Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the full question for upvote, if it is not answered in full it will be downvoted. Q4) Your corporation is considering replacing older

Please answer the full question for upvote, if it is not answered in full it will be downvoted.

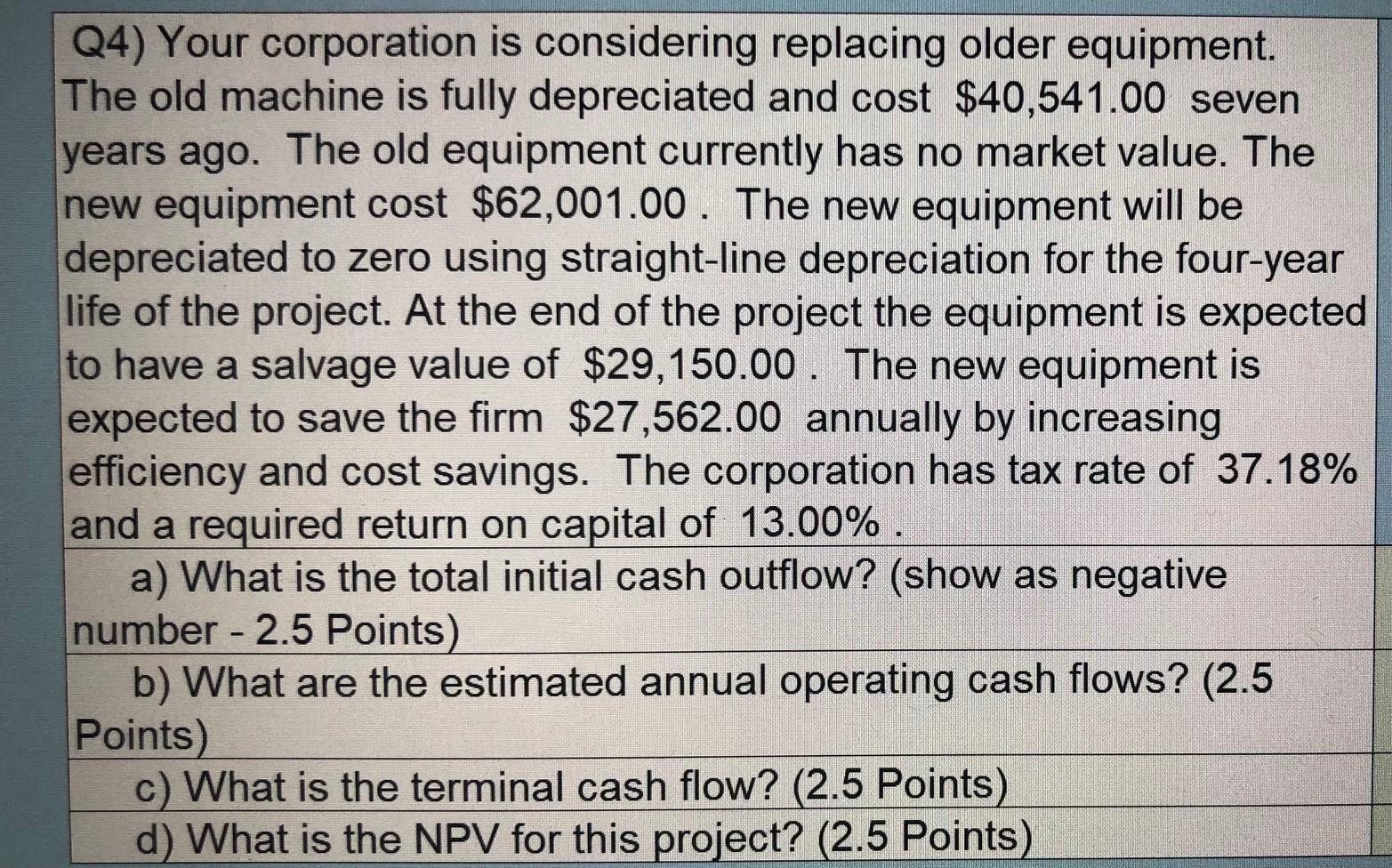

Q4) Your corporation is considering replacing older equipment. The old machine is fully depreciated and cost $40,541.00 seven years ago. The old equipment currently has no market value. The new equipment cost $62,001.00. The new equipment will be depreciated to zero using straight-line depreciation for the four-year life of the project. At the end of the project the equipment is expected to have a salvage value of $29,150.00. The new equipment is expected to save the firm $27,562.00 annually by increasing efficiency and cost savings. The corporation has tax rate of 37.18% and a required return on capital of 13.00%. a) What is the total initial cash outflow? (show as negative number - 2.5 Points) b) What are the estimated annual operating cash flows? (2.5 Points) c) What is the terminal cash flow? (2.5 Points) d) What is the NPV for this project? (2.5 Points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started