Answered step by step

Verified Expert Solution

Question

1 Approved Answer

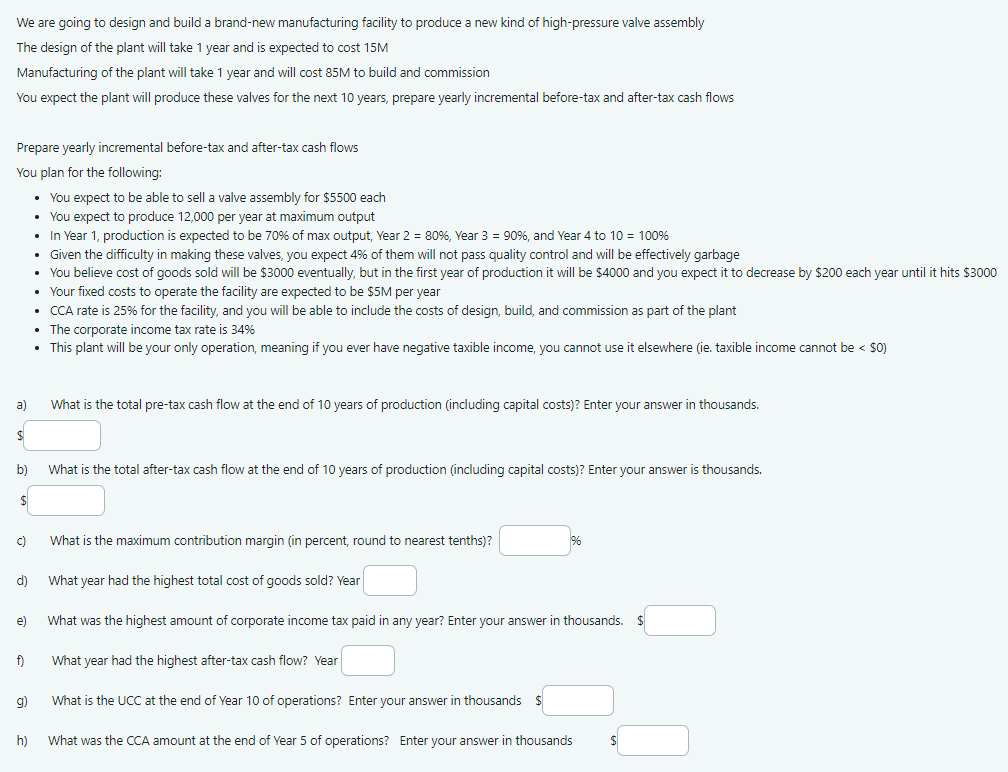

Please answer the following showing calculation We are going to design and build a brand - new manufacturing facility to produce a new kind of

Please answer the following showing calculation

We are going to design and build a brandnew manufacturing facility to produce a new kind of highpressure valve assembly

The design of the plant will take year and is expected to cost

Manufacturing of the plant will take year and will cost to build and commission

You expect the plant will produce these valves for the next years, prepare yearly incremental beforetax and aftertax cash flows

Prepare yearly incremental beforetax and aftertax cash flows

You plan for the following:

You expect to be able to sell a valve assembly for $ each

You expect to produce per year at maximum output

In Year production is expected to be of max output, Year Year and Year to

Given the difficulty in making these valves, you expect of them will not pass quality control and will be effectively garbage

You believe cost of goods sold will be $ eventually, but in the first year of production it will be $ and you expect it to decrease by $ each year until it hits $

Your fixed costs to operate the facility are expected to be $ per year

CCA rate is for the facility, and you will be able to include the costs of design, build, and commission as part of the plant

The corporate income tax rate is

This plant will be your only operation, meaning if you ever have negative taxible income, you cannot use it elsewhere ie taxible income cannot be $

a What is the total pretax cash flow at the end of years of production including capital costs Enter your answer in thousands.

b What is the total aftertax cash flow at the end of years of production including capital costs Enter your answer is thousands.

$

c What is the maximum contribution margin in percent, round to nearest tenths

d What year had the highest total cost of goods sold? Year

e What was the highest amount of corporate income tax paid in any year? Enter your answer in thousands. $

f What year had the highest aftertax cash flow? Year

g What is the UCC at the end of Year of operations? Enter your answer in thousands $

h What was the CCA amount at the end of Year of operations? Enter your answer in thousands

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started