Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions:- NO PLAGIARISM PLEASE. Question1) Explain how do you balance off an account using one of the accounts from part 1.

Please answer the following questions:- NO PLAGIARISM PLEASE.

Question1) Explain how do you balance off an account using one of the accounts from part 1.

Question 2) Explain what is the trial balance and why are trial balances prepared.

Question 3) Explain what is the Income Statement and what can you conclude looking at Sumaya's

Question 4) What is the difference between an Asset and a Liability and provide two examples of each.

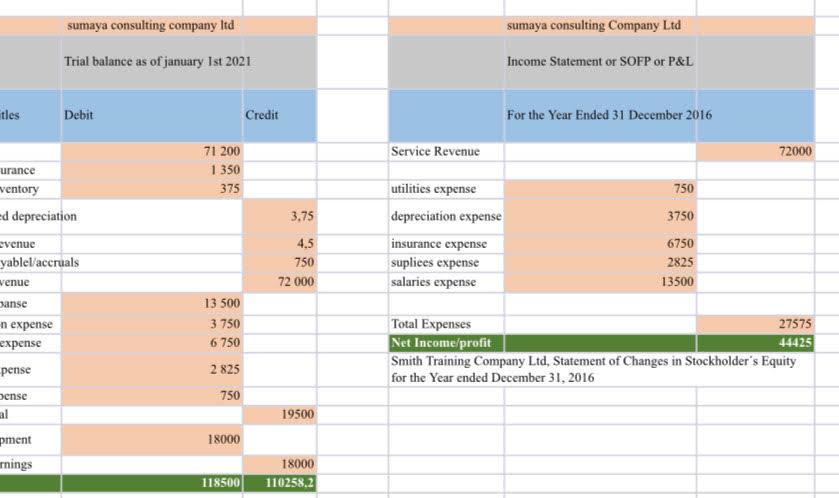

sumaya consulting company Itd Trial balance as of january 1st 2021 Debit 71.200 1.350 375 13 500 3 750 6 750 2 825 tles urance ventory ed depreciation venue yablel/accruals venue Danse -n expense expense pense pense al pment nings 750 18000 118500 Credit 3,75 4,5 750 72 000 19500 18000 110258,2 sumaya consulting Company Ltd Income Statement or SOFP or P&L For the Year Ended 31 December 2016 Service Revenue 72000 utilities expense 750 depreciation expense 3750 insurance expense 6750 suplices expense 2825 salaries expense 13500 Total Expenses 27575 Net Income/profit 44425 Smith Training Company Ltd, Statement of Changes in Stockholder's Equity for the Year ended December 31, 2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started