Answered step by step

Verified Expert Solution

Question

1 Approved Answer

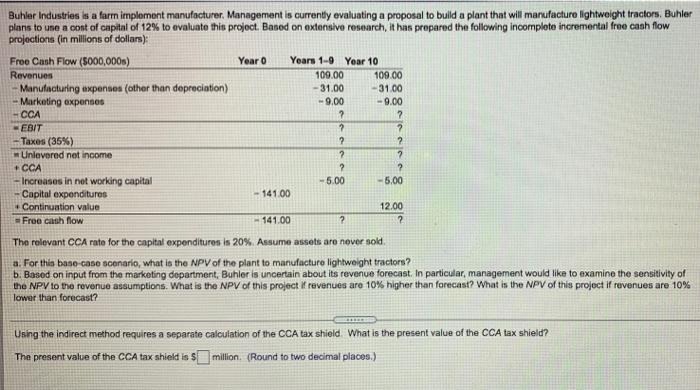

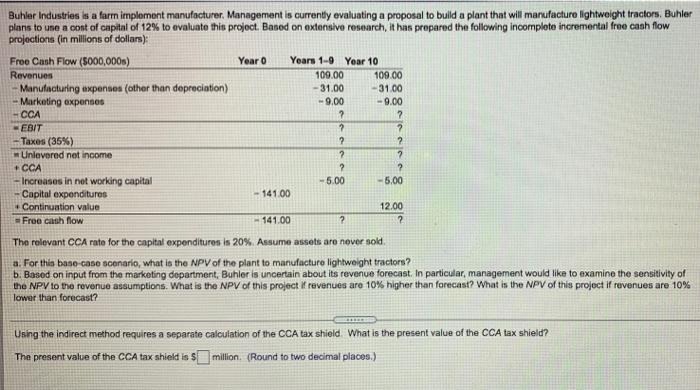

please answer the following questions. thank you for your help! Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build

please answer the following questions.

Buhler Industries is a farm implement manufacturer. Management is currently evaluating a proposal to build a plant that will manufacture lightweight tractors. Buhler plans to une a cont of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incomplete incremental free cash flow projections (in Millions of dollars); Free Cash Flow (5000,000s) Year 0 Years 1-9 Year 10 Revenues 109.00 109.00 Manufacturing expenses (other than depreciation) - 31.00 - 31.00 Marketing expensos -9.00 - 9.00 -CCA 2 ? - EBIT ? ? - Taxes (35%) ? 2 Unlevered net income 2 2 +CCA 2 ? - Increases in not working capital 5.00 -5.00 - Capital expenditures - 141.00 Continuation value 12.00 Free cash flow 141.00 The relevant CCA rate for the capital expenditures is 20%. Assume assets are never sold. a. For this base-case scenario, what is the NPV of the plant to manufacture lightweight tractors? b. Based on input from the marketing department, Buhler is uncertain about its revenue forecast . In particular, management would like to examine the sensitivity of the NPV to the revenue assumptions. What is the NPV of this project if revenues are 10% higher than forecast? What is the NPV of this project if revenues are 10% lower than forecast? ? 2 Using the Indirect method requires a separate calculation of the CCA tax shield. What is the present value of the CCA tax shield? The present value of the CCA tax shield is $ million. (Round to two decimal places.) thank you for your help!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started