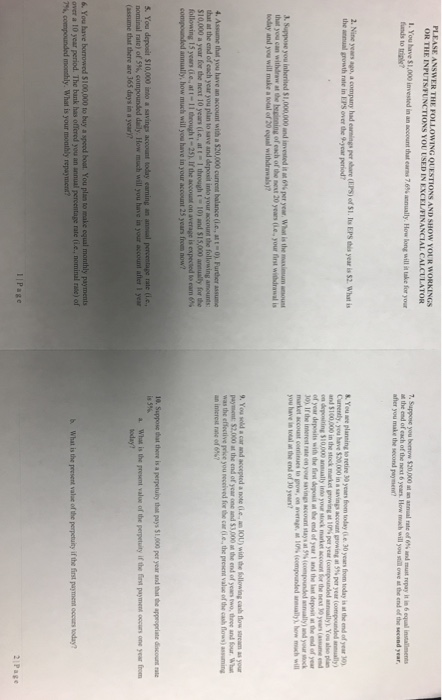

PLEASE ANSWER THE FOLLOWINGG OUESTIONS AND SHOW YOUR WORKINGS OR THE INPUTS/FUNCTIONS YOU USED IN EXCELFINANCIAL CALCULATOR I. You have S1,000 invested in an account that earns 7.6% annually. How long will it take for your fands to triple? 7. Suppose you borrow $20,000 at an annual rate of 6% and must repay it in 6 equal installments at the end of each of the nest 6 years. How mach will you still owe at the end of the second year after you make the second payment 2. Nine years ago, a company had earmings per share (EPS) of S1. Its EPS this year is $2. What is the annual growth rate in EPS over the 9-year period" S. You ae planning to retire 30 years from today e. 30 years from today is at the end of year 30) Cumently, you have $20,000 in a savings account growing at 5% per year (compounded anuallys and $100,000 in the stock market growing at 10% per year (ocompounded annally). You also plan on depositing S10,000 anually inso your stock market account for the next 30 years (assume end of year deposits with the firvt deposit at the end of year I and the last deposit at the emd of year 30) If the interest rate on your savings account stays at 5% (compounded annally) and your sock market account comtinues to grow, on average, 10% (compounded annually), how mach will you have in total at the end of 30 years? 3. Suppose you inherited SI,000,000 and invested it at 6% per year. What is the maxium anoust that you can withdraw at the beginning of each of the next 20 years (Le, your first withdrawal is today and you will make a total of 20 equal withdrawals)" 9. You sold a car and accepted a note (ie., an 1OU) with the following cash flow stream as your payment: $2.000 at the end of year one and 53,000 at the end of years two, three and four. What was the effective price you received for the car (ie., the present value of the cash flows) assuming an interest rate of 667 4. Assume that you have an account with a $20,000 current balance (i.e, at t0). Further assume that at the end of each year you plan to save and deposit into your account the following amounts S10,000 a year for the next 10 years (i.e., at t-I through t 10) and $15,000 antually for the following 15 years (ie, at t-11 theough t-25), If the account on average is expected to eam 6% compounded annually, how much will you have in your account 25 years from now? 10. Suppose that there is a perpetuity that pays S1,000 per year and that he appropriate discount rate is 5% 5. You deposit $10,000 into a savings account today eaming an annal percentage rate (i.c., nominal rate) of 5% , compounded daily. How much will you have in your account after I year (assume that there are 365 days in a year? a What is the present value of the perpetuity if the first payment occurs one year from today? 6. You have borrowed S100,000 to buy a speed boat. You plan to make equal monthly payments over a 10 year period. The bank has offTered you an annual percentage rate (ie., nominal rate) of 7% , compounded monthly. What is your monthly repayment? b What is the peesent value of the perpetuity if the first payment occurs soday? 1Page 2 Page