Please answer the following questions, Thanks!

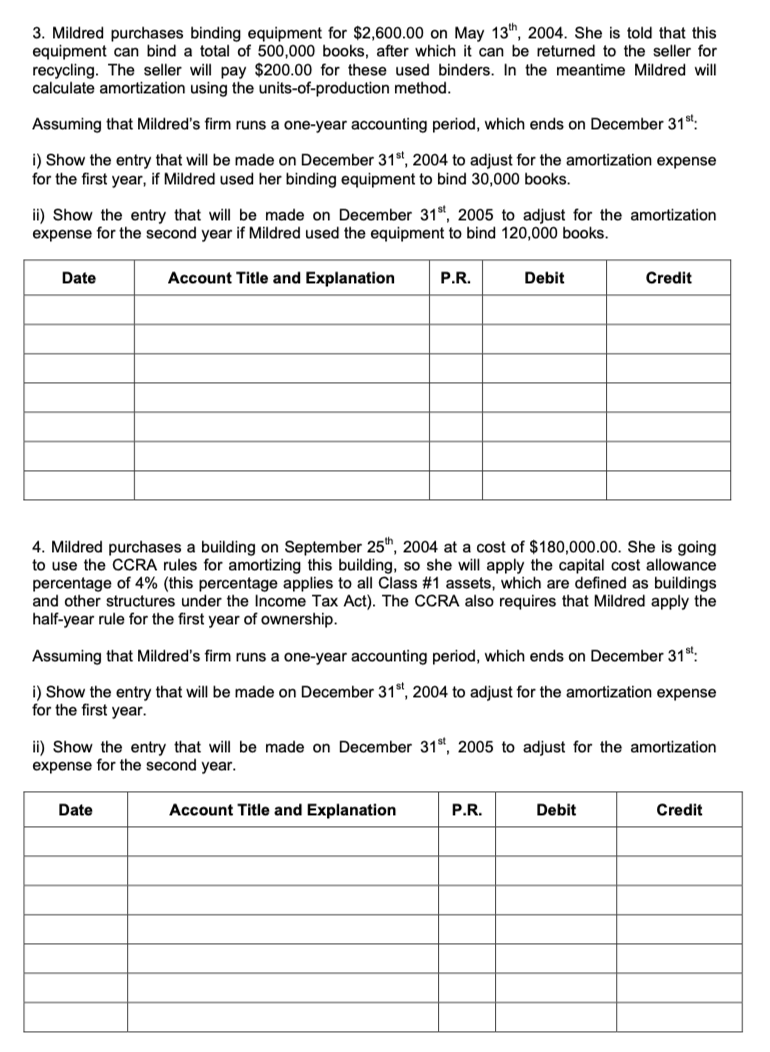

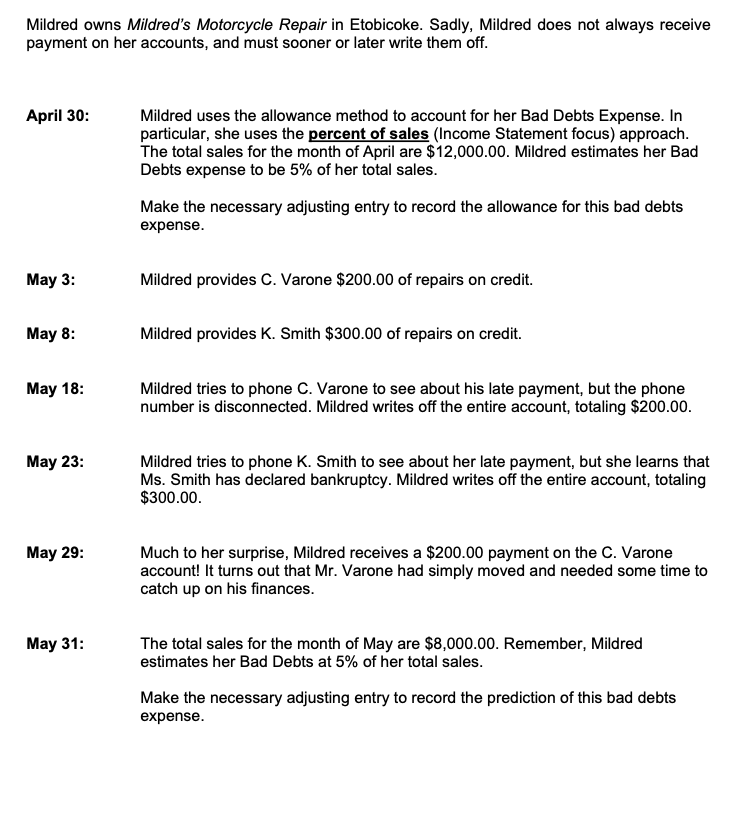

3. Mildred purchases binding equipment for $2,600.00 on May 13", 2004. She is told that this equipment can bind a total of 500,000 books, after which it can be returned to the seller for recycling. The seller will pay $200.00 for these used binders. In the meantime Mildred will calculate amortization using the units-of-production method. Assuming that Mildred's firm runs a one-year accounting period, which ends on December 31: i) Show the entry that will be made on December 31, 2004 to adjust for the amortization expense for the first year, if Mildred used her binding equipment to bind 30,000 books. ii) Show the entry that will be made on December 31", 2005 to adjust for the amortization expense for the second year if Mildred used the equipment to bind 120,000 books. Date Account Title and Explanation P.R. Debit Credit 4. Mildred purchases a building on September 25", 2004 at a cost of $180,000.00. She is going to use the CCRA rules for amortizing this building, so she will apply the capital cost allowance percentage of 4% (this percentage applies to all Class #1 assets, which are defined as buildings and other structures under the Income Tax Act). The CCRA also requires that Mildred apply the half-year rule for the first year of ownership. Assuming that Mildred's firm runs a one-year accounting period, which ends on December 31": i) Show the entry that will be made on December 31", 2004 to adjust for the amortization expense for the first year. ii) Show the entry that will be made on December 31", 2005 to adjust for the amortization expense for the second year. Date Account Title and Explanation P.R. Debit CreditMildred owns Mildred's Motorcycle Repair in Etobicoke. Sadly, Mildred does not always receive payment on her accounts, and must sooner or later write them off. April 30: May18: May 23: May 29: May 31: Mildred uses the allowance method to account for her Bad Debts Expense. In particular. she uses the percent of sales (Income Statement focus} approach. The total sales for the month of April are $12,000.00. Mildred estimates her Bad Debts expense to be 5% of her total sales. Make the necessary adjusting entry to record the allowance for this bad debts expense. Mildred provides C. Varone $200.00 of repairs on credit. Mildred provides K. Smith $300.00 of repairs on credit. Mildred tries to phone C. Varone to see about his late payment, but the phone number is disconnected. Mildred writes off the entire account, totaling $200.00. Mildred tries to phone K. Smith to see about her late payment. but she learns that Ms. Smith has declared bankruptcy. Mildred writes off the entire account, totaling $300.00. Much to her surprise. Mildred receives a $200.00 payment on the C. Varone account! It turns out that Mr. Varone had simply moved and needed sometime to catch up on his nances. The total sales for the month of May are $8,000.00. Remember, Mildred estimates her Bad Debts at 5% of her total sales. Make the necessary adjusting entry to record the prediction of this bad debts expense