Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions. Thank you. There should be 8 answers total. Please number using 1, 2, 3, 4, 5, and etc. 8. Changes

Please answer the following questions. Thank you. There should be 8 answers total. Please number using 1, 2, 3, 4, 5, and etc.

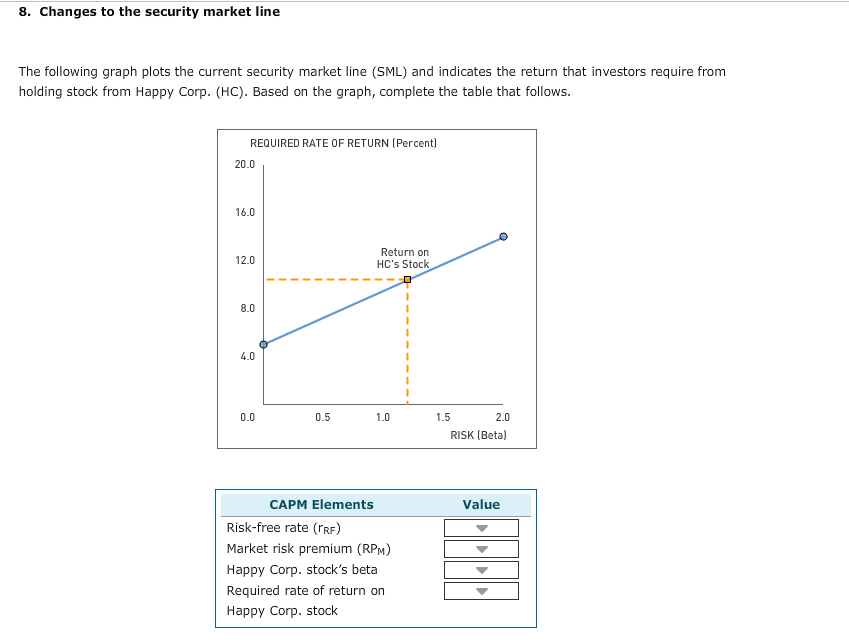

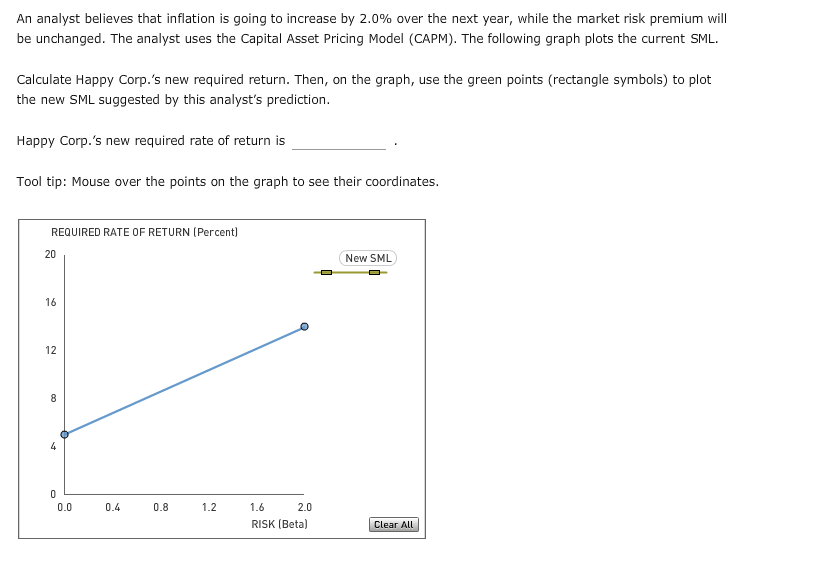

8. Changes to the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows. REQUIRED RATE 0F RETURN (Percent0 20.0 16.0 Return on 12.0 HC's Stock 8.0 4.0 1.5 1.0 2.0 0.0 RISK (Beta) CAPM Elements Value Risk-free rate (r Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on w Happy Corp. stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started