Please answer the following:

Then answer combined ratio, investment ratio, operating ratio, and overall profitability:

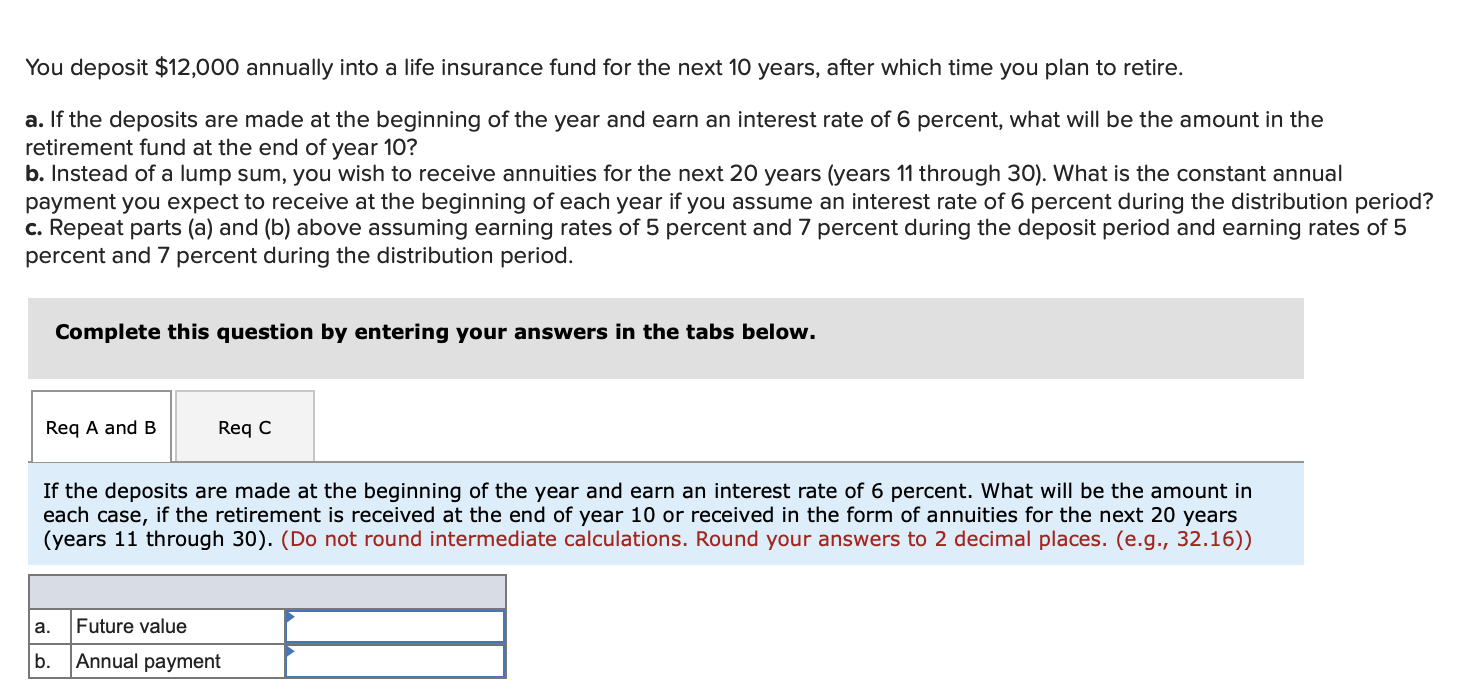

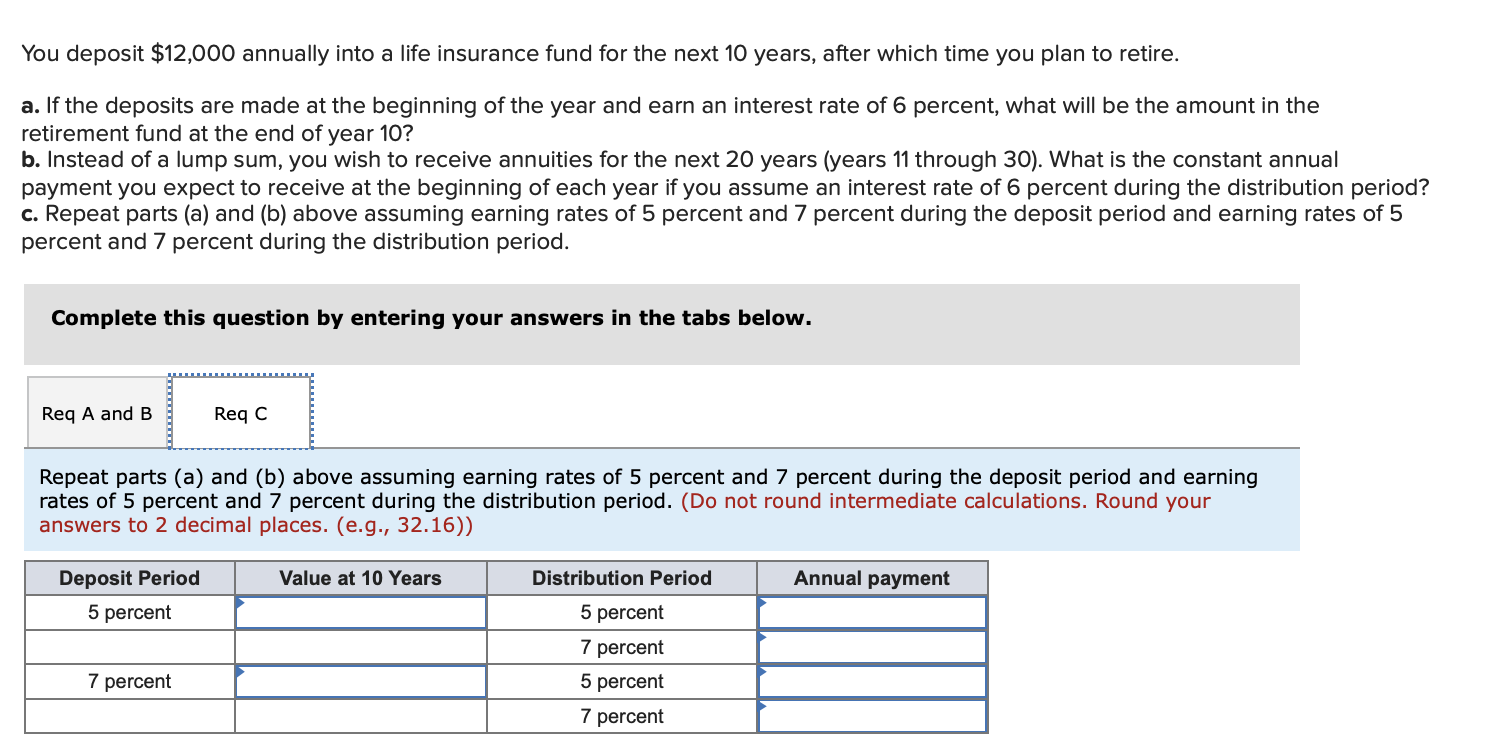

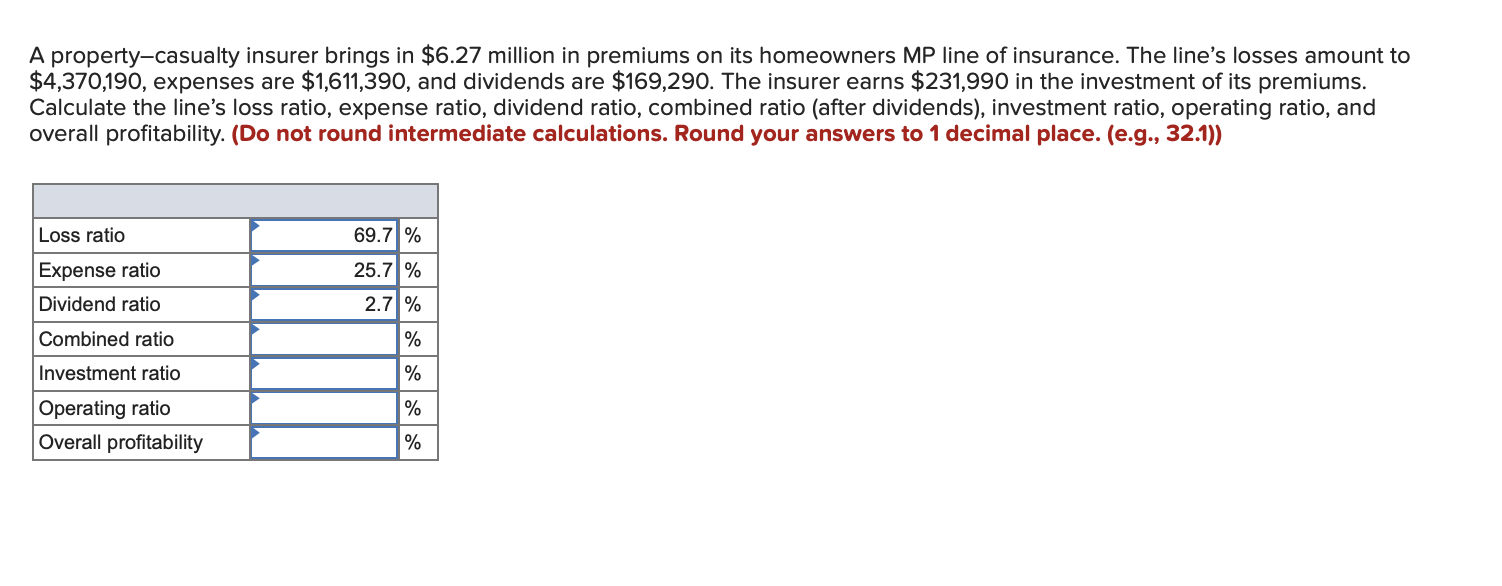

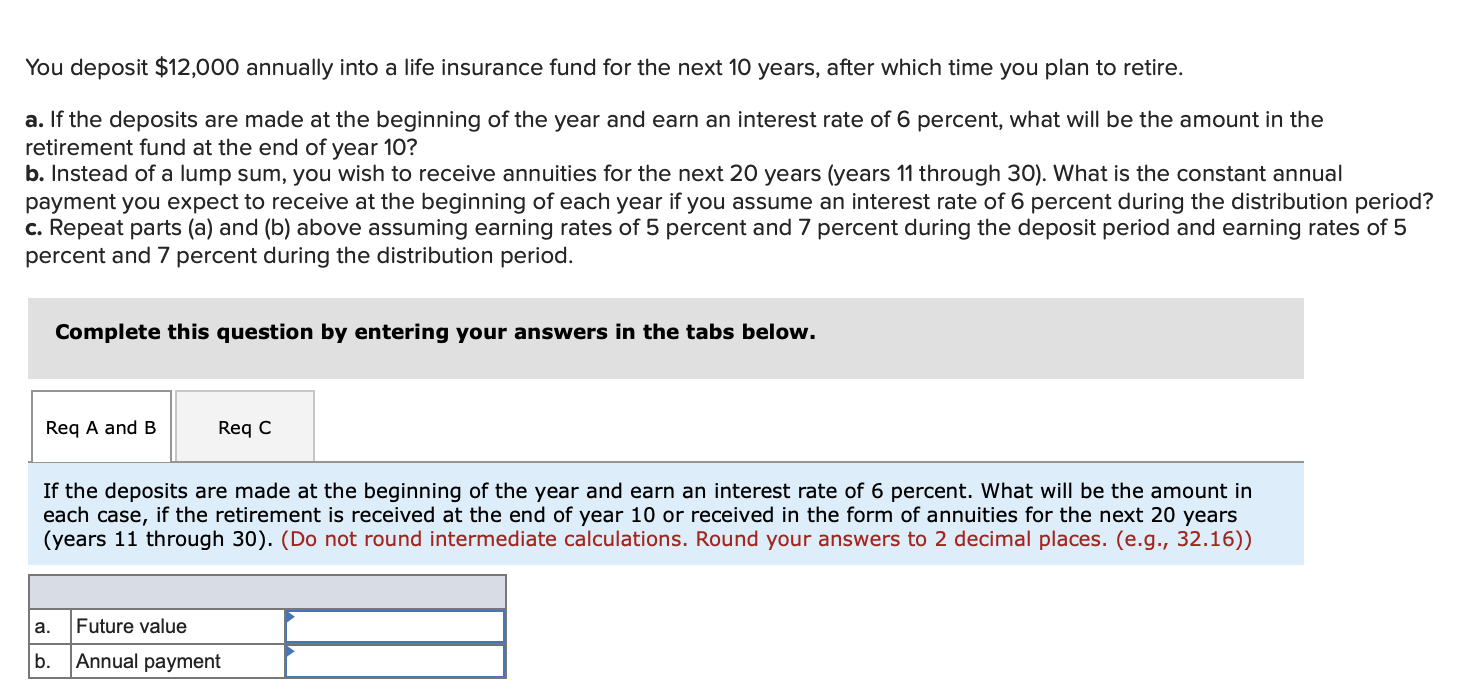

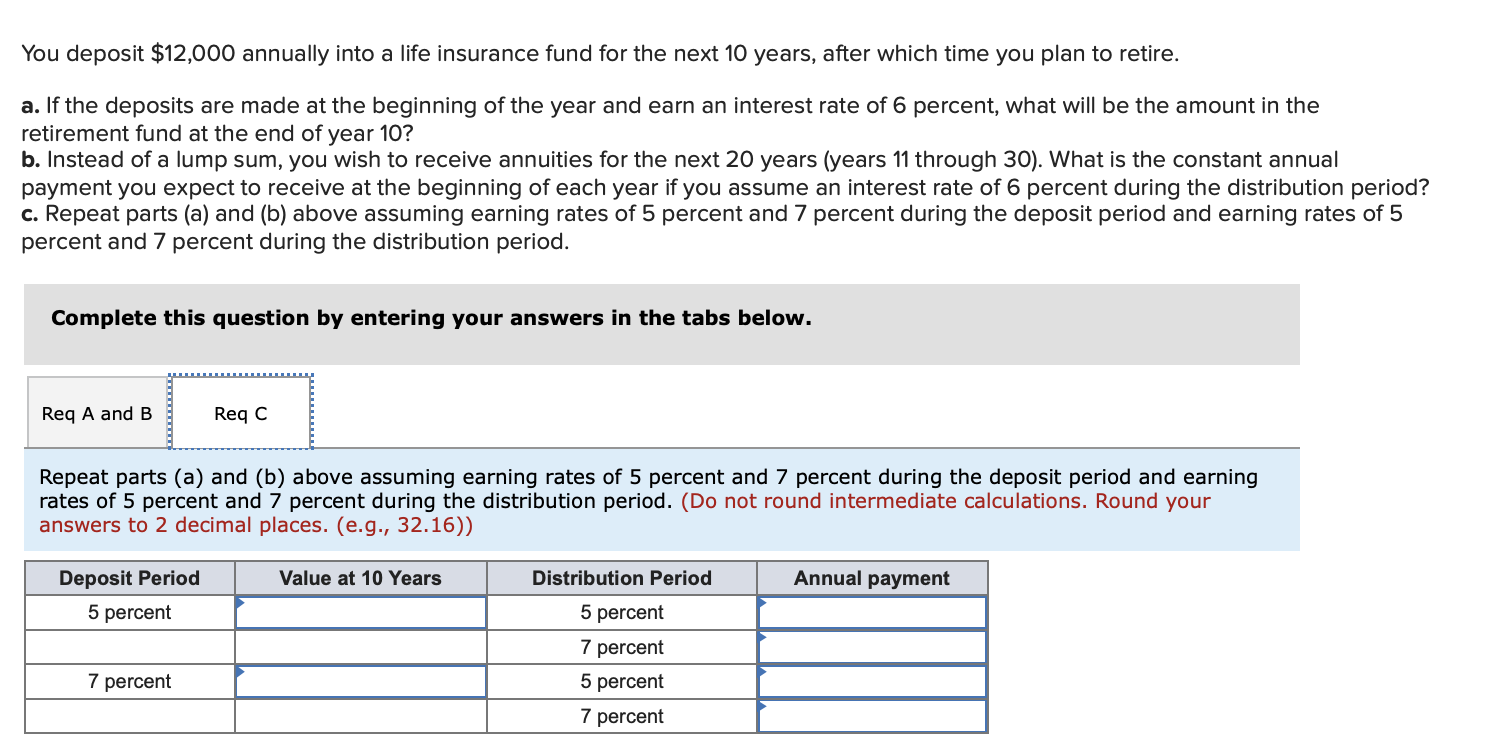

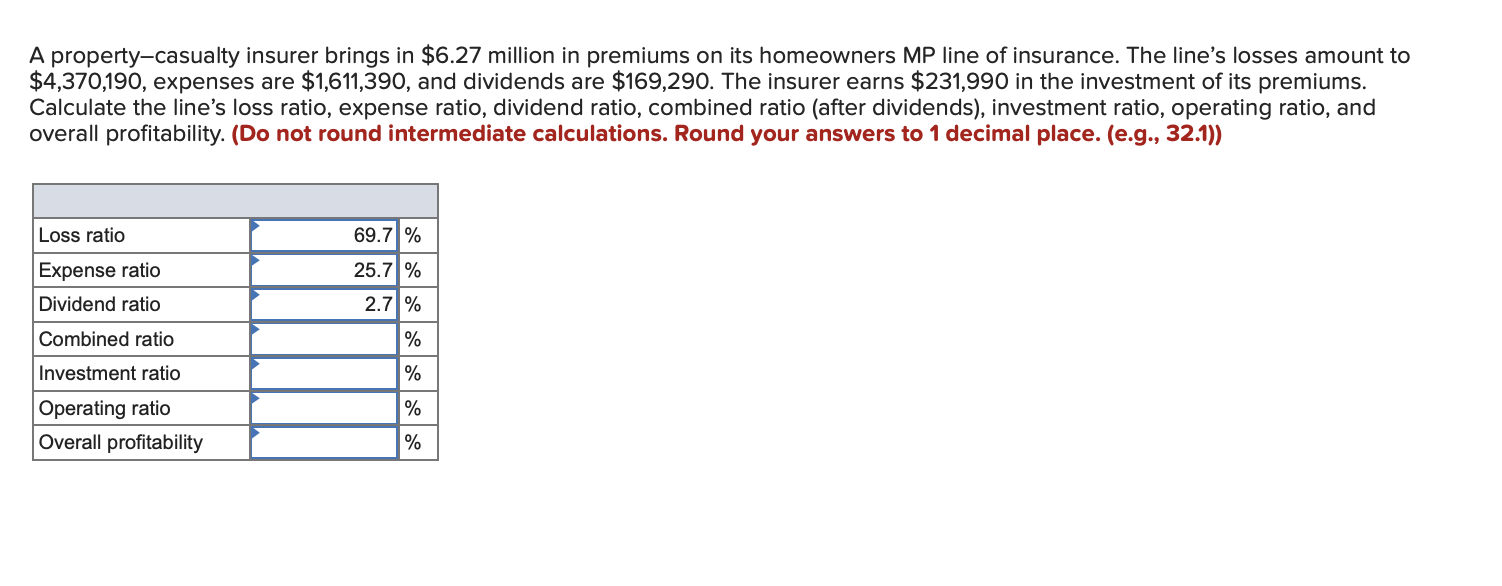

You deposit $12,000 annually into a life insurance fund for the next 10 years, after which time you plan to retire. a. If the deposits are made at the beginning of the year and earn an interest rate of 6 percent, what will be the amount in the retirement fund at the end of year 10? b. Instead of a lump sum, you wish to receive annuities for the next 20 years (years 11 through 30). What is the constant annual payment you expect to receive at the beginning of each year if you assume an interest rate of 6 percent during the distribution period? c. Repeat parts (a) and (b) above assuming earning rates of 5 percent and 7 percent during the deposit period and earning rates of 5 percent and 7 percent during the distribution period. Complete this question by entering your answers in the tabs below. Req A and B Reqc If the deposits are made at the beginning of the year and earn an interest rate of 6 percent. What will be the amount in each case, if the retirement is received at the end of year 10 or received in the form of annuities for the next 20 years (years 11 through 30). (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. Future value b. Annual payment You deposit $12,000 annually into a life insurance fund for the next 10 years, after which time you plan to retire. a. If the deposits are made at the beginning of the year and earn an interest rate of 6 percent, what will be the amount in the retirement fund at the end of year 10? b. Instead of a lump sum, you wish to receive annuities for the next 20 years (years 11 through 30). What is the constant annual payment you expect to receive at the beginning of each year if you assume an interest rate of 6 percent during the distribution period? c. Repeat parts (a) and (b) above assuming earning rates of 5 percent and 7 percent during the deposit period and earning rates of 5 percent and 7 percent during the distribution period. Complete this question by entering your answers in the tabs below. Req A and B Reqc Repeat parts (a) and (b) above assuming earning rates of 5 percent and 7 percent during the deposit period and earning rates of 5 percent and 7 percent during the distribution period. (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Value at 10 Years Distribution Period Annual payment Deposit Period 5 percent 5 percent 7 percent 5 percent 7 percent 7 percent A property-casualty insurer brings in $6.27 million in premiums on its homeowners MP line of insurance. The line's losses amount to $4,370,190, expenses are $1,611,390, and dividends are $169,290. The insurer earns $231,990 in the investment of its premiums. Calculate the line's loss ratio, expense ratio, dividend ratio, combined ratio (after dividends), investment ratio, operating ratio, and overall profitability. (Do not round intermediate calculations. Round your answers to 1 decimal place. (e.g., 32.1)) Loss ratio 69.71% 25.71% Expense ratio Dividend ratio 2.71% Combined ratio % Investment ratio % % Operating ratio Overall profitability % You deposit $12,000 annually into a life insurance fund for the next 10 years, after which time you plan to retire. a. If the deposits are made at the beginning of the year and earn an interest rate of 6 percent, what will be the amount in the retirement fund at the end of year 10? b. Instead of a lump sum, you wish to receive annuities for the next 20 years (years 11 through 30). What is the constant annual payment you expect to receive at the beginning of each year if you assume an interest rate of 6 percent during the distribution period? c. Repeat parts (a) and (b) above assuming earning rates of 5 percent and 7 percent during the deposit period and earning rates of 5 percent and 7 percent during the distribution period. Complete this question by entering your answers in the tabs below. Req A and B Reqc If the deposits are made at the beginning of the year and earn an interest rate of 6 percent. What will be the amount in each case, if the retirement is received at the end of year 10 or received in the form of annuities for the next 20 years (years 11 through 30). (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. Future value b. Annual payment You deposit $12,000 annually into a life insurance fund for the next 10 years, after which time you plan to retire. a. If the deposits are made at the beginning of the year and earn an interest rate of 6 percent, what will be the amount in the retirement fund at the end of year 10? b. Instead of a lump sum, you wish to receive annuities for the next 20 years (years 11 through 30). What is the constant annual payment you expect to receive at the beginning of each year if you assume an interest rate of 6 percent during the distribution period? c. Repeat parts (a) and (b) above assuming earning rates of 5 percent and 7 percent during the deposit period and earning rates of 5 percent and 7 percent during the distribution period. Complete this question by entering your answers in the tabs below. Req A and B Reqc Repeat parts (a) and (b) above assuming earning rates of 5 percent and 7 percent during the deposit period and earning rates of 5 percent and 7 percent during the distribution period. (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Value at 10 Years Distribution Period Annual payment Deposit Period 5 percent 5 percent 7 percent 5 percent 7 percent 7 percent A property-casualty insurer brings in $6.27 million in premiums on its homeowners MP line of insurance. The line's losses amount to $4,370,190, expenses are $1,611,390, and dividends are $169,290. The insurer earns $231,990 in the investment of its premiums. Calculate the line's loss ratio, expense ratio, dividend ratio, combined ratio (after dividends), investment ratio, operating ratio, and overall profitability. (Do not round intermediate calculations. Round your answers to 1 decimal place. (e.g., 32.1)) Loss ratio 69.71% 25.71% Expense ratio Dividend ratio 2.71% Combined ratio % Investment ratio % % Operating ratio Overall profitability %