please answer the following. will Upvote

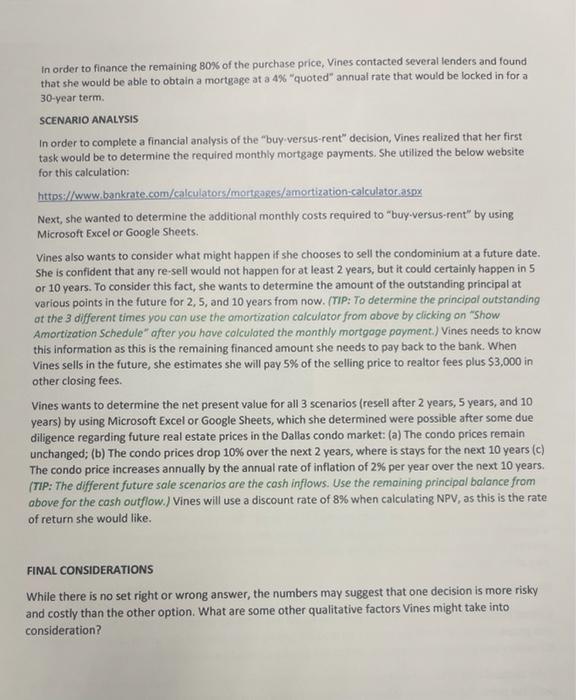

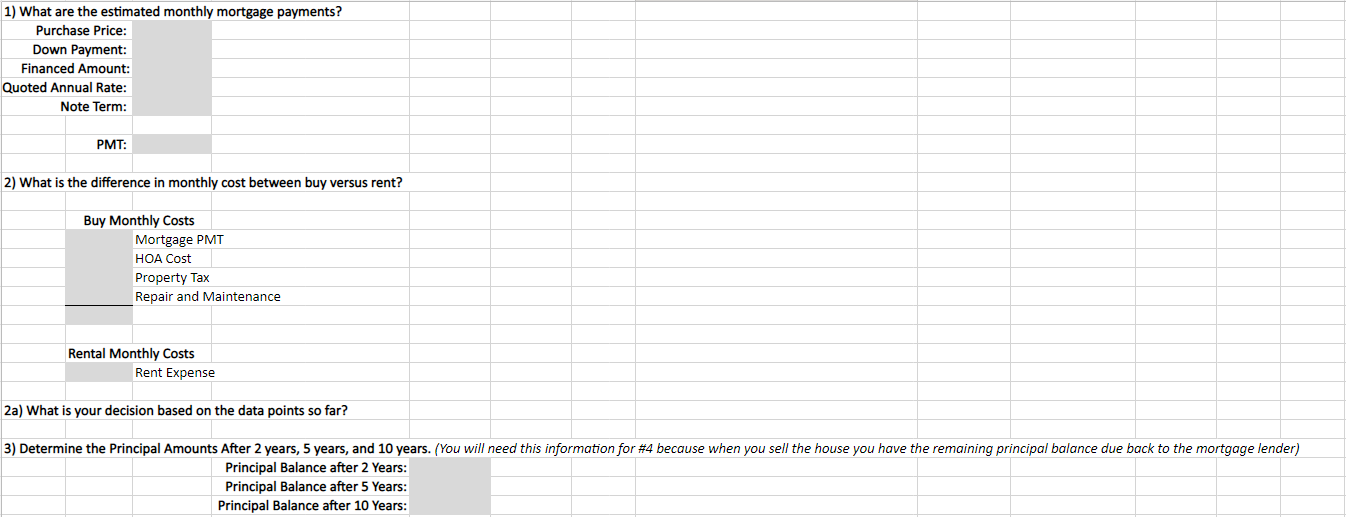

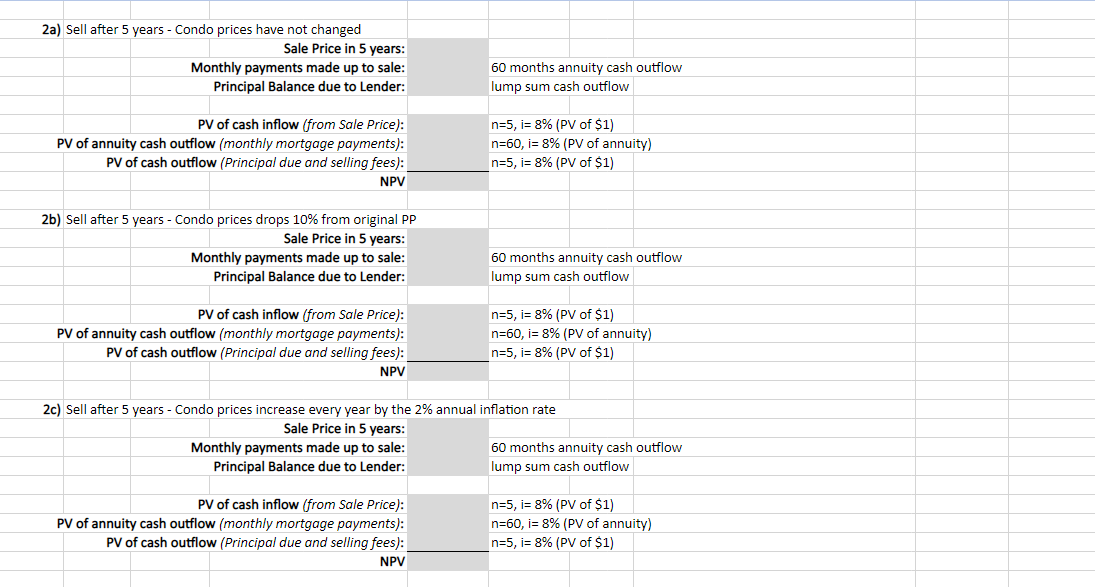

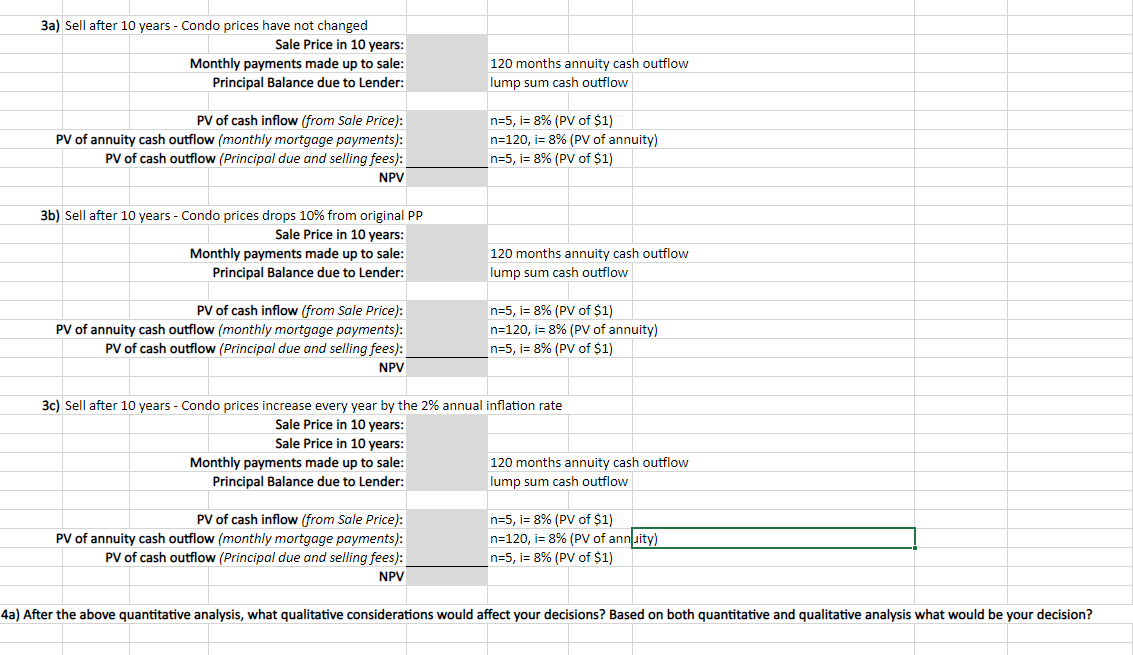

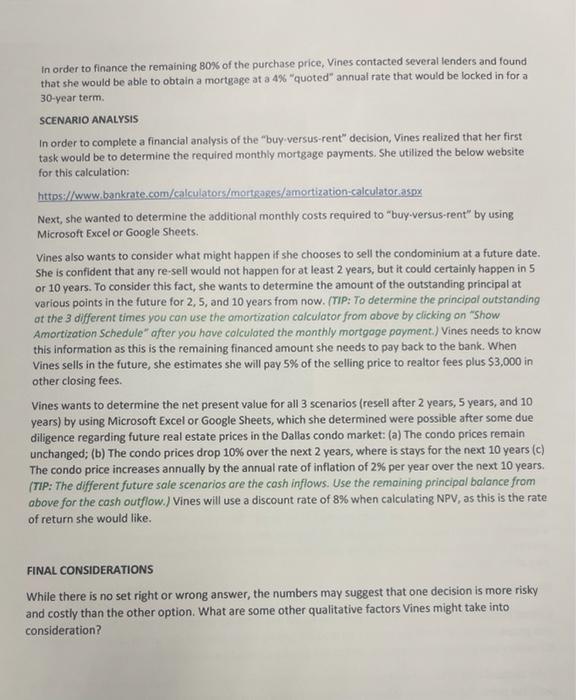

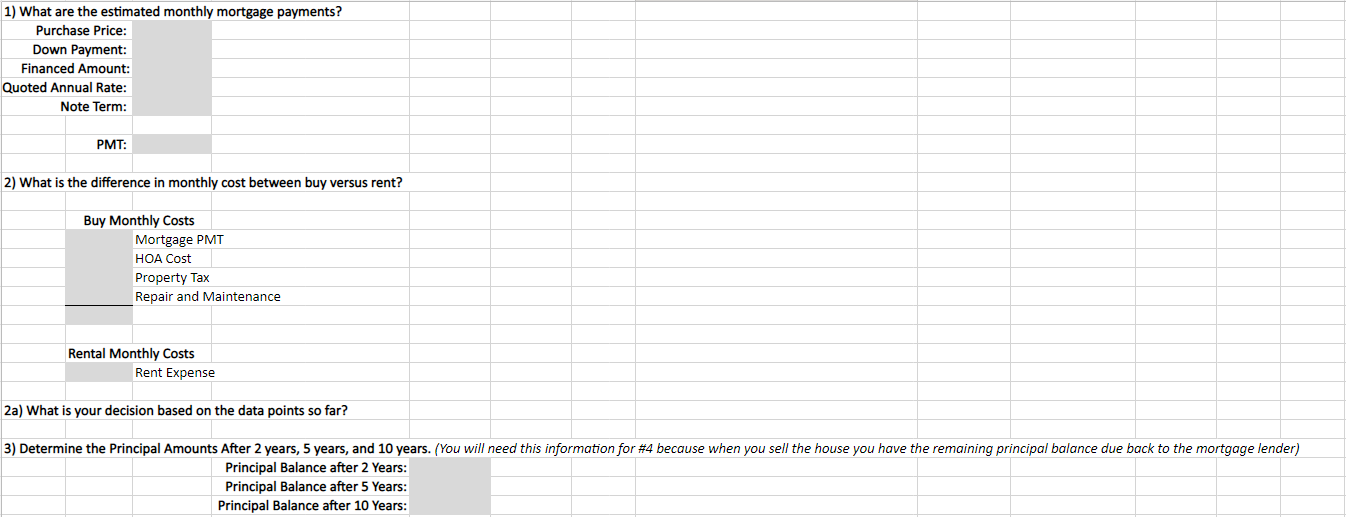

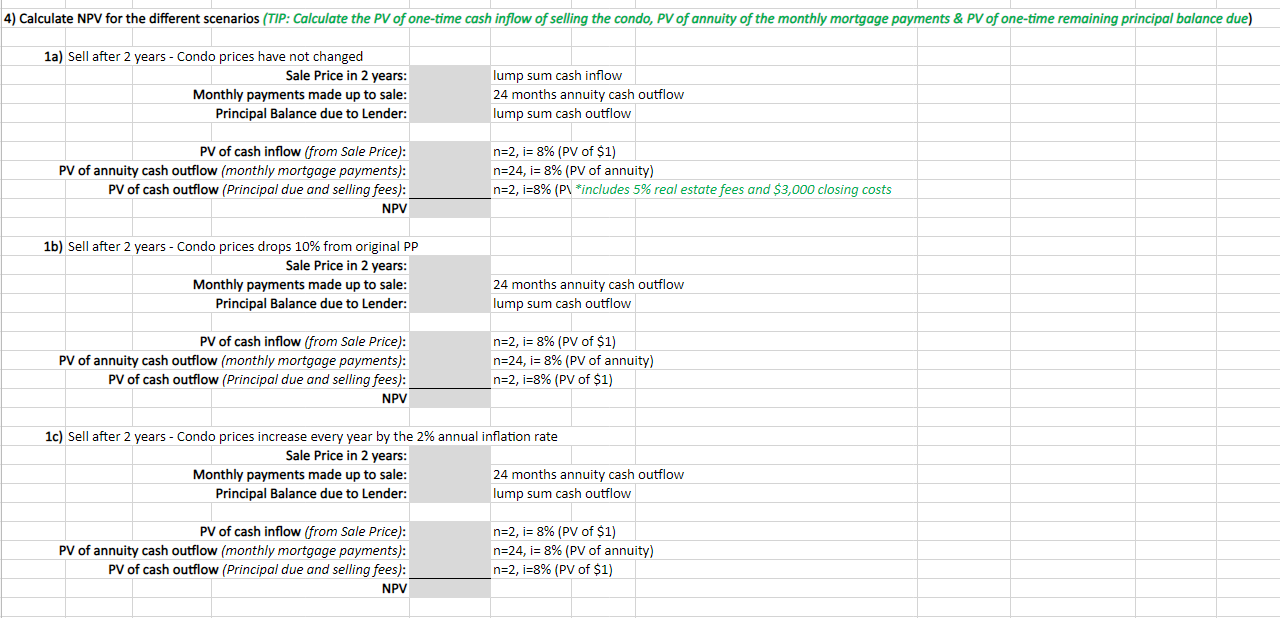

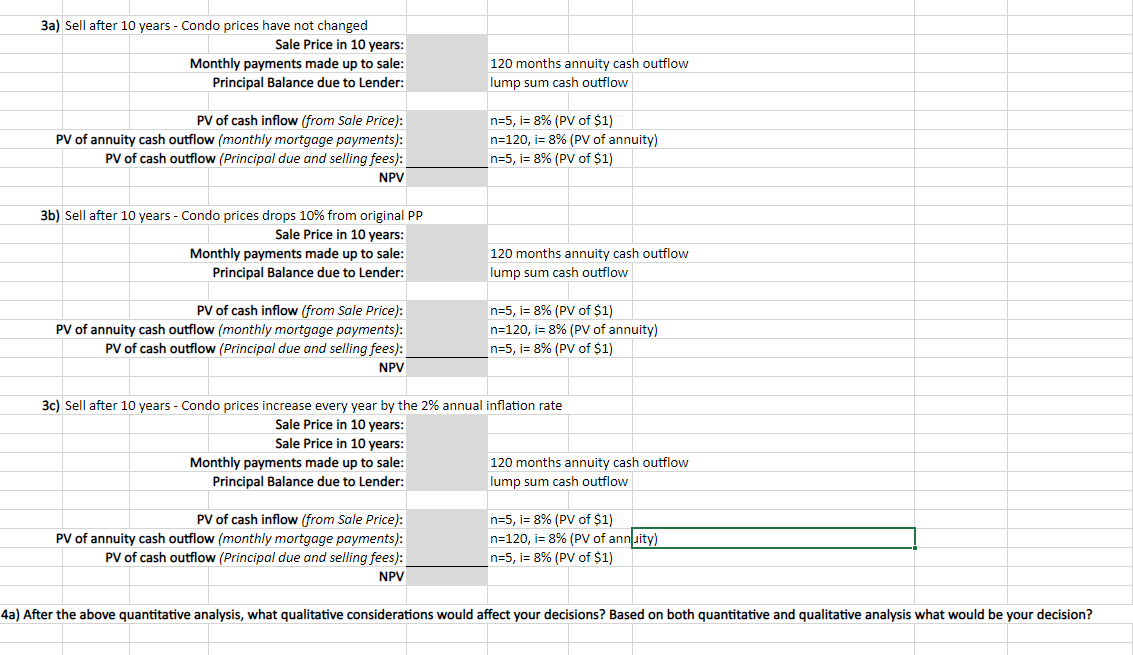

TIME VALUE OF MONEY: THE BUY VERSUS RENT DECISION BACKGROUND INFORMATION In May 2021, Jessica Vines completed her MBA and moved to Dallas, Texas for a new job in investing banking. There, she rented a spacious, two-bedroom condominium for $2,500 per month, which included parking but not utilities or internet services. In July 2021, the virtually identical unit next door became available for sale with an asking price of $600,000 Vines believed she could purchase it for the asking price. She realized she was facing the classic "buy-versus-rent" decision. It was time for her to apply some of the analytical tools she had acquired in business school, including "time value of money" concepts, to her personal life. While Vines really liked the condominium unit she was renting, as well as the condominium building itself, she felt like it would be inadequate for her long-term needs, as she planned to move to a house or even to a larger penthouse condominium within 5 to 10 years, even sooner if her job worked out well. Friends and family had given Vines a variety of mixed opinions concerning the "buy-versus-rent" debate, ranging from "you're throwing your money away on rent" to "it's better to keep things as cheap and flexible as possible until you are ready to settle in for good." She realized that both sides presented good arguments, but she wanted to analyze the "buy-versus-rent" decision from a quantitative point of view in order to provide some context for the qualitative considerations that would ultimately be a major part of her decision FINANCIAL DETAILS If Vines purchased the new condominium, she would pay monthly condo HOA fees of 1,200 per year, plus property taxes of $300 per month on the unit. Unlike when renting, she would also be responsible for repairs and general maintenance, which she estimated would average $600 per year. If she decided to purchase the new unit, Vines intended to provide a cash down payment of 20% of the purchase price. For simplicity, Vines is estimating closing costs (to include loan originations fees, appraisal fees, title insurance, survey fee, etc.) to be approximately 3.5% of the purchase price. In order to finance the remaining 80% of the purchase price, Vines contacted several lenders and found that she would be able to obtain a mortgage at a 4% "quoted" annual rate that would be locked in for a 30-year term. SCENARIO ANALYSIS In order to complete a financial analysis of the "buy versus-rent" decision, Vines realized that her first task would be to determine the required monthly mortgage payments. She utilized the below website for this calculation: https://www.bankrate.com/calculators/mortgages/amortization calculator aspx Next, she wanted to determine the additional monthly costs required to "buy-versus-rent" by using Microsoft Excel or Google Sheets. Vines also wants to consider what might happen if she chooses to sell the condominium at a future date. She is confident that any re-sell would not happen for at least 2 years, but it could certainly happen in 5 or 10 years. To consider this fact, she wants to determine the amount of the outstanding principal at various points in the future for 2,5, and 10 years from now. (TIP: To determine the principal outstanding at the 3 different times you can use the amortization calculator from above by clicking on "Show Amortization Schedule" after you have calculated the monthly mortgage payment.) Vines needs to know this information as this is the remaining financed amount she needs to pay back to the bank. When Vines sells in the future, she estimates she will pay 5% of the selling price to realtor fees plus $3,000 in other closing fees Vines wants to determine the net present value for all 3 scenarios (resell after 2 years, 5 years, and 10 years) by using Microsoft Excel or Google Sheets, which she determined were possible after some due diligence regarding future real estate prices in the Dallas condo market: (a) The condo prices remain unchanged; (b) The condo prices drop 10% over the next 2 years, where is stays for the next 10 years (c) The condo price increases annually by the annual rate of inflation of 2% per year over the next 10 years. (TIP: The different future sale scenarios are the cash inflows. Use the remaining principal balance from above for the cash outflow.) Vines will use a discount rate of 8% when calculating NPV, as this is the rate of return she would like. FINAL CONSIDERATIONS While there is no set right or wrong answer, the numbers may suggest that one decision is more risky and costly than the other option. What are some other qualitative factors Vines might take into consideration? 1) What are the estimated monthly mortgage payments? Purchase Price: Down Payment: Financed Amount: Quoted Annual Rate: Note Term: PMT: 2) What is the difference in monthly cost between buy versus rent? Buy Monthly Costs Mortgage PMT HOA Cost Property Tax Repair and Maintenance Rental Monthly Costs Rent Expense 2a) What is your decision based on the data points so far? 3) Determine the Principal Amounts After 2 years, 5 years, and 10 years. (You will need this information for #4 because when you sell the house you have the remaining principal balance due back to the mortgage lender) Principal Balance after 2 Years: Principal Balance after 5 Years: Principal Balance after 10 Years: 4) Calculate NPV for the different scenarios (TIP: Calculate the PV of one-time cash inflow of selling the condo, PV of annuity of the monthly mortgage payments & PV of one-time remaining principal balance due) 1a) Sell after 2 years - Condo prices have not changed Sale Price in 2 years: 2 Monthly payments made up to sale: Principal Balance due to Lender: lump sum cash inflow 24 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=2, i= 8% (PV of $1) n=24, i=8% (PV of annuity) n=2, i=8% (P\ *includes 5% real estate fees and $3,000 closing costs 1b) Sell after 2 years - Condo prices drops 10% from original PP Sale Price in 2 years: Monthly payments made up to sale: Principal Balance due to Lender: 24 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=2, i= 8% (PV of $1) n=24, i= 8% (PV of annuity) n=2, i=8% (PV of $1) 1c) Sell after 2 years - Condo prices increase every year by the 2% annual inflation rate Sale Price in 2 years: Monthly payments made up to sale: 24 months annuity cash outflow Principal Balance due to Lender: lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=2, i= 8% (PV of $1) n=24, i= 8% (PV of annuity) n=2, i=8% (PV of $1) 2a) Sell after 5 years - Condo prices have not changed Sale Price in 5 years: Monthly payments made up to sale: Principal Balance due to Lender: 60 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=60, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 2b) Sell after 5 years - Condo prices drops 10% from original PP Sale Price in 5 years: Monthly payments made up to sale: Principal Balance due to Lender: 60 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=60, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 2c) Sell after 5 years - Condo prices increase every year by the 2% annual inflation rate Sale Price in 5 years: Monthly payments made up to sale: 60 months annuity cash outflow Principal Balance due to Lender: lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=60, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 3a) Sell after 10 years - Condo prices have not changed Sale Price in 10 years: Monthly payments made up to sale: Principal Balance due to Lender: 120 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=120, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 3b) Sell after 10 years - Condo prices drops 10% from original PP Sale Price in 10 years: Monthly payments made up to sale: Principal Balance due to Lender: 120 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=120, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 3c) Sell after 10 years - Condo prices increase every year by the 2% annual inflation rate Sale Price in 10 years: Sale Price in 10 years: Monthly payments made up to sale: 120 months annuity cash outflow Principal Balance due to Lender: lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=120, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 4a) After the above quantitative analysis, what qualitative considerations would affect your decisions? Based on both quantitative and qualitative analysis what would be your decision? TIME VALUE OF MONEY: THE BUY VERSUS RENT DECISION BACKGROUND INFORMATION In May 2021, Jessica Vines completed her MBA and moved to Dallas, Texas for a new job in investing banking. There, she rented a spacious, two-bedroom condominium for $2,500 per month, which included parking but not utilities or internet services. In July 2021, the virtually identical unit next door became available for sale with an asking price of $600,000 Vines believed she could purchase it for the asking price. She realized she was facing the classic "buy-versus-rent" decision. It was time for her to apply some of the analytical tools she had acquired in business school, including "time value of money" concepts, to her personal life. While Vines really liked the condominium unit she was renting, as well as the condominium building itself, she felt like it would be inadequate for her long-term needs, as she planned to move to a house or even to a larger penthouse condominium within 5 to 10 years, even sooner if her job worked out well. Friends and family had given Vines a variety of mixed opinions concerning the "buy-versus-rent" debate, ranging from "you're throwing your money away on rent" to "it's better to keep things as cheap and flexible as possible until you are ready to settle in for good." She realized that both sides presented good arguments, but she wanted to analyze the "buy-versus-rent" decision from a quantitative point of view in order to provide some context for the qualitative considerations that would ultimately be a major part of her decision FINANCIAL DETAILS If Vines purchased the new condominium, she would pay monthly condo HOA fees of 1,200 per year, plus property taxes of $300 per month on the unit. Unlike when renting, she would also be responsible for repairs and general maintenance, which she estimated would average $600 per year. If she decided to purchase the new unit, Vines intended to provide a cash down payment of 20% of the purchase price. For simplicity, Vines is estimating closing costs (to include loan originations fees, appraisal fees, title insurance, survey fee, etc.) to be approximately 3.5% of the purchase price. In order to finance the remaining 80% of the purchase price, Vines contacted several lenders and found that she would be able to obtain a mortgage at a 4% "quoted" annual rate that would be locked in for a 30-year term. SCENARIO ANALYSIS In order to complete a financial analysis of the "buy versus-rent" decision, Vines realized that her first task would be to determine the required monthly mortgage payments. She utilized the below website for this calculation: https://www.bankrate.com/calculators/mortgages/amortization calculator aspx Next, she wanted to determine the additional monthly costs required to "buy-versus-rent" by using Microsoft Excel or Google Sheets. Vines also wants to consider what might happen if she chooses to sell the condominium at a future date. She is confident that any re-sell would not happen for at least 2 years, but it could certainly happen in 5 or 10 years. To consider this fact, she wants to determine the amount of the outstanding principal at various points in the future for 2,5, and 10 years from now. (TIP: To determine the principal outstanding at the 3 different times you can use the amortization calculator from above by clicking on "Show Amortization Schedule" after you have calculated the monthly mortgage payment.) Vines needs to know this information as this is the remaining financed amount she needs to pay back to the bank. When Vines sells in the future, she estimates she will pay 5% of the selling price to realtor fees plus $3,000 in other closing fees Vines wants to determine the net present value for all 3 scenarios (resell after 2 years, 5 years, and 10 years) by using Microsoft Excel or Google Sheets, which she determined were possible after some due diligence regarding future real estate prices in the Dallas condo market: (a) The condo prices remain unchanged; (b) The condo prices drop 10% over the next 2 years, where is stays for the next 10 years (c) The condo price increases annually by the annual rate of inflation of 2% per year over the next 10 years. (TIP: The different future sale scenarios are the cash inflows. Use the remaining principal balance from above for the cash outflow.) Vines will use a discount rate of 8% when calculating NPV, as this is the rate of return she would like. FINAL CONSIDERATIONS While there is no set right or wrong answer, the numbers may suggest that one decision is more risky and costly than the other option. What are some other qualitative factors Vines might take into consideration? 1) What are the estimated monthly mortgage payments? Purchase Price: Down Payment: Financed Amount: Quoted Annual Rate: Note Term: PMT: 2) What is the difference in monthly cost between buy versus rent? Buy Monthly Costs Mortgage PMT HOA Cost Property Tax Repair and Maintenance Rental Monthly Costs Rent Expense 2a) What is your decision based on the data points so far? 3) Determine the Principal Amounts After 2 years, 5 years, and 10 years. (You will need this information for #4 because when you sell the house you have the remaining principal balance due back to the mortgage lender) Principal Balance after 2 Years: Principal Balance after 5 Years: Principal Balance after 10 Years: 4) Calculate NPV for the different scenarios (TIP: Calculate the PV of one-time cash inflow of selling the condo, PV of annuity of the monthly mortgage payments & PV of one-time remaining principal balance due) 1a) Sell after 2 years - Condo prices have not changed Sale Price in 2 years: 2 Monthly payments made up to sale: Principal Balance due to Lender: lump sum cash inflow 24 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=2, i= 8% (PV of $1) n=24, i=8% (PV of annuity) n=2, i=8% (P\ *includes 5% real estate fees and $3,000 closing costs 1b) Sell after 2 years - Condo prices drops 10% from original PP Sale Price in 2 years: Monthly payments made up to sale: Principal Balance due to Lender: 24 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=2, i= 8% (PV of $1) n=24, i= 8% (PV of annuity) n=2, i=8% (PV of $1) 1c) Sell after 2 years - Condo prices increase every year by the 2% annual inflation rate Sale Price in 2 years: Monthly payments made up to sale: 24 months annuity cash outflow Principal Balance due to Lender: lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=2, i= 8% (PV of $1) n=24, i= 8% (PV of annuity) n=2, i=8% (PV of $1) 2a) Sell after 5 years - Condo prices have not changed Sale Price in 5 years: Monthly payments made up to sale: Principal Balance due to Lender: 60 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=60, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 2b) Sell after 5 years - Condo prices drops 10% from original PP Sale Price in 5 years: Monthly payments made up to sale: Principal Balance due to Lender: 60 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=60, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 2c) Sell after 5 years - Condo prices increase every year by the 2% annual inflation rate Sale Price in 5 years: Monthly payments made up to sale: 60 months annuity cash outflow Principal Balance due to Lender: lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=60, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 3a) Sell after 10 years - Condo prices have not changed Sale Price in 10 years: Monthly payments made up to sale: Principal Balance due to Lender: 120 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=120, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 3b) Sell after 10 years - Condo prices drops 10% from original PP Sale Price in 10 years: Monthly payments made up to sale: Principal Balance due to Lender: 120 months annuity cash outflow lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=120, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 3c) Sell after 10 years - Condo prices increase every year by the 2% annual inflation rate Sale Price in 10 years: Sale Price in 10 years: Monthly payments made up to sale: 120 months annuity cash outflow Principal Balance due to Lender: lump sum cash outflow PV of cash inflow (from Sale Price): PV of annuity cash outflow (monthly mortgage payments): PV of cash outflow (Principal due and selling fees): NPV n=5, i= 8% (PV of $1) n=120, i= 8% (PV of annuity) n=5, i= 8% (PV of $1) 4a) After the above quantitative analysis, what qualitative considerations would affect your decisions? Based on both quantitative and qualitative analysis what would be your decision