Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions: The statements below seek to distinguish between legal (statutory) tax incidence and economic tax incidence. Select the MOST correct statement

Please answer the following questions:

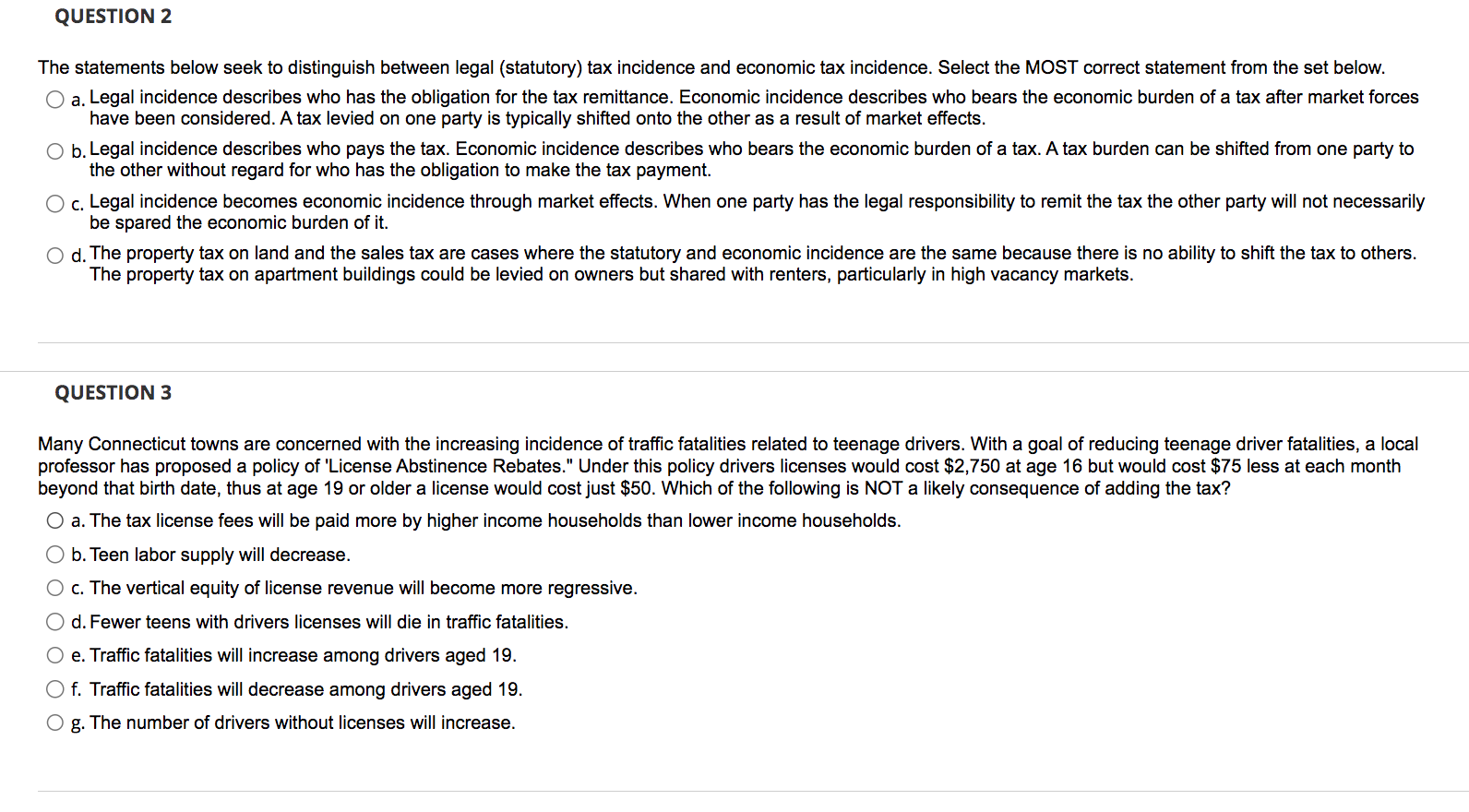

The statements below seek to distinguish between legal (statutory) tax incidence and economic tax incidence. Select the MOST correct statement from the set below. a. Legal incidence describes who has the obligation for the tax remittance. Economic incidence describes who bears the economic burden of a tax after market forces have been considered. A tax levied on one party is typically shifted onto the other as a result of market effects. b. Legal incidence describes who pays the tax. Economic incidence describes who bears the economic burden of a tax. A tax burden can be shifted from one party to the other without regard for who has the obligation to make the tax payment. c. Legal incidence becomes economic incidence through market effects. When one party has the legal responsibility to remit the tax the other party will not necessarily be spared the economic burden of it. d. The property tax on land and the sales tax are cases where the statutory and economic incidence are the same because there is no ability to shift the tax to others. The property tax on apartment buildings could be levied on owners but shared with renters, particularly in high vacancy markets. QUESTION 3 Many Connecticut towns are concerned with the increasing incidence of traffic fatalities related to teenage drivers. With a goal of reducing teenage driver fatalities, a local professor has proposed a policy of 'License Abstinence Rebates." Under this policy drivers licenses would cost $2,750 at age 16 but would cost $75 less at each month beyond that birth date, thus at age 19 or older a license would cost just $50. Which of the following is NOT a likely consequence of adding the tax? a. The tax license fees will be paid more by higher income households than lower income households. b. Teen labor supply will decrease. c. The vertical equity of license revenue will become more regressive. d. Fewer teens with drivers licenses will die in traffic fatalities. e. Traffic fatalities will increase among drivers aged 19. f. Traffic fatalities will decrease among drivers aged 19. g. The number of drivers without licenses will increase

The statements below seek to distinguish between legal (statutory) tax incidence and economic tax incidence. Select the MOST correct statement from the set below. a. Legal incidence describes who has the obligation for the tax remittance. Economic incidence describes who bears the economic burden of a tax after market forces have been considered. A tax levied on one party is typically shifted onto the other as a result of market effects. b. Legal incidence describes who pays the tax. Economic incidence describes who bears the economic burden of a tax. A tax burden can be shifted from one party to the other without regard for who has the obligation to make the tax payment. c. Legal incidence becomes economic incidence through market effects. When one party has the legal responsibility to remit the tax the other party will not necessarily be spared the economic burden of it. d. The property tax on land and the sales tax are cases where the statutory and economic incidence are the same because there is no ability to shift the tax to others. The property tax on apartment buildings could be levied on owners but shared with renters, particularly in high vacancy markets. QUESTION 3 Many Connecticut towns are concerned with the increasing incidence of traffic fatalities related to teenage drivers. With a goal of reducing teenage driver fatalities, a local professor has proposed a policy of 'License Abstinence Rebates." Under this policy drivers licenses would cost $2,750 at age 16 but would cost $75 less at each month beyond that birth date, thus at age 19 or older a license would cost just $50. Which of the following is NOT a likely consequence of adding the tax? a. The tax license fees will be paid more by higher income households than lower income households. b. Teen labor supply will decrease. c. The vertical equity of license revenue will become more regressive. d. Fewer teens with drivers licenses will die in traffic fatalities. e. Traffic fatalities will increase among drivers aged 19. f. Traffic fatalities will decrease among drivers aged 19. g. The number of drivers without licenses will increase Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started