please answer the following, thank you!

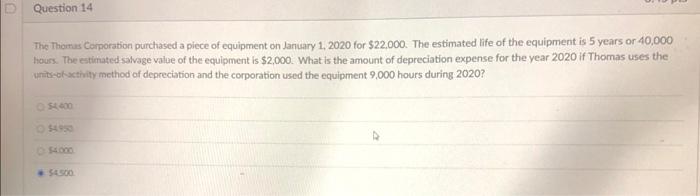

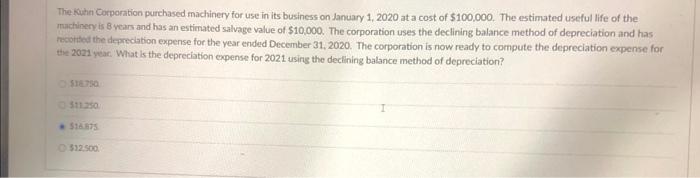

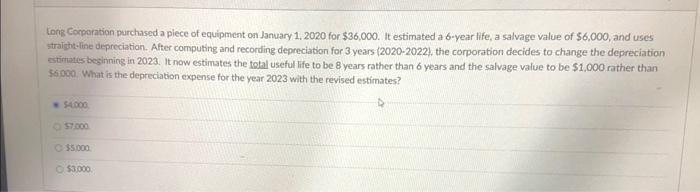

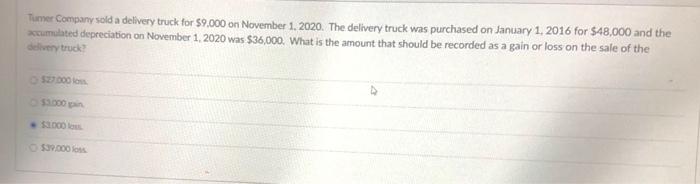

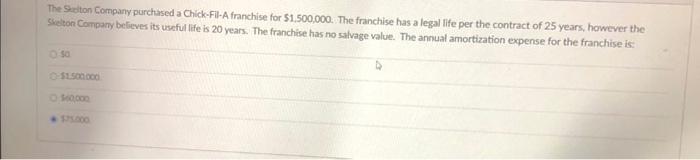

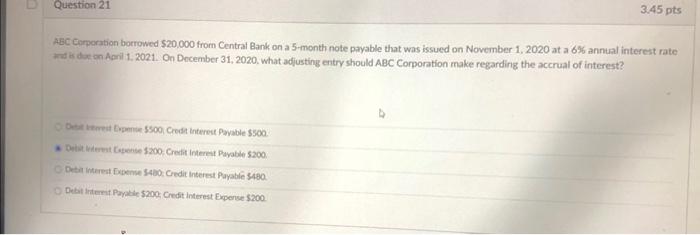

D Question 14 The Thomas Corporation purchased a piece of equipment on January 1, 2020 for $22.000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated salvage value of the equipment is $2,000. What is the amount of depreciation expense for the year 2020 if Thomas uses the units of activity method of depreciation and the corporation used the equipment 9,000 hours during 2020? 460 $450 500 The Kuhn Corporation purchased machinery for use in its business on January 1, 2020 at a cost of $100,000. The estimated useful life of the machinery is B years and has an estimated salvage value of $10,000. The corporation uses the declining balance method of depreciation and has recorted the depreciation expense for the year ended December 31, 2020. The corporation is now ready to compute the depreciation expense for the 2021 year. What is the depreciation expense for 2021 using the declining balance method of depreciation? $18.75 512.500 Long Corporation purchased a piece of equipment on January 1, 2020 for $36,000. It estimated a 6-year life, a salvage value of $6,000, and uses straight-line depreciation. After computing and recording depreciation for 3 years (2020-2022, the corporation decides to change the depreciation stimates beginning in 2023. It now estimates the total useful life to be 8 years rather than 6 years and the salvage value to be $1,000 rather than 56.000. What is the depreciation expense for the year 2023 with the revised estimates? $4.000 57.000 55.000 $3.000 Tumer Company sold a delivery truck for $9.000 on November 1, 2020. The delivery truck was purchased on January 1, 2016 for $48,000 and the xcumulated depreciation on November 1, 2020 was $36,000. What is the amount that should be recorded as a gain or loss on the sale of the delivery truck 527.000 10 39.000 The Selton Company purchased a Chick-Fi-A franchise for $1.500,000. The franchise has a legal life per the contract of 25 years, however the Skelton Company believes its useful life is 20 years. The franchise has no salvage value. The annual amortization expense for the franchise is: 50 -$1.500 od top . Question 21 3.45 pts ABC Corporation borrowed $20,000 from Central Bank on a 5-month note payable that was issued on November 1, 2020 at a 6% annual interest rate and so on April 1, 2021. On December 31, 2020. what adjusting entry should ABC Corporation make regarding the accrual of interest? Depen 5500 Credit interest Payable $500 Det er en 200 Credit Interest Payable $200 Debt interest Expense 5480 Credit interest Payable 5480 Debt interest Payable $200 Credit interest Expense 5200