Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER THE FULL QUESTION THEY ARE INTERELATED AND PART OF 1 MAIN QUESTION. IT IS URGENT THANK YOU! 7. a. Explain the differences between

PLEASE ANSWER THE FULL QUESTION THEY ARE INTERELATED AND PART OF 1 MAIN QUESTION.

IT IS URGENT THANK YOU!

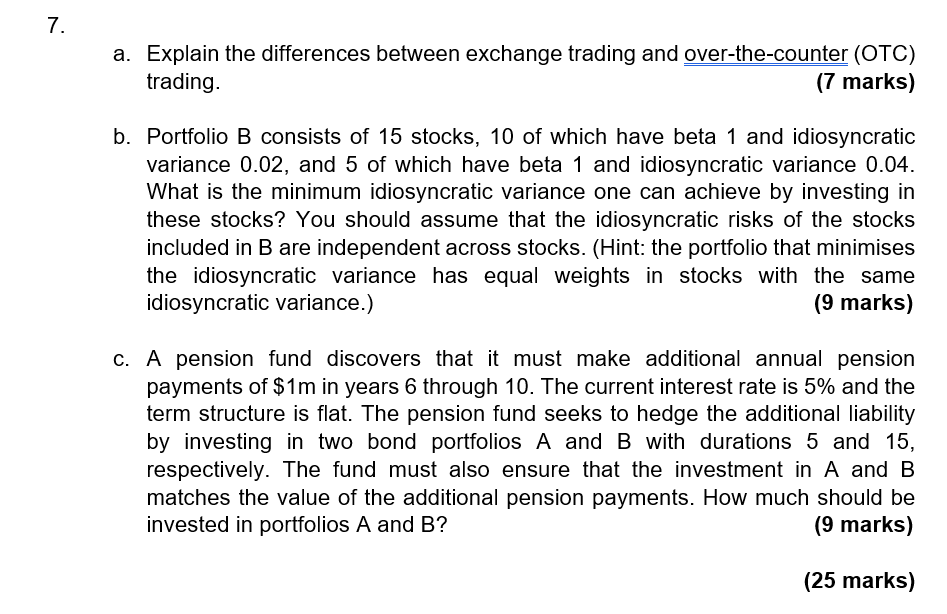

7. a. Explain the differences between exchange trading and over-the-counter (OTC) trading. (7 marks) b. Portfolio B consists of 15 stocks, 10 of which have beta 1 and idiosyncratic variance 0.02, and 5 of which have beta 1 and idiosyncratic variance 0.04. What is the minimum idiosyncratic variance one can achieve by investing in these stocks? You should assume that the idiosyncratic risks of the stocks included in B are independent across stocks. (Hint: the portfolio that minimises the idiosyncratic variance has equal weights in stocks with the same idiosyncratic variance.) (9 marks) c. A pension fund discovers that it must make additional annual pension payments of $1m in years 6 through 10. The current interest rate is 5% and the term structure is flat. The pension fund seeks to hedge the additional liability by investing in two bond portfolios A and B with durations 5 and 15, respectively. The fund must also ensure that the investment in A and B matches the value of the additional pension payments. How much should be invested in portfolios A and B? (9 marks) (25 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started