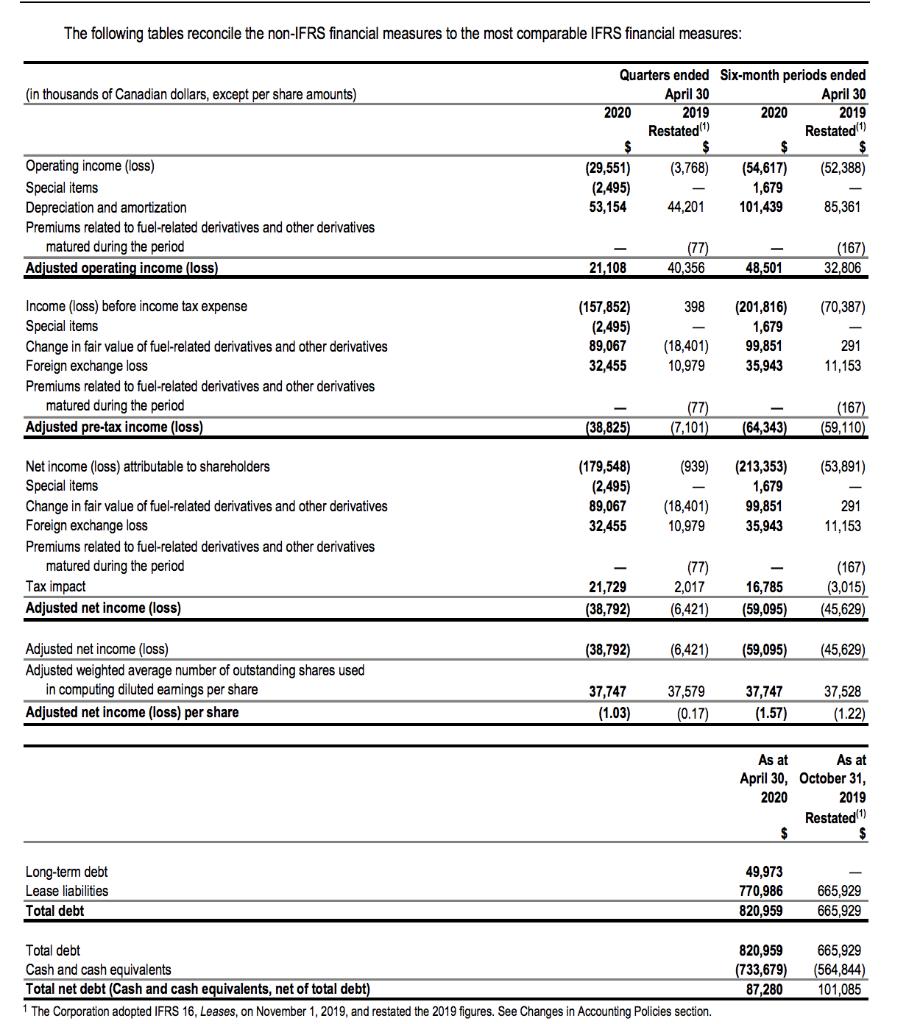

As at As at April 30, 2020 October 31, 2019 As at November 1, 2018 Restated Restated [note 3] [note 3] (in thousands of Canadian dollars) Notes ASSETS Cash and cash equivalents Cash and cash equivalents in trust or otherwise reserved 733,679 280,788 564,844 593,654 4 301,547 287,735 Trade and other receivables 127,590 137,944 133,626 Income taxes receivable Inventories Prepaid expenses 4,167 1,423 11,405 15,847 14,464 12,196 41,300 8,577 10,543 1,218,840 74,489 63,706 20,413 20,250 1,145,253 Derivative financial instruments 4,870 17,765 1,118,729 Current portion of deposits Current assets Cash and cash equivalents reserved 56,268 51,224 51,184 Deposits Income taxes receivable 5 183,160 166,137 166,026 15,100 15,100 15,100 Deferred tax assets 28,148 16,105 Property, plant and equipment Intangible assets 961,546 33,894 6 891,445 36,852 721,504 42,689 Derivative financial instruments 84 Investment 7 18,795 16,533 16,084 Other assets 257 322 186 1,205,761 1,028,962 2.174,215 Non-current assets 1,269,020 2,487,860 2,324,490 LIABILITIES Trade and other payables Income taxes payable 376,930 311,065 312,273 15 4,244 1,117 517,352 Customer deposits and deferred revenues Derivative financial instruments 605,139 561,404 104,072 135,810 10,431 2,766 71,250 Current portion of lease liabilities 8 99,814 Current portion of provision for return conditions 9 8,266 Current liabilities 1,230,232 986,958 904,758 566,115 155,120 Long-tem debt and lease liabilities 8 685,149 493,920 Provision for retum conditions 9 164,947 128,528 Other liabilities 10 48,429 47.444 41,128 679 Derivative financial instruments 176 1,650 Deferred tax liabilities 1,496 900,197 9,752 780,081 11,739 Non-current liabilities EQUITY 675,994 221,012 15,948 123,843 (791) (2,581) 357,431 2,487,860 219,684 Share capital Share-based payment reserve Retained eamings Unrealized gain (loss) on cash flow hedges Cumulative exchange differences 11 221,012 15,948 336,993 (9,176) (7,326) 18,017 362,590 1,971 (8,799) 593,463 557,451 2,324,490 2.174.215 See accompanying notes to unaudited interim condensed consolidated financial statements NOTICE The Corporation's independent auditors have not performed a review of the accompanying interim condensed consolidated financial statements

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Net Income before Income Tax 29551112454466 36330 2 Total of Depreciation Expen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started