Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the journal entries and show your work for calculations Recording a Temporary Difference On December 31, for GAAP purposes, Clubs Inc. reported a

please answer the journal entries and show your work for calculations

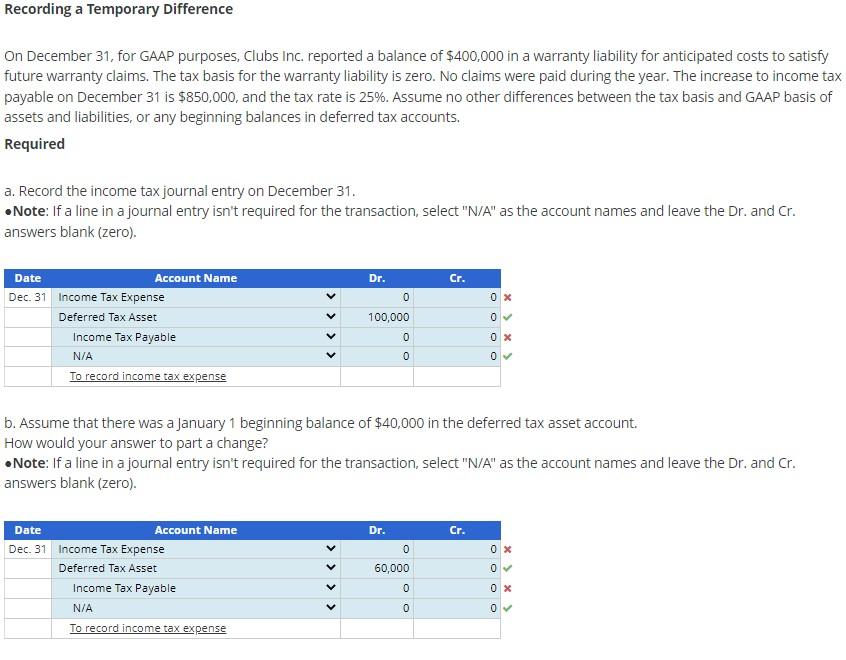

Recording a Temporary Difference On December 31, for GAAP purposes, Clubs Inc. reported a balance of $400,000 in a warranty liability for anticipated costs to satisfy future warranty claims. The tax basis for the warranty liability is zero. No claims were paid during the year. The increase to income tax payable on December 31 is $850,000, and the tax rate is 25%. Assume no other differences between the tax basis and GAAP basis of assets and liabilities, or any beginning balances in deferred tax accounts. Required a. Record the income tax journal entry on December 31. - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). b. Assume that there was a January 1 beginning balance of $40,000 in the deferred tax asset account. How would your answer to part a change? - Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started