Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the highlighted section!! You will play the role of Phuc, one of the UpDown co-founders. You will be negotiating the roles of your

Please answer the highlighted section!!

You will play the role of Phuc, one of the UpDown co-founders. You will be negotiating the roles of your co-founders Michael and Phuc;

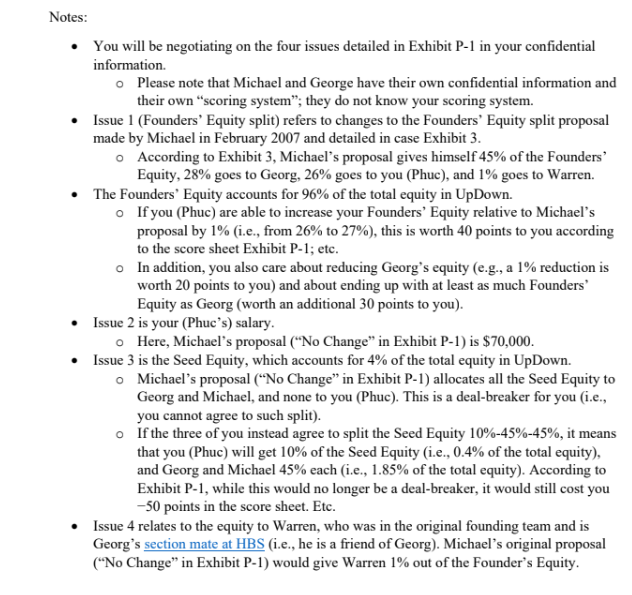

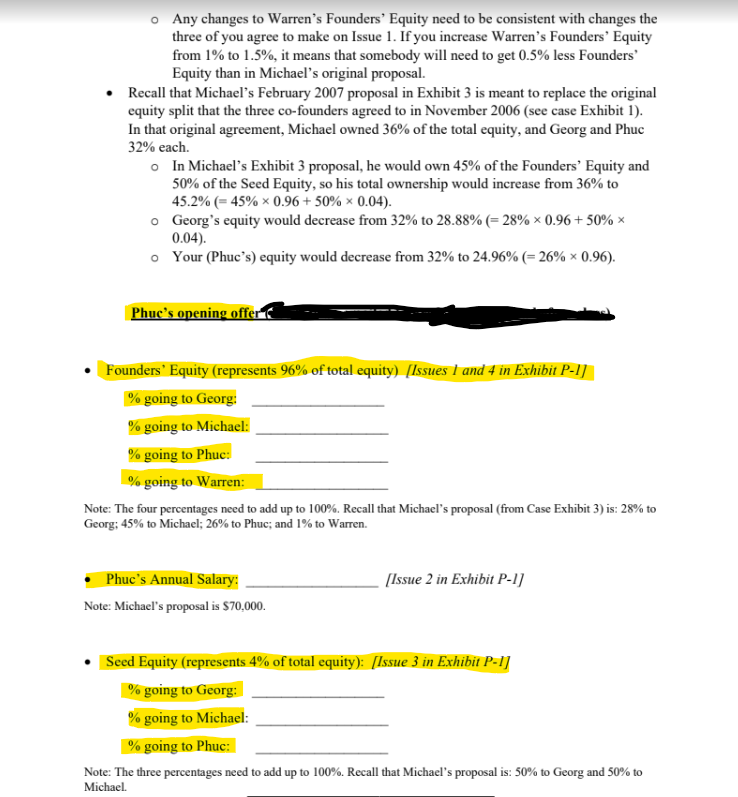

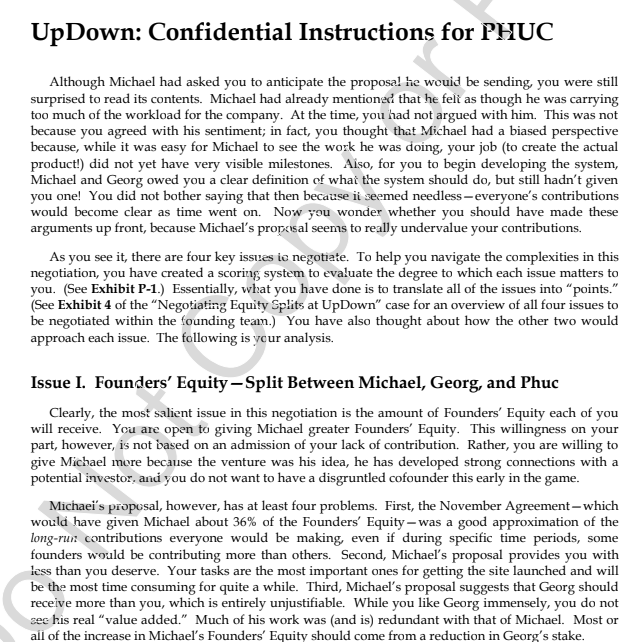

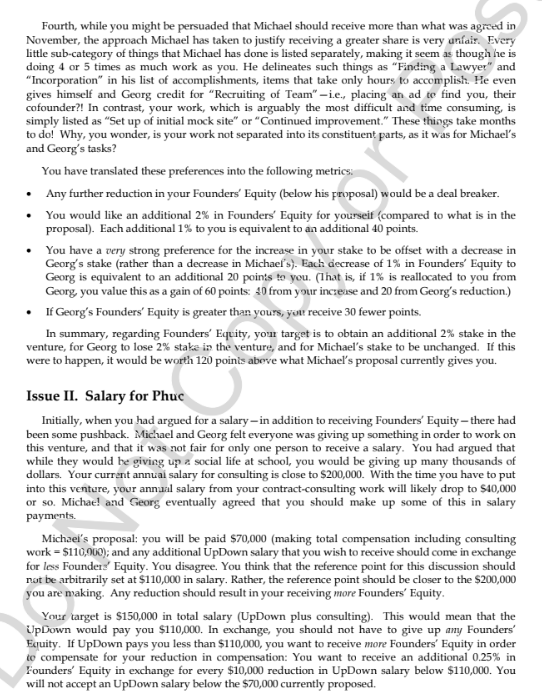

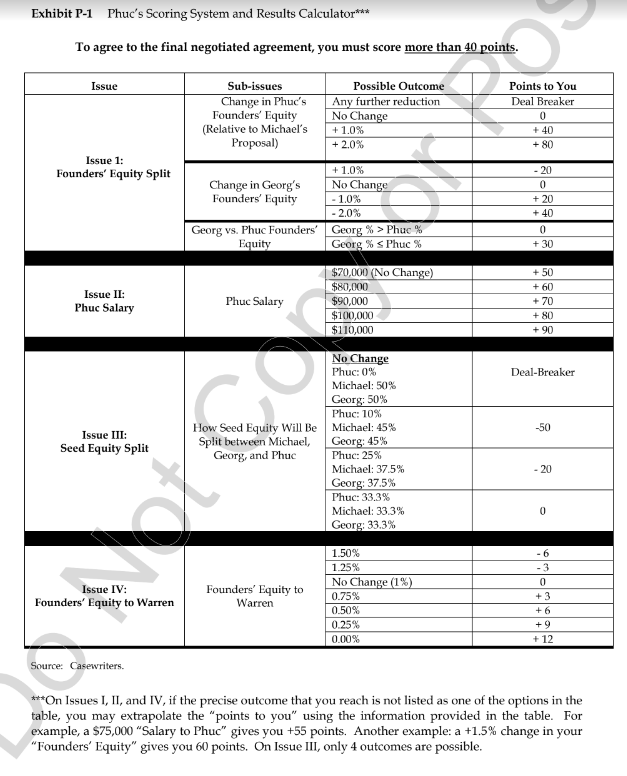

Notes: - You will be negotiating on the four issues detailed in Exhibit P-1 in your confidential information. - Please note that Michael and George have their own confidential information and their own "scoring system"; they do not know your scoring system. - Issue 1 (Founders' Equity split) refers to changes to the Founders' Equity split proposal made by Michael in February 2007 and detailed in case Exhibit 3. - According to Exhibit 3, Michael's proposal gives himself 45% of the Founders' Equity, 28\% goes to Georg, 26\% goes to you (Phuc), and 1\% goes to Warren. - The Founders' Equity accounts for 96% of the total equity in UpDown. If you (Phuc) are able to increase your Founders' Equity relative to Michael's proposal by 1% (i.e., from 26% to 27% ), this is worth 40 points to you according to the score sheet Exhibit P-1; etc. In addition, you also care about reducing Georg's equity (e.g., a 1\% reduction is worth 20 points to you) and about ending up with at least as much Founders' Equity as Georg (worth an additional 30 points to you). - Issue 2 is your (Phuc's) salary. - Here, Michael's proposal ("No Change" in Exhibit P-1) is $70,000. - Issue 3 is the Seed Equity, which accounts for 4% of the total equity in UpDown. - Michael's proposal ("No Change" in Exhibit P-1) allocates all the Seed Equity to Georg and Michael, and none to you (Phuc). This is a deal-breaker for you (i.e., you cannot agree to such split). If the three of you instead agree to split the Seed Equity 10\%-45\%-45\%, it means that you (Phuc) will get 10% of the Seed Equity (i.e., 0.4% of the total equity), and Georg and Michael 45% each (i.e., 1.85\% of the total equity). According to Exhibit P-1, while this would no longer be a deal-breaker, it would still cost you -50 points in the score sheet. Etc. - Issue 4 relates to the equity to Warren, who was in the original founding team and is Georg's section mate at HBS (i.e., he is a friend of Georg). Michael's original proposal ("No Change" in Exhibit P-1) would give Warren 1\% out of the Founder's Equity. - Any changes to Warren's Founders' Equity need to be consistent with changes the three of you agree to make on Issue 1. If you increase Warren's Founders' Equity from 1% to 1.5%, it means that somebody will need to get 0.5% less Founders' Equity than in Michael's original proposal. - Recall that Michael's February 2007 proposal in Exhibit 3 is meant to replace the original equity split that the three co-founders agreed to in November 2006 (see case Exhibit 1). In that original agreement, Michael owned 36% of the total equity, and Georg and Phuc 32% each. - In Michael's Exhibit 3 proposal, he would own 45% of the Founders' Equity and 50% of the Seed Equity, so his total ownership would increase from 36% to 45.2%(=45%0.96+50%0.04). Georg's equity would decrease from 32% to 28.88%(=28%0.96+50% 0.04) Your (Phuc's) equity would decrease from 32% to 24.96%(=26%0.96 ). Phuc's onening offere - Founders' Equity (represents 96\% of total equity) [Issues I and 4 in Exhibit P-1] % going to Georg: % going to Michael: % going to Phuc: \% going to Warren: Note: The four percentages need to add up to 100%. Recall that Michael's proposal (from Case Exhibit 3) is: 28% to Georg; 45% to Michael; 26% to Phuc; and 1% to Warren. - Phuc's Annual Salary: [Issue 2 in Exhibit P-1] Note: Michael's proposal is $70,000. - Seed Equity (represents 4% of total equity): [Issue 3 in Exhibit P-1] % going to Michael: Note: The three percentages need to add up to 100%. Recall that Michael's proposal is: 50% to Georg and 50% to Michael. Although Michael had asked you to anticipate the proposal he wouid be sending, you were still surprised to read its contents. Michael had already mentioned that he felt as though he was carrying too much of the workload for the company. At the time, you had not argued with him. This was not because you agreed with his sentiment; in fact, you thought that Michael had a biased perspective because, while it was easy for Michael to see the work he was doing, your job (to create the actual product!) did not yet have very visible milestones. Aiso, for you to begin developing the system, Michael and Georg owed you a clear definition of what the system should do, but still hadn't given you one! You did not bother saying that then because ii seemed needless-everyone's contributions would become clear as time went on. Now you wonder whether you should have made these arguments up front, because Michael's proposal seems to really undervalue your contributions. As you see it, there are four key issues is negotiate. To help you navigate the complexities in this negotiation, you have created a scoring system to evaluate the degree to which each issue matters to you. (See Exhibit P-1.) Essentially, what you have done is to translate all of the issues into "points." (See Exhibit 4 of the "Negotiating Equity Splits at UpDown" case for an overview of all four issues to be negotiated within the founding team.) You have also thought about how the other two would approach each issue. The following is your analysis. Issue I. Founders' Equity - Split Between Michael, Georg, and Phuc Clearly, the most salient issue in this negotiation is the amount of Founders' Equity each of you will receive. You are open to giving Michael greater Founders' Equity. This willingness on your part, however, is not based on an admission of your lack of contribution. Rather, you are willing to give Michael more because the venture was his idea, he has developed strong connections with a potential investor: and you do not want to have a disgruntled cofounder this early in the game. Michaei's proposal, however, has at least four problems. First, the November Agreement-which would have given Michael about 36% of the Founders' Equity-was a good approximation of the long-run contributions everyone would be making, even if during specific time periods, some founders would be contributing more than others. Second, Michael's proposal provides you with less than you deserve. Your tasks are the most important ones for getting the site launched and will be the most time consuming for quite a while. Third, Michael's proposal suggests that Georg should receive more than you, which is entirely unjustifiable. While you like Georg immensely, you do not sec his real "value added." Much of his work was (and is) redundant with that of Michael. Most or all of the increase in Michael's Founders' Equity should come from a reduction in Georg's stake. Fourth, while you might be persuaded that Michael should receive more than what was agred in November, the approach Michael has taken to justify receiving a greater share is very anair. Every little sub-category of things that Michael has done is listed separately, making it seem as though he is doing 4 or 5 times as much work as you. He delineates such things as "Finding a Lawyer" and "Incorporation" in his list of accomplishments, items that take only hours to accomplish. He even gives himself and Georg credit for "Recruiting of Team"-i.e., placing an ad to find you, their cofounder?! In contrast, your work, which is arguably the most difficult and time consuming, is simply listed as "Set up of initial mock site" or "Continued improvement." These things take months to do! Why, you wonder, is your work not separated into its constituent parts, as it was for Michael's and Georg's tasks? You have translated these preferences into the following metrics: - Any further reduction in your Founders' Equity (below his froposal) would be a deal breaker. - You would like an additional 2\% in Founders' Equity for yourseif (compared to what is in the proposal). Each additional 1% to you is equivalent to an additional 40 points. - You have a very strong preference for the increase in your stake to be offset with a decrease in Georg's stake (rather than a decrease in Michael's). Each decrease of 1% in Founders' Equity to Georg is equivalent to an additional 20 points to you. (That is, if 1% is reallocated to you from Georg, you value this as a gain of 60 points: 40 from your increuse and 20 from Georg's reduction.) - If Georg's Founders' Equity is greater than yours, your receive 30 fewer points. In summary, regarding Founders' Equity, your target is to obtain an additional 2\% stake in the venture, for Georg to lose 2% stake in the venture, and for Michael's stake to be unchanged. If this were to happen, it would be worth 120 points abeve what Michael's proposal currently gives you. Issue II. Salary for Phuc Initially, when you had argued for a salary - in addition to receiving Founders' Equity - there had been some pushback. Michael and Georg felt everyone was giving up something in order to work on this venture, and that it was not fair for only one person to receive a salary. You had argued that while they would be giving up a social life at school, you would be giving up many thousands of dollars. Your current annual salary for consulting is close to $200,000. With the time you have to put into this ventere, your annual salary from your contract-consulting work will likely drop to $40,000 or so. Michae! and Georg eventually agreed that you should make up some of this in salary payments. Michael's proposal: you will be paid $70,000 (making total compensation including consulting work =$110,000); and any additional UpDown salary that you wish to receive should come in exchange for less Foundere' Equity. You disagree. You think that the reference point for this discussion should not be arbitrarily set at $110,000 in salary. Rather, the reference point should be closer to the $200,000 you are naking. Any reduction should result in your receiving more Founders' Equity. Your target is $150,000 in total salary (UpDown plus consulting). This would mean that the UpDown would pay you $110,000. In exchange, you should not have to give up any Founders' Equity. If UpDown pays you less than $110,000, you want to receive more Founders' Equity in order to compensate for your reduction in compensation: You want to receive an additional 0.25% in Founders' Equity in exchange for every $10,000 reduction in UpDown salary below $110,000. You will not accept an UpDown salary below the $70,000 currently proposed. If you obtain a $110,000 UpDown salary and lose no Founders' Equity compared to Michael's proposal, it will be worth an additional 40 points to you (i.e., each additional $10,000 in salary is worth 10 points). Issue III. Seed Equity for Initial Investment Michael's proposal divides the total equity in UpDown into two categories: Founders' Equity ( 96% of total equity) and Seed Equity ( 4% of total equity). Seed Equity refers to the portion of total equity carved out for those who invested money in UpDown at the very outset. You were surprised-and annoyed - to see that Michael and Georg were each credited with 50% of the Seed Equity for having initially invested $5,000 each in the venture. The logic, as absurd as it is to you, was articulated by Michael as follows: "At the time, $5,000 was a significant contribution given where the company was, and all of it was at risk." There are two problems with this argument. First, if you had been present at the time of the founding, you too would have willingly put in this seed money. Second, most of the money they put in was never even used. It just sat there in the bank. This issue is, above all else, an issue of fairness. You want the current pool of Seed Equity to be split equally by all three of you. In fact, the current proposal, in which you receive 0% of the Seed Equity and Michael and Georg each receive 50%, is a deal-breaker for you. You would like to see an equal split (33.3\% each). The worst-case scenario that would still be acceptable to you would be for you to receive 10% and for both of them to split the remaining 90%. Note: While only incremental changes will be made to Founders' Equity in this negotiation (Issue I), the entire amount of Seed Equity (Issue III) is up for grabs. Thus, both issues are weighted heavily in your scoring system. Issue IV. Founders' Equity - Warren's Share A final, smaller issue, pertains to the amount of Founders' Equity that Warren receives. Warren was a member of the original founding team, but he exited before you even joined. Your impression is that Warren contributed little to the company, but that his position as a "founder" makes him deserving of some equity. Michael's proposal gives Warren 1% Founders' Equity in the company. You think this is generous. In fact, you would be happy to see Warren receive nothing and for that equity to be shared equally by all three of you. Michael may feel similarly, but not Georg. Warren is Georg's section mate at HBS, and Georg has mentioned that Warren deserves closer to 2.0%. You do not feel compelled to fight too hard on this issue because you cannot judge Warren's contributions. Each 0.25% reduction in Warren's share is worth an additional 3 points to you. If Warren's share is increased, someone will have to lower his own stake. Perhaps Georg should do the chipping in. The Option to Walk Away Having considered all of the issues, and having given thought to your alternatives to joining this venture (i.e., working on your other business ideas or on lucrative consulting work), you have decided that you would need improvements in Michael's proposal for it to be acceptable. If your point total at the end of the negotiation is less than 40 points, you cannot agree to the deal. Of course, you want as much value out of this negotiation as possible. Exhibit P-1 Phuc's Scoring System and Results Calculator To agree to the final negotiated agreement, you must score more than 40 points. On Issues I, II, and IV, if the precise outcome that you reach is not listed as one of the options in the table, you may extrapolate the "points to you" using the information provided in the table. For example, a $75,000 "Salary to Phuc" gives you +55 points. Another example: a +1.5% change in your "Founders' Equity" gives you 60 points. On Issue III, only 4 outcomes are possible. Notes: - You will be negotiating on the four issues detailed in Exhibit P-1 in your confidential information. - Please note that Michael and George have their own confidential information and their own "scoring system"; they do not know your scoring system. - Issue 1 (Founders' Equity split) refers to changes to the Founders' Equity split proposal made by Michael in February 2007 and detailed in case Exhibit 3. - According to Exhibit 3, Michael's proposal gives himself 45% of the Founders' Equity, 28\% goes to Georg, 26\% goes to you (Phuc), and 1\% goes to Warren. - The Founders' Equity accounts for 96% of the total equity in UpDown. If you (Phuc) are able to increase your Founders' Equity relative to Michael's proposal by 1% (i.e., from 26% to 27% ), this is worth 40 points to you according to the score sheet Exhibit P-1; etc. In addition, you also care about reducing Georg's equity (e.g., a 1\% reduction is worth 20 points to you) and about ending up with at least as much Founders' Equity as Georg (worth an additional 30 points to you). - Issue 2 is your (Phuc's) salary. - Here, Michael's proposal ("No Change" in Exhibit P-1) is $70,000. - Issue 3 is the Seed Equity, which accounts for 4% of the total equity in UpDown. - Michael's proposal ("No Change" in Exhibit P-1) allocates all the Seed Equity to Georg and Michael, and none to you (Phuc). This is a deal-breaker for you (i.e., you cannot agree to such split). If the three of you instead agree to split the Seed Equity 10\%-45\%-45\%, it means that you (Phuc) will get 10% of the Seed Equity (i.e., 0.4% of the total equity), and Georg and Michael 45% each (i.e., 1.85\% of the total equity). According to Exhibit P-1, while this would no longer be a deal-breaker, it would still cost you -50 points in the score sheet. Etc. - Issue 4 relates to the equity to Warren, who was in the original founding team and is Georg's section mate at HBS (i.e., he is a friend of Georg). Michael's original proposal ("No Change" in Exhibit P-1) would give Warren 1\% out of the Founder's Equity. - Any changes to Warren's Founders' Equity need to be consistent with changes the three of you agree to make on Issue 1. If you increase Warren's Founders' Equity from 1% to 1.5%, it means that somebody will need to get 0.5% less Founders' Equity than in Michael's original proposal. - Recall that Michael's February 2007 proposal in Exhibit 3 is meant to replace the original equity split that the three co-founders agreed to in November 2006 (see case Exhibit 1). In that original agreement, Michael owned 36% of the total equity, and Georg and Phuc 32% each. - In Michael's Exhibit 3 proposal, he would own 45% of the Founders' Equity and 50% of the Seed Equity, so his total ownership would increase from 36% to 45.2%(=45%0.96+50%0.04). Georg's equity would decrease from 32% to 28.88%(=28%0.96+50% 0.04) Your (Phuc's) equity would decrease from 32% to 24.96%(=26%0.96 ). Phuc's onening offere - Founders' Equity (represents 96\% of total equity) [Issues I and 4 in Exhibit P-1] % going to Georg: % going to Michael: % going to Phuc: \% going to Warren: Note: The four percentages need to add up to 100%. Recall that Michael's proposal (from Case Exhibit 3) is: 28% to Georg; 45% to Michael; 26% to Phuc; and 1% to Warren. - Phuc's Annual Salary: [Issue 2 in Exhibit P-1] Note: Michael's proposal is $70,000. - Seed Equity (represents 4% of total equity): [Issue 3 in Exhibit P-1] % going to Michael: Note: The three percentages need to add up to 100%. Recall that Michael's proposal is: 50% to Georg and 50% to Michael. Although Michael had asked you to anticipate the proposal he wouid be sending, you were still surprised to read its contents. Michael had already mentioned that he felt as though he was carrying too much of the workload for the company. At the time, you had not argued with him. This was not because you agreed with his sentiment; in fact, you thought that Michael had a biased perspective because, while it was easy for Michael to see the work he was doing, your job (to create the actual product!) did not yet have very visible milestones. Aiso, for you to begin developing the system, Michael and Georg owed you a clear definition of what the system should do, but still hadn't given you one! You did not bother saying that then because ii seemed needless-everyone's contributions would become clear as time went on. Now you wonder whether you should have made these arguments up front, because Michael's proposal seems to really undervalue your contributions. As you see it, there are four key issues is negotiate. To help you navigate the complexities in this negotiation, you have created a scoring system to evaluate the degree to which each issue matters to you. (See Exhibit P-1.) Essentially, what you have done is to translate all of the issues into "points." (See Exhibit 4 of the "Negotiating Equity Splits at UpDown" case for an overview of all four issues to be negotiated within the founding team.) You have also thought about how the other two would approach each issue. The following is your analysis. Issue I. Founders' Equity - Split Between Michael, Georg, and Phuc Clearly, the most salient issue in this negotiation is the amount of Founders' Equity each of you will receive. You are open to giving Michael greater Founders' Equity. This willingness on your part, however, is not based on an admission of your lack of contribution. Rather, you are willing to give Michael more because the venture was his idea, he has developed strong connections with a potential investor: and you do not want to have a disgruntled cofounder this early in the game. Michaei's proposal, however, has at least four problems. First, the November Agreement-which would have given Michael about 36% of the Founders' Equity-was a good approximation of the long-run contributions everyone would be making, even if during specific time periods, some founders would be contributing more than others. Second, Michael's proposal provides you with less than you deserve. Your tasks are the most important ones for getting the site launched and will be the most time consuming for quite a while. Third, Michael's proposal suggests that Georg should receive more than you, which is entirely unjustifiable. While you like Georg immensely, you do not sec his real "value added." Much of his work was (and is) redundant with that of Michael. Most or all of the increase in Michael's Founders' Equity should come from a reduction in Georg's stake. Fourth, while you might be persuaded that Michael should receive more than what was agred in November, the approach Michael has taken to justify receiving a greater share is very anair. Every little sub-category of things that Michael has done is listed separately, making it seem as though he is doing 4 or 5 times as much work as you. He delineates such things as "Finding a Lawyer" and "Incorporation" in his list of accomplishments, items that take only hours to accomplish. He even gives himself and Georg credit for "Recruiting of Team"-i.e., placing an ad to find you, their cofounder?! In contrast, your work, which is arguably the most difficult and time consuming, is simply listed as "Set up of initial mock site" or "Continued improvement." These things take months to do! Why, you wonder, is your work not separated into its constituent parts, as it was for Michael's and Georg's tasks? You have translated these preferences into the following metrics: - Any further reduction in your Founders' Equity (below his froposal) would be a deal breaker. - You would like an additional 2\% in Founders' Equity for yourseif (compared to what is in the proposal). Each additional 1% to you is equivalent to an additional 40 points. - You have a very strong preference for the increase in your stake to be offset with a decrease in Georg's stake (rather than a decrease in Michael's). Each decrease of 1% in Founders' Equity to Georg is equivalent to an additional 20 points to you. (That is, if 1% is reallocated to you from Georg, you value this as a gain of 60 points: 40 from your increuse and 20 from Georg's reduction.) - If Georg's Founders' Equity is greater than yours, your receive 30 fewer points. In summary, regarding Founders' Equity, your target is to obtain an additional 2\% stake in the venture, for Georg to lose 2% stake in the venture, and for Michael's stake to be unchanged. If this were to happen, it would be worth 120 points abeve what Michael's proposal currently gives you. Issue II. Salary for Phuc Initially, when you had argued for a salary - in addition to receiving Founders' Equity - there had been some pushback. Michael and Georg felt everyone was giving up something in order to work on this venture, and that it was not fair for only one person to receive a salary. You had argued that while they would be giving up a social life at school, you would be giving up many thousands of dollars. Your current annual salary for consulting is close to $200,000. With the time you have to put into this ventere, your annual salary from your contract-consulting work will likely drop to $40,000 or so. Michae! and Georg eventually agreed that you should make up some of this in salary payments. Michael's proposal: you will be paid $70,000 (making total compensation including consulting work =$110,000); and any additional UpDown salary that you wish to receive should come in exchange for less Foundere' Equity. You disagree. You think that the reference point for this discussion should not be arbitrarily set at $110,000 in salary. Rather, the reference point should be closer to the $200,000 you are naking. Any reduction should result in your receiving more Founders' Equity. Your target is $150,000 in total salary (UpDown plus consulting). This would mean that the UpDown would pay you $110,000. In exchange, you should not have to give up any Founders' Equity. If UpDown pays you less than $110,000, you want to receive more Founders' Equity in order to compensate for your reduction in compensation: You want to receive an additional 0.25% in Founders' Equity in exchange for every $10,000 reduction in UpDown salary below $110,000. You will not accept an UpDown salary below the $70,000 currently proposed. If you obtain a $110,000 UpDown salary and lose no Founders' Equity compared to Michael's proposal, it will be worth an additional 40 points to you (i.e., each additional $10,000 in salary is worth 10 points). Issue III. Seed Equity for Initial Investment Michael's proposal divides the total equity in UpDown into two categories: Founders' Equity ( 96% of total equity) and Seed Equity ( 4% of total equity). Seed Equity refers to the portion of total equity carved out for those who invested money in UpDown at the very outset. You were surprised-and annoyed - to see that Michael and Georg were each credited with 50% of the Seed Equity for having initially invested $5,000 each in the venture. The logic, as absurd as it is to you, was articulated by Michael as follows: "At the time, $5,000 was a significant contribution given where the company was, and all of it was at risk." There are two problems with this argument. First, if you had been present at the time of the founding, you too would have willingly put in this seed money. Second, most of the money they put in was never even used. It just sat there in the bank. This issue is, above all else, an issue of fairness. You want the current pool of Seed Equity to be split equally by all three of you. In fact, the current proposal, in which you receive 0% of the Seed Equity and Michael and Georg each receive 50%, is a deal-breaker for you. You would like to see an equal split (33.3\% each). The worst-case scenario that would still be acceptable to you would be for you to receive 10% and for both of them to split the remaining 90%. Note: While only incremental changes will be made to Founders' Equity in this negotiation (Issue I), the entire amount of Seed Equity (Issue III) is up for grabs. Thus, both issues are weighted heavily in your scoring system. Issue IV. Founders' Equity - Warren's Share A final, smaller issue, pertains to the amount of Founders' Equity that Warren receives. Warren was a member of the original founding team, but he exited before you even joined. Your impression is that Warren contributed little to the company, but that his position as a "founder" makes him deserving of some equity. Michael's proposal gives Warren 1% Founders' Equity in the company. You think this is generous. In fact, you would be happy to see Warren receive nothing and for that equity to be shared equally by all three of you. Michael may feel similarly, but not Georg. Warren is Georg's section mate at HBS, and Georg has mentioned that Warren deserves closer to 2.0%. You do not feel compelled to fight too hard on this issue because you cannot judge Warren's contributions. Each 0.25% reduction in Warren's share is worth an additional 3 points to you. If Warren's share is increased, someone will have to lower his own stake. Perhaps Georg should do the chipping in. The Option to Walk Away Having considered all of the issues, and having given thought to your alternatives to joining this venture (i.e., working on your other business ideas or on lucrative consulting work), you have decided that you would need improvements in Michael's proposal for it to be acceptable. If your point total at the end of the negotiation is less than 40 points, you cannot agree to the deal. Of course, you want as much value out of this negotiation as possible. Exhibit P-1 Phuc's Scoring System and Results Calculator To agree to the final negotiated agreement, you must score more than 40 points. On Issues I, II, and IV, if the precise outcome that you reach is not listed as one of the options in the table, you may extrapolate the "points to you" using the information provided in the table. For example, a $75,000 "Salary to Phuc" gives you +55 points. Another example: a +1.5% change in your "Founders' Equity" gives you 60 points. On Issue III, only 4 outcomes are possibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started