Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the following questions with the data found in the photo. I showed the the drop downs for requirement one through five, they are

Please answer the following questions with the data found in the photo. I showed the the drop downs for requirement one through five, they are the same options if I showed one of dropdown for the question. Thank you so much.

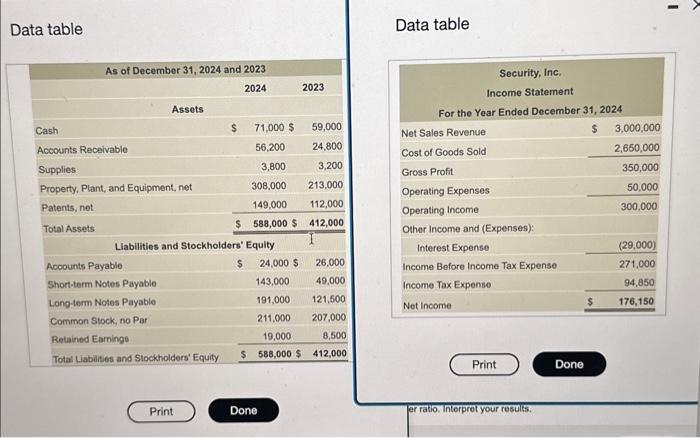

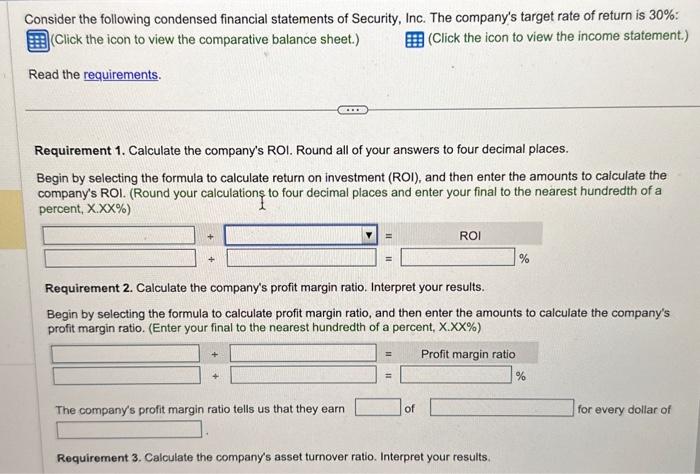

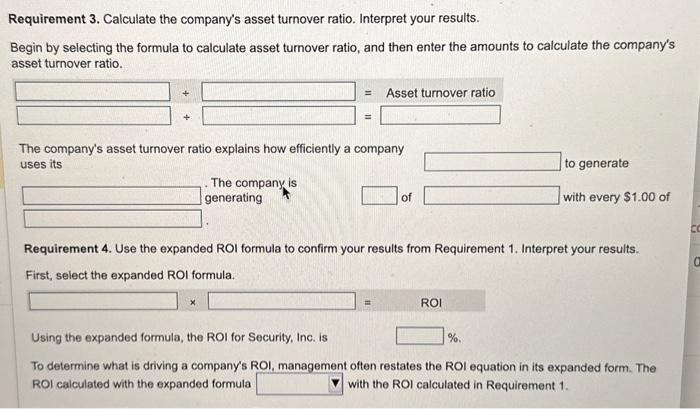

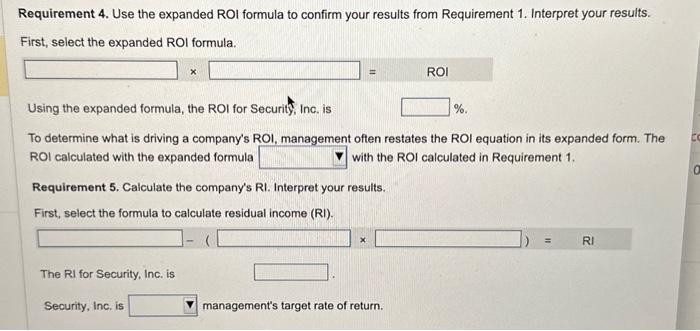

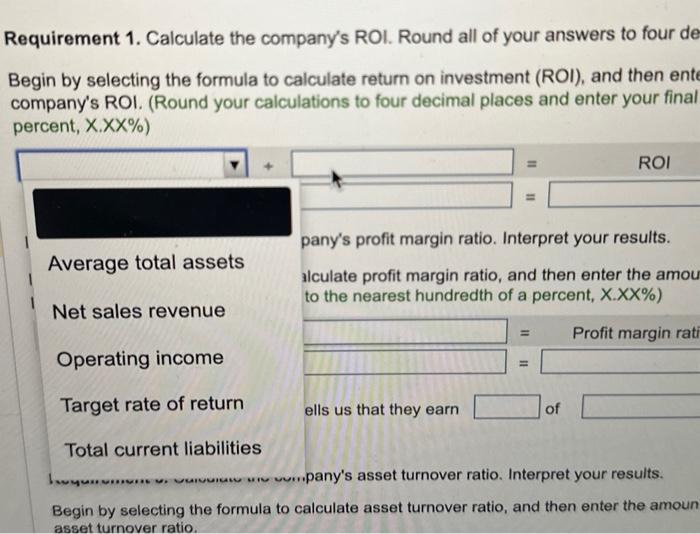

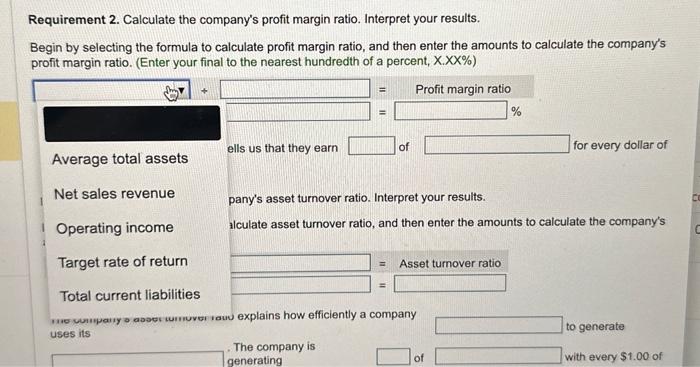

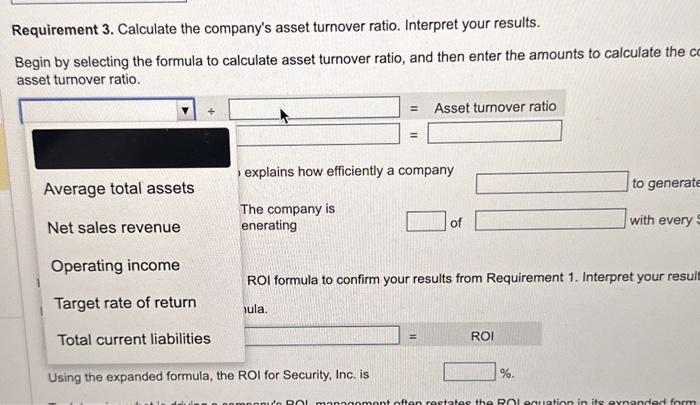

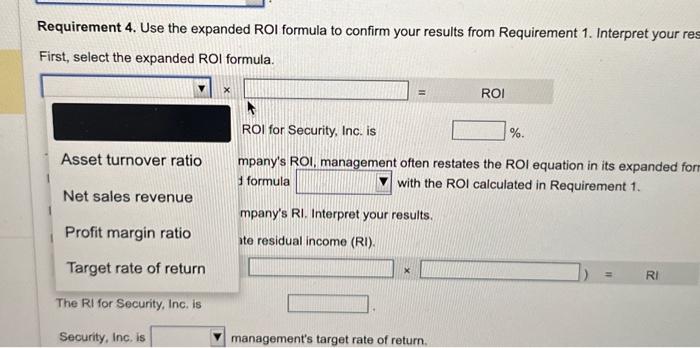

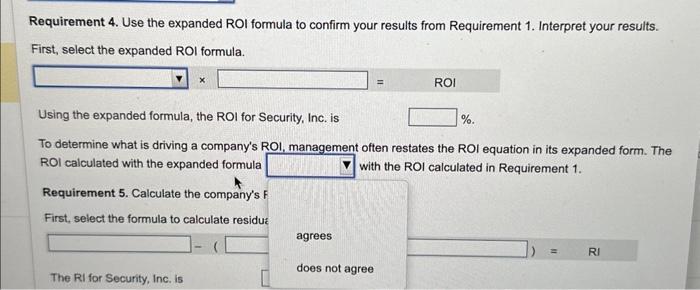

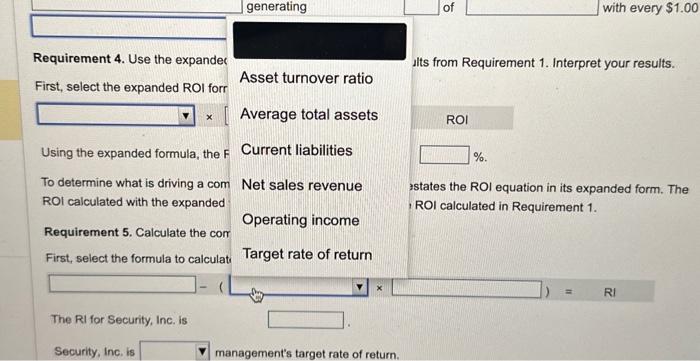

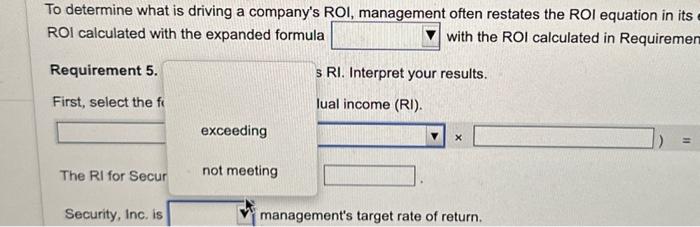

Data table Data table Consider the following condensed financial statements of Security, Inc. The company's target rate of return is 30% : (Click the icon to view the comparative balance sheet. (Click the icon to view the income statement.) Read the requirements. Requirement 1. Calculate the company's ROI. Round all of your answers to four decimal places. Begin by selecting the formula to calculate return on investment (ROI), and then enter the amounts to calculate the company's ROI. (Round your calculations to four decimal places and enter your final to the nearest hundredth of a percent, X.XX\%) Requirement 2. Calculate the company's profit margin ratio. Interpret your results. Begin by selecting the formula to calculate profit margin ratio, and then enter the amounts to calculate the company's profit margin ratio. (Enter your final to the nearest hundredth of a percent, X.XX ) The company's profit margin ratio tells us that they earn of for every dollar of Requirement 3. Calculate the company's asset turnover ratio. Interpret your results. Requirement 3. Calculate the company's asset turnover ratio. Interpret your results. Begin by selecting the formula to calculate asset turnover ratio, and then enter the amounts to calculate the company's asset turnover ratio. The company's asset turnover ratio explains how efficiently a company uses its to generate The company is generating of with every $1.00 of Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. First, select the expanded ROI formula. Using the expanded formula, the ROI for Security, Inc. is % To determine what is driving a company's ROI, management often restates the ROI equation in its expanded form. The ROI calculated with the expanded formula with the ROI calculated in Requirement 1. Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. First, select the expanded ROI formula. =ROI Using the expanded formula, the ROI for Security, Inc. is % To determine what is driving a company's ROI. management often restates the ROI equation in its expanded form. The ROI calculated with the expanded formula with the ROI calculated in Requirement 1. Requirement 5. Calculate the company's RI. Interpret your results. First, select the formula to calculate residual income (RI). (x=RI The Rl for Security, Inc. is Security, Inc. is management's target rate of return. Requirement 1. Calculate the company's ROI. Round all of your answers to four de Begin by selecting the formula to calculate return on investment (ROI), and then ente company's ROI. (Round your calculations to four decimal places and enter your final percent, X.XX%) pany's profit margin ratio. Interpret your results. alculate profit margin ratio, and then enter the amou to the nearest hundredth of a percent, X.XX\%) Requirement 2. Calculate the company's profit margin ratio. Interpret your results. . The company is generating of with every $1.00 of Requirement 3. Calculate the company's asset turnover ratio. Interpret your results. Begin by selecting the formula to calculate asset turnover ratio, and then enter the amounts to calculate the asset turnover ratio. Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your re First, select the expanded ROI formula. ROI for Security, Inc. is %. mpany's ROI, management often restates the ROI equation in its expanded fo I formula with the ROI calculated in Requirement 1. mpany's RI. Interpret your results. Ite residual income (RI). The RI for Security, Inc. is Security, Inc, is management's target rate of return. Requirement 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. First, select the expanded ROI formula. Using the expanded formula, the ROI for Security, Inc. is %. To determine what is driving a company's ROI, management often restates the ROI equation in its expanded form. The ROI calculated with the expanded formula with the ROI calculated in Requirement 1. Requirement 5. Calculate the company's F First, select the formula to calculate residus agrees does not agree The RI for Security, Inc. is Requirement 4. Use the expandec Ilts from Requirement 1 . Interpret your results. First, select the expanded ROI forr ROI To determine what is driving a com zstates the ROI equation in its expanded form. The ROI calculated with the expanded i ROI calculated in Requirement 1. Requirement 5. Calculate the corr First, select the formula to calculati The RI for Security, Inc. is Security, Inc. is management's target rate of return. To determine what is driving a company's ROI, management often restates the ROI equation in its ROI calculated with the expanded formula with the ROI calculated in Requiremel Requirement 5. S RI. Interpret your results. First, select the fi lual income (RI). exceeding The RI for Secur not meeting Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started