Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the full question orrevtly for a thumbs up! Thank you. Mortgages, loans taken to purchase a property, Involve regular payments at fixed intervals

please answer the full question orrevtly for a thumbs up! Thank you.

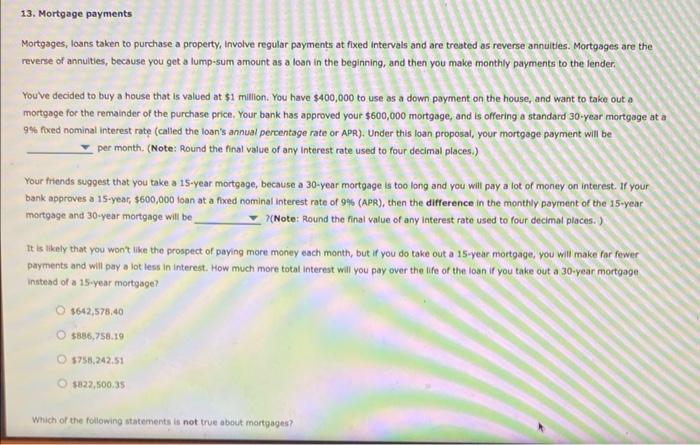

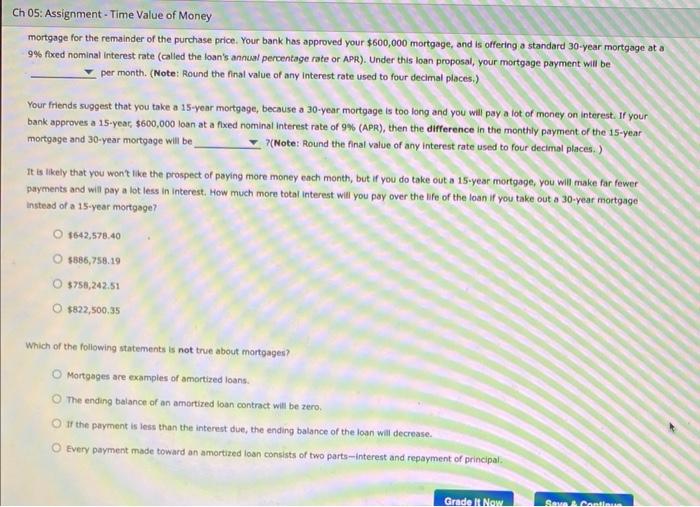

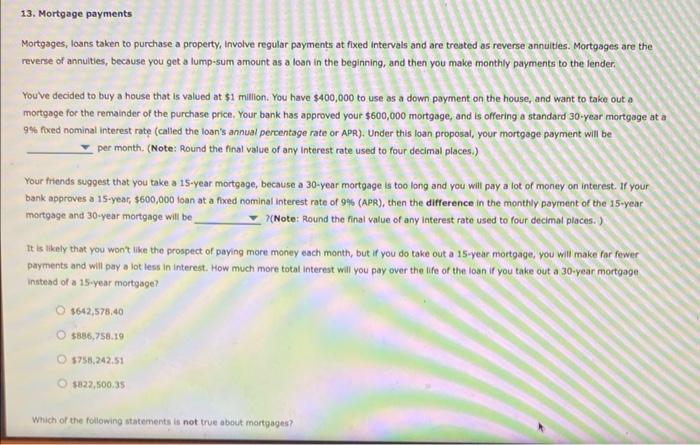

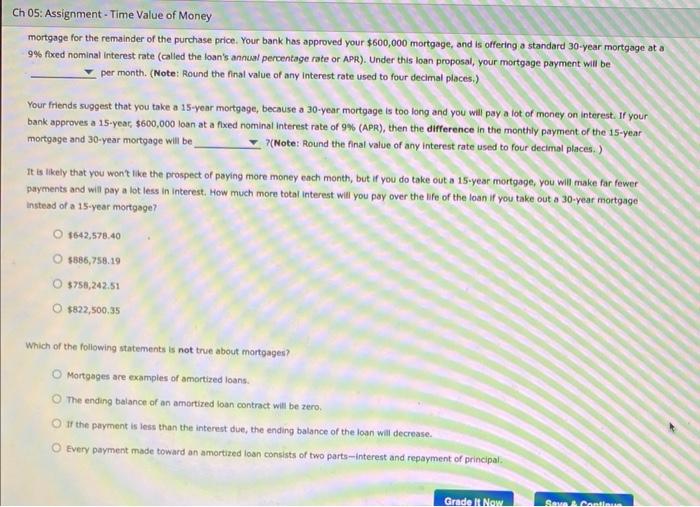

Mortgages, loans taken to purchase a property, Involve regular payments at fixed intervals and are treated as reverse annulties. Mortgages are the reverse of annulties, because you get a lump-sum amount as a loan in the beginning, and then you make monthly payments to the lender. Youve decided to buy a house that is valued at $1 million. You have $400,000 to use as a down payment on the house, and want to take out a mortgage for the remainder of the purchase price, Your bank has approved your $600,000 mortgage, and is offering a standard 30 -year mortgage at a 9% foxed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month. (Note: Round the final value of any interest rate used to four decimal places.) Your friends suggest that you take a 15-year mortgage, because a 30-year mortgage is too long and you will pay a lot of money on interest. If your bank approves a 15 -year, 5600,000 loan at a fixed nominal interest rate of 9% (ApR), then the difference in the monthly payment of the 15 -year mortgage and 30 -year mortgage will be 7 (Note: Round the final value of any interest rate used to four decimal places.) It is likely that you wont like the prospect of paying more money each month, but if you do take out a 15 -year mortgage, you will make for fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage. instesd of a 15-year mortgage? 3642,578,40 5886,758.19 3758.242.51 8822,500.35 Which of the following statements is not true about mortgages? mortgage for the remainder of the purchase price. Your bank has approved your $600,000 mortgage, and is offering a standard 30 -year mortgage at a 9\% fixed nominal interest rate (called the loan's annual percentage rate or APR). Under this loan proposal, your mortgage payment will be per month. (Note: Round the final value of any interest rate used to four decimal places,) Your friends suggest that you take a 15 -year mortgage, because a 30 -year mortgage is too long and you will pay a lot of money on interesti. If your bank approves a 15-yeac, $600,000 loan at a fixed nominal interest rate of 9% (APR), then the difference in the monthly payment of the 15year mortgage and 30-year mortgage will be 7 (Note: Round the final value of any interest rate used to four decimal places.) It is likely that you wont like the prospect of paying more money each month, but if you do take out a 15 -year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30 -year mortgage instead of a 15-year mortgage? $1642,578.40$5886,758.19$5758,242.51$822,500,35 Which of the following statements is not true about mortgages? Mortgages are examples of amortized loans. The ending balance of an amortized loan contract will be zero. If the payment is less than the interest due, the ending balance of the loan will decrease. Every payment made toward an amortized loan consists of two parts-interest and repayment of principal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started