please answer the last schedule

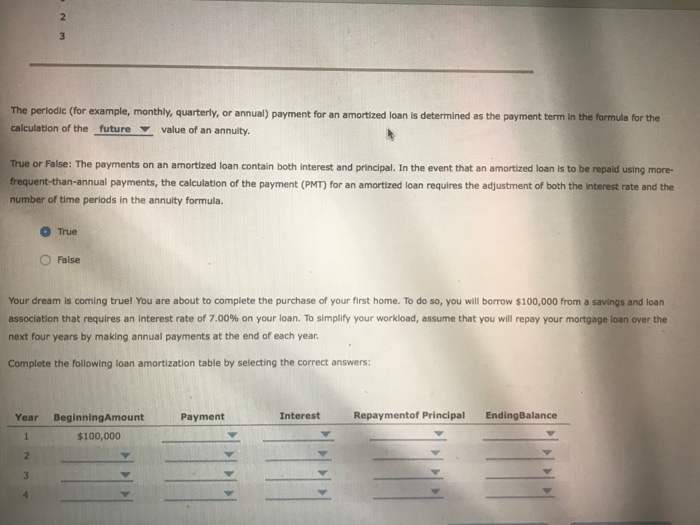

An amortization table reports the amount loan. of Interest and principal contalined within each regularly scheduled payment used to repay an amortized Example Amortization Schedule Year Beginning Amount Payment Interest Repayment of Prncipal Ending Balance The periodic (for example, monthly, quarterly, calculation of the futurevalue of an annuity or annual) payment for an amortized loan is determined as the payment term in the formula for the True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using more- payments, the calculation of the peyment (PMT) for an amortized loan requires the adjustment of both the interest rate and the number of time periods in the annuity formula. O True False Your dream is coming true! You are about to complete the purchase of your nrst homeTo do so, you will borrow sooooo rom: uvng"ndbn association that requires an interest rate of 7.00% on your loan. TO simplify your workload, assume that you will repay your mortgage loan over the next four years by making annual payments at the end of each year Complete the following loan amortization table by selecting the correct answers: The perlodic (for example, monthly, quarterly, or annual) payment for an amortized loan is determined as the payment term in the formula for the calculation of the future value of an annuity. True or False: The payments on an amortized loan contain both interest and principal. In the event that an amortized loan is to be repaid using more- frequent-than-annual payments, the calculation of the payment (PMT) for an amortized loan requires the adjustment of both the interest rate and the number of time periods in the annuity formula. O True O False Your dream is coming true! You are about to complete the purchase of your first home. To do so, you will borrow $100,000 from a savings and loan association that requires an interest rate of 7.00% on your loan. To simplify your workload, assume that you will repay your mortgage loan over the next four years by making annual payments at the end of each year Complete the following loan amortization table by selecting the correct answers: Year BeginningAmount Payment Interest Repaymentof Principal EndingBalance $100,000