Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the last question = Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1)

please answer the last question

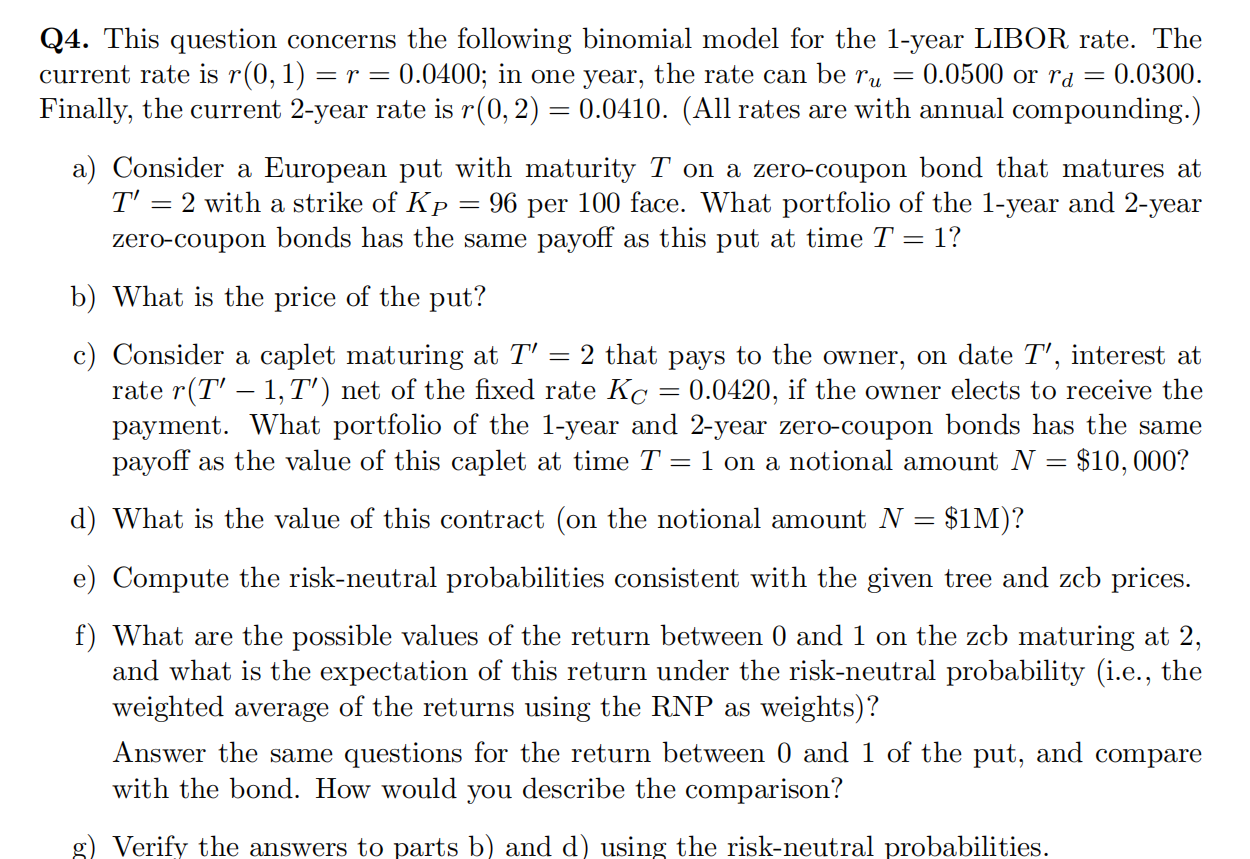

= Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) = r = 0.0400; in one year, the rate can be ru = 0.0500 or rd = 0.0300. Finally, the current 2-year rate is r(0, 2) = 0.0410. (All rates are with annual compounding.) a) Consider a European put with maturity T on a zero-coupon bond that matures at T' = 2 with a strike of Kp = 96 per 100 face. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as this put at time T = 1? b) What is the price of the put? = c) Consider a caplet maturing at T' 2 that pays to the owner, on date T', interest at rate r(T' 1,T') net of the fixed rate Kc = 0.0420, if the owner elects to receive the payment. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as the value of this caplet at time T =1 on a notional amount N $10,000? = d) What is the value of this contract (on the notional amount N = $1M)? = e) Compute the risk-neutral probabilities consistent with the given tree and zcb prices. f) What are the possible values of the return between 0 and 1 on the zcb maturing at 2, and what is the expectation of this return under the risk-neutral probability (i.e., the weighted average of the returns using the RNP as weights)? Answer the same questions for the return between 0 and 1 of the put, and compare with the bond. How would you describe the comparison? g) Verify the answers to parts b) and d) using the risk-neutral probabilities. = Q4. This question concerns the following binomial model for the 1-year LIBOR rate. The current rate is r(0, 1) = r = 0.0400; in one year, the rate can be ru = 0.0500 or rd = 0.0300. Finally, the current 2-year rate is r(0, 2) = 0.0410. (All rates are with annual compounding.) a) Consider a European put with maturity T on a zero-coupon bond that matures at T' = 2 with a strike of Kp = 96 per 100 face. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as this put at time T = 1? b) What is the price of the put? = c) Consider a caplet maturing at T' 2 that pays to the owner, on date T', interest at rate r(T' 1,T') net of the fixed rate Kc = 0.0420, if the owner elects to receive the payment. What portfolio of the 1-year and 2-year zero-coupon bonds has the same payoff as the value of this caplet at time T =1 on a notional amount N $10,000? = d) What is the value of this contract (on the notional amount N = $1M)? = e) Compute the risk-neutral probabilities consistent with the given tree and zcb prices. f) What are the possible values of the return between 0 and 1 on the zcb maturing at 2, and what is the expectation of this return under the risk-neutral probability (i.e., the weighted average of the returns using the RNP as weights)? Answer the same questions for the return between 0 and 1 of the put, and compare with the bond. How would you describe the comparison? g) Verify the answers to parts b) and d) using the risk-neutral probabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started