Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the last two pictures the first three are information YOU MUST SUBMIT ALL HANDWRITTEN PAGES OF THIS DOCUMENT Part 1: Insert the Trial

please answer the last two pictures the first three are information

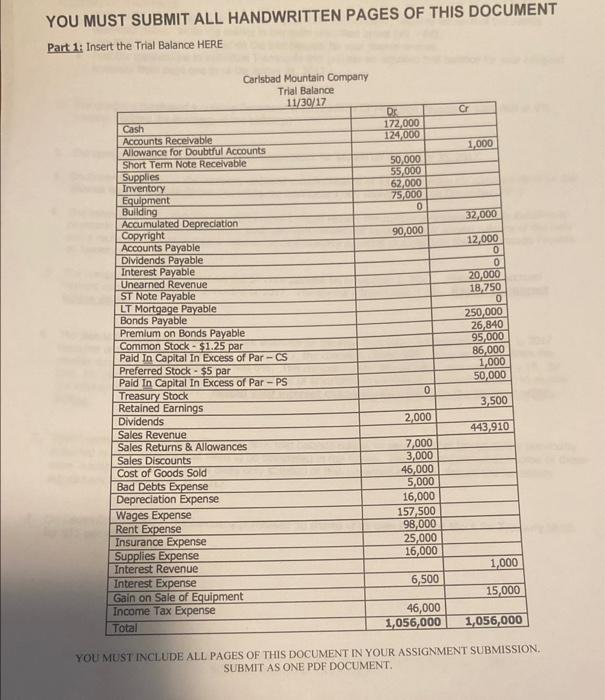

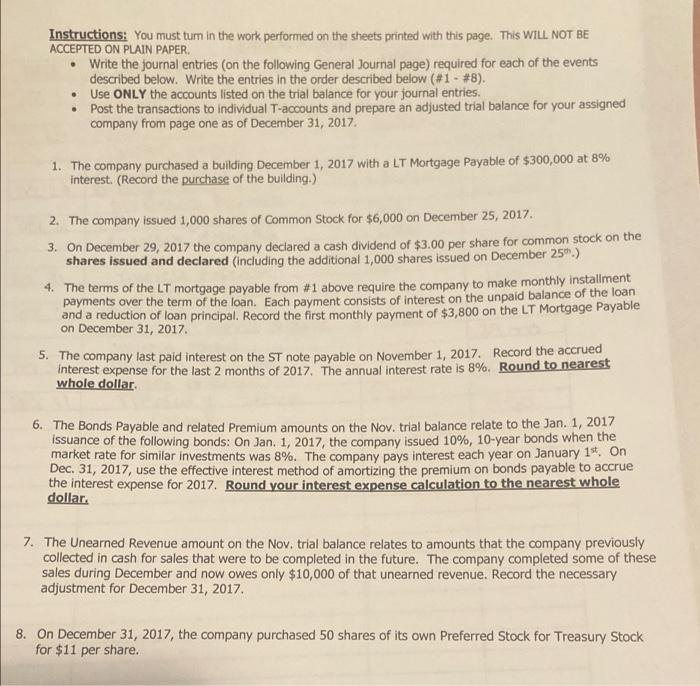

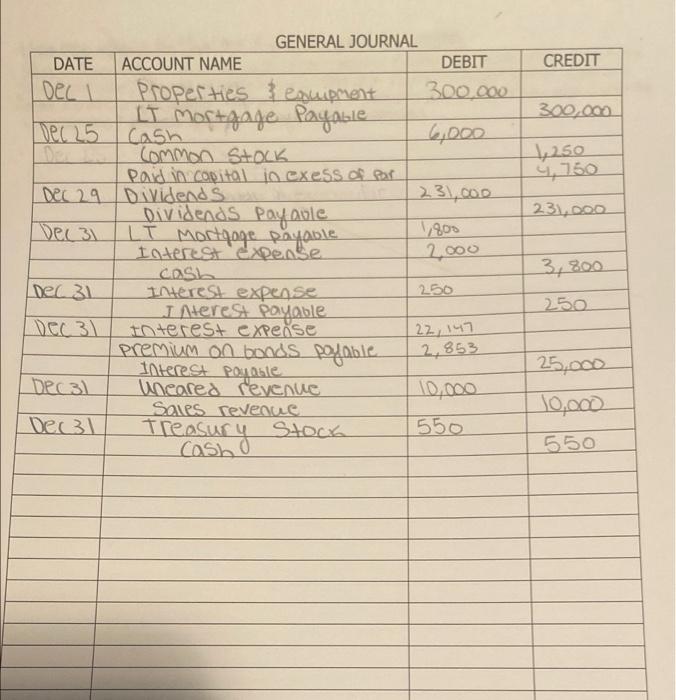

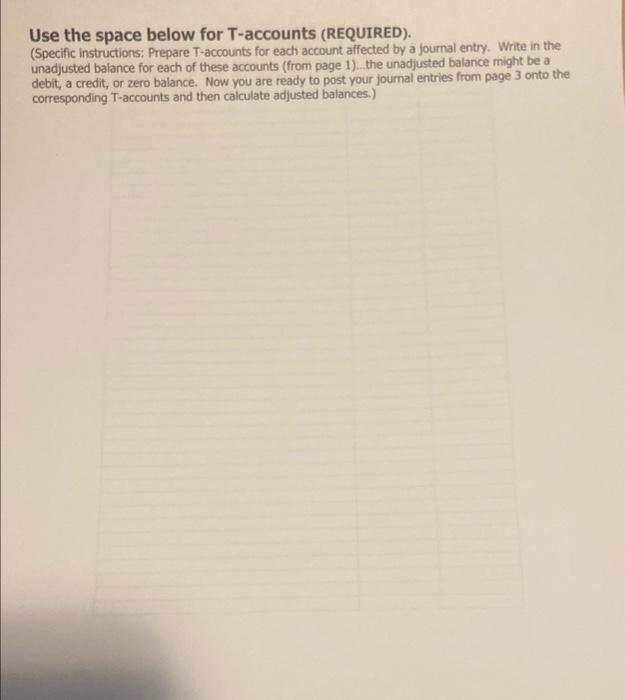

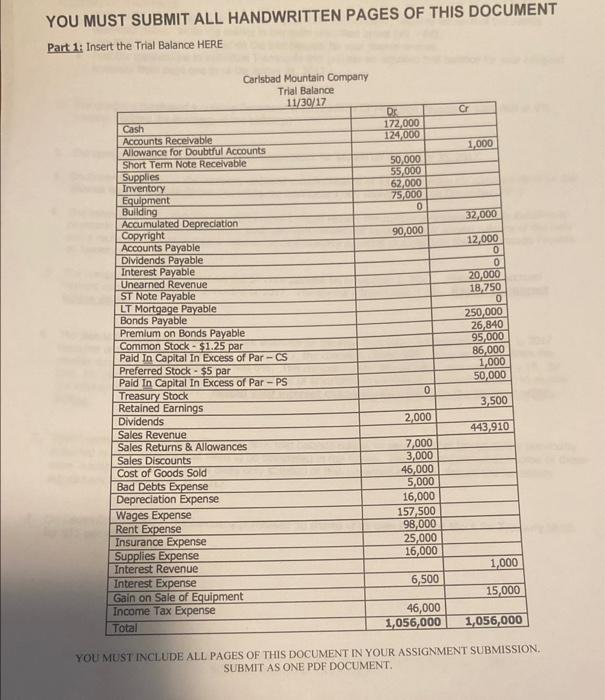

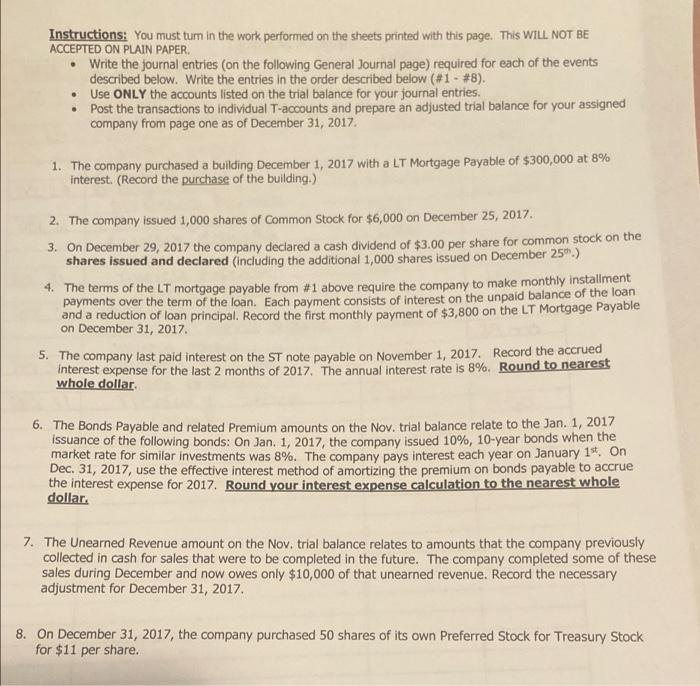

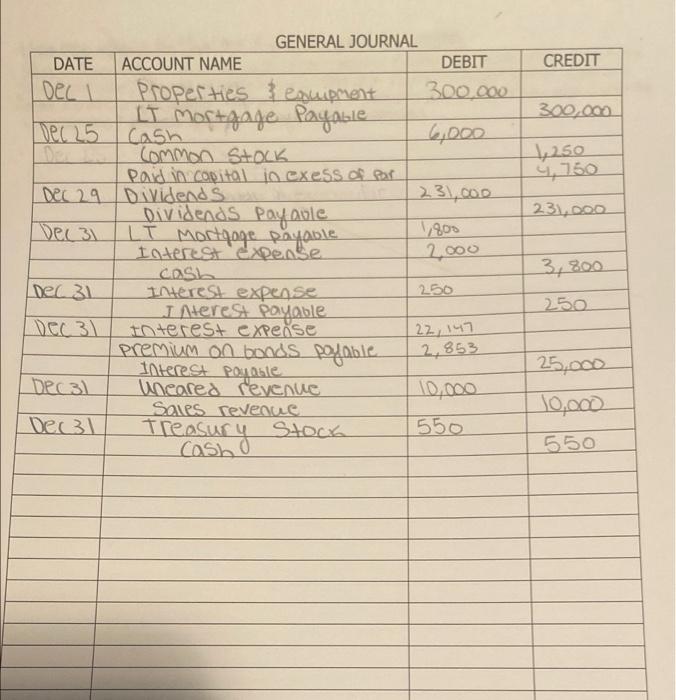

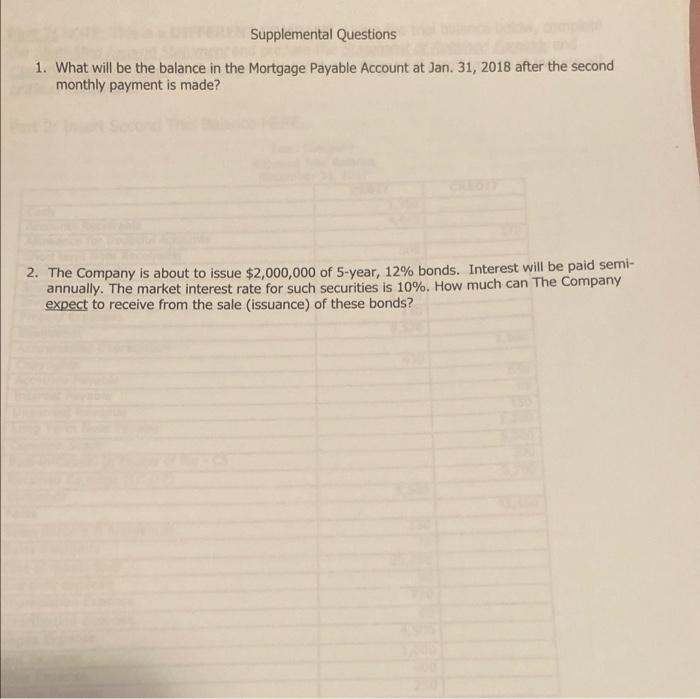

YOU MUST SUBMIT ALL HANDWRITTEN PAGES OF THIS DOCUMENT Part 1: Insert the Trial Balance HERE Carlsbad Mountain Company Trial Balance 11/30/17 Cr DE 172,000 124,000 1,000 50,000 55,000 62,000 75,000 0 32,000 90,000 Cash Accounts Receivable Allowance for Doubtful Accounts Short Term Note Receivable Supplies Inventory Equipment Building Accumulated Depreciation Copyright Accounts Payable Dividends Payable Interest Payable Unearned Revenue ST Note Payable LT Mortgage Payable Bonds Payable Premium on Bonds Payable Common Stock - $1.25 par Paid In Capital In Excess of Par-CS Preferred Stock - $5 par Paid In Capital In Excess of Par-PS Treasury Stock Retained Earnings Dividends Sales Revenue Sales Returns & Allowances Sales Discounts Cost of Goods Sold Bad Debts Expense Depreciation Expense Wages Expense Rent Expense Insurance Expense Supplies Expense Interest Revenue Interest Expense Gain on Sale of Equipment Income Tax Expense Total 12,000 0 0 20,000 18,750 0 250,000 26,840 95,000 86,000 1,000 50,000 0 3,500 2,000 443,910 7,000 3,000 46,000 5,000 16,000 157,500 98,000 25,000 16,000 1,000 6,500 15,000 46,000 1,056,000 1,056,000 YOU MUST INCLUDE ALL PAGES OF THIS DOCUMENT IN YOUR ASSIGNMENT SUBMISSION SUBMIT AS ONE PDF DOCUMENT, CREDIT 300.000 1,250 4,750 231,000 GENERAL JOURNAL DATE ACCOUNT NAME DEBIT Dec I Properties & eacupment 300.000 LT mortgage Payable Dec 25 Cash 6000 Common stock Paid in capital in exess of Par Dec 29 Dividends. 231,000 Dividends payaule Dec 31 IT Mortgage payable 800 Interest expense. 2,000 cash Dec 31 Interest expense 250 Interest Payable Dec 31 Interest expense Premium on bonds palable Interest Payable Decal uneared revenue 10.000 Sales revenue Decal Treasury Stock 550 o 34 800 250 22, 147 2,853 25,000 10,000 550 Use the space below for T-accounts (REQUIRED). (Specific instructions: Prepare T-accounts for each account affected by a journal entry. Write in the unadjusted balance for each of these accounts (from page 1). the unadjusted balance might be a debit, a credit, or zero balance. Now you are ready to post your journal entries from page 3 onto the corresponding T-accounts and then calculate adjusted balances.) ADJUSTED TRIAL BALANCE 12/31/17 8 Dr Supplemental Questions 1. What will be the balance in the Mortgage Payable Account at Jan. 31, 2018 after the second monthly payment is made? 2. The Company is about to issue $2,000,000 of 5-year, 12% bonds. Interest will be paid semi- annually. The market interest rate for such securities is 10%. How much can The Company expect to receive from the sale (issuance) of these bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started