Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the following, thanks! The following account balances were extracted from the accounting records of Paul Corporation at the end of the year: Accounts

please answer the following, thanks!

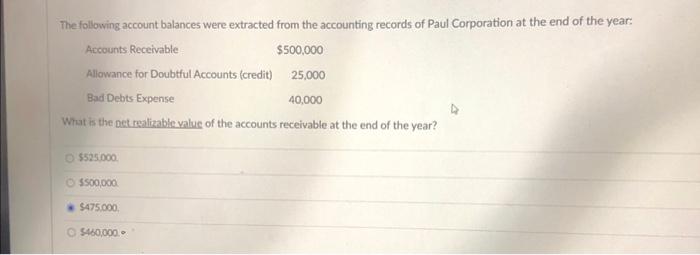

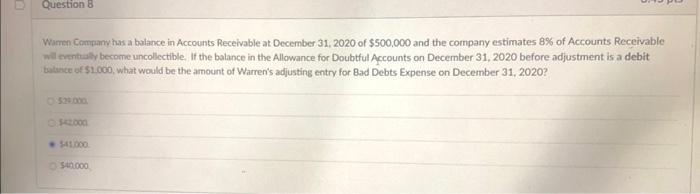

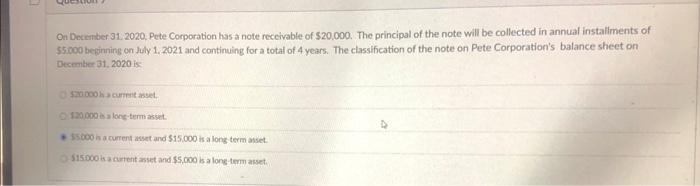

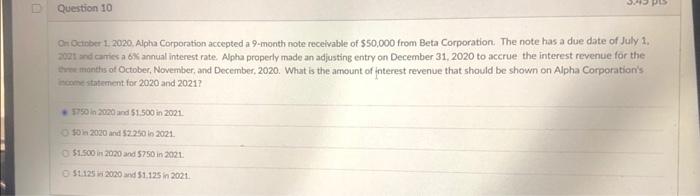

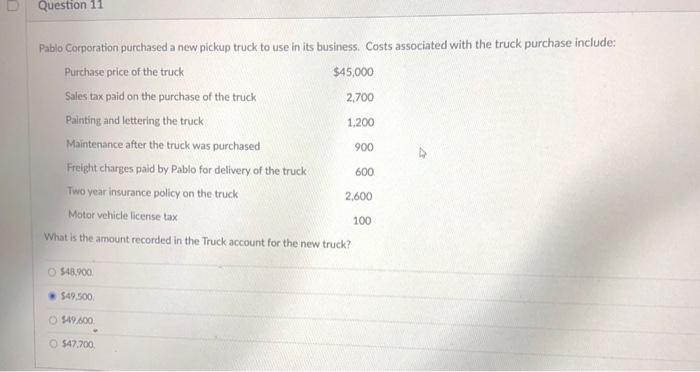

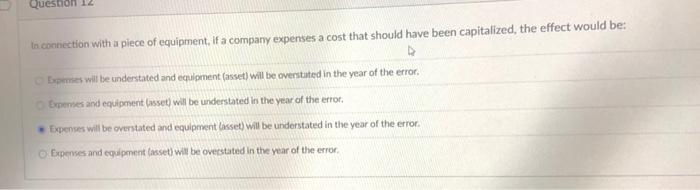

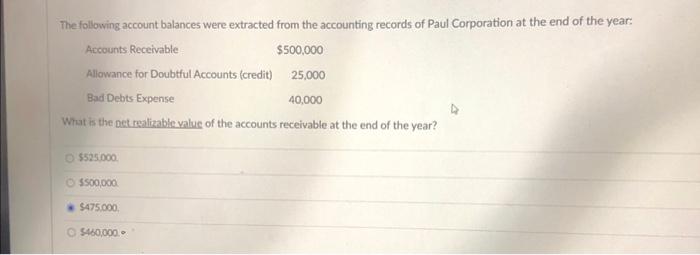

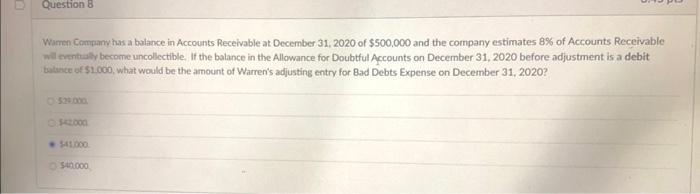

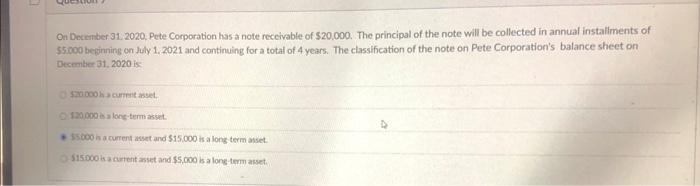

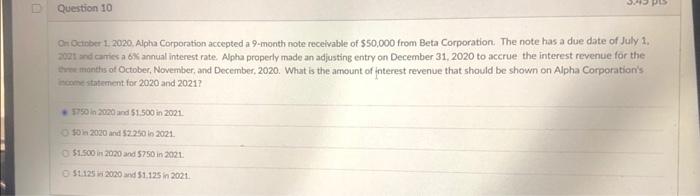

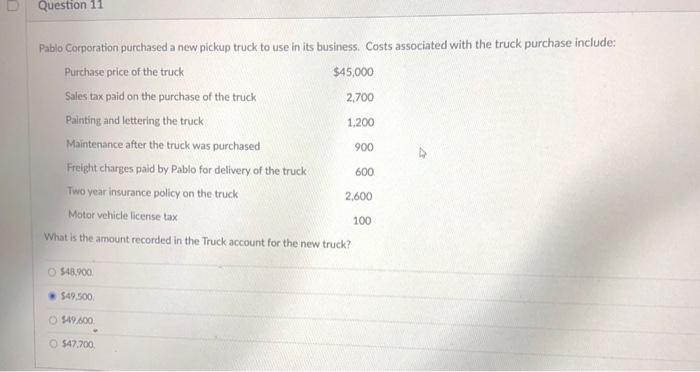

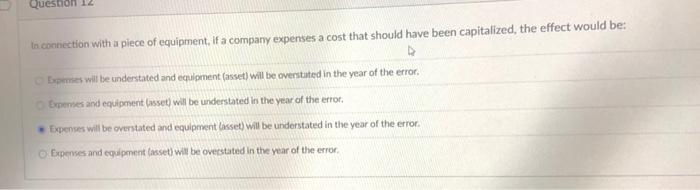

The following account balances were extracted from the accounting records of Paul Corporation at the end of the year: Accounts Receivable $500,000 Allowance for Doubtful Accounts (credit) 25,000 Bad Debts Expense 40,000 What is the pet realizable value of the accounts receivable at the end of the year? $525.000 $500,000 $475.000 5460,000.- Question 8 a Warren Company has a balance in Accounts Receivable at December 31, 2020 of $500.000 and the company estimates 8% of Accounts Receivable will become uncollectible. If the balance in the Allowance for Doubtful Accounts on December 31, 2020 before adjustment is a debit balance of $1.000, what would be the amount of Warren's adjusting entry for Bad Debts Expense on December 31, 2020? 1000 $45.000 $4.000 On December 31, 2020, Pete Corporation has a note receivable of $20,000. The principal of the note will be collected in annual installments of $5.000 beginning on July 1, 2021 and continuing for a total of 4 years. The classification of the note on Pete Corporation's balance sheet on December 31, 2020 SDCO current asset 100.000 is a long termas 55000 is a current and $15.000 is a long term asset 515.000 is current asset and $5.000 is a long-term asset Question 10 On October 1, 2020. Alpha Corporation accepted a 9-month note receivable of $50,000 from Beta Corporation. The note has a due date of July 1, 2021 and comes a 6% annual interest rate. Alpha properly made an adjusting entry on December 31, 2020 to accrue the interest revenue for the three months of October, November, and December, 2020. What is the amount of interest revenue that should be shown on Alpha Corporation's come statement for 2020 and 2021? 1750 in 2000 and 51.500 in 2021. Son 2020 and $2.250 in 2021 $1.500 in 2020 and 5750 in 2021 51.125 2020 and 51.125 in 2021 Question 11 Pablo Corporation purchased a new pickup truck to use in its business. Costs associated with the truck purchase include: Purchase price of the truck $45,000 Sales tax paid on the purchase of the truck 2,700 Painting and lettering the truck 1.200 Maintenance after the truck was purchased 900 Freight charges paid by Pablo for delivery of the truck Two year insurance policy on the truck 2,600 Motor vehicle license tax 100 What is the amount recorded in the Truck account for the new truck? 600 548.900 549.500 549.000 547,700 Questo In connection with a piece of equipment, if a company expenses a cost that should have been capitalized, the effect would be: Dones will be understated and equipment (asset) will be overstated in the year of the error. pemes and equipment (asset) will be understated in the year of the error, Expenses will be overstated and equipment asset) Will be understated in the year of the error. Expenses and equipment Casset) will be overstated in the year of the error

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started