Answered step by step

Verified Expert Solution

Question

1 Approved Answer

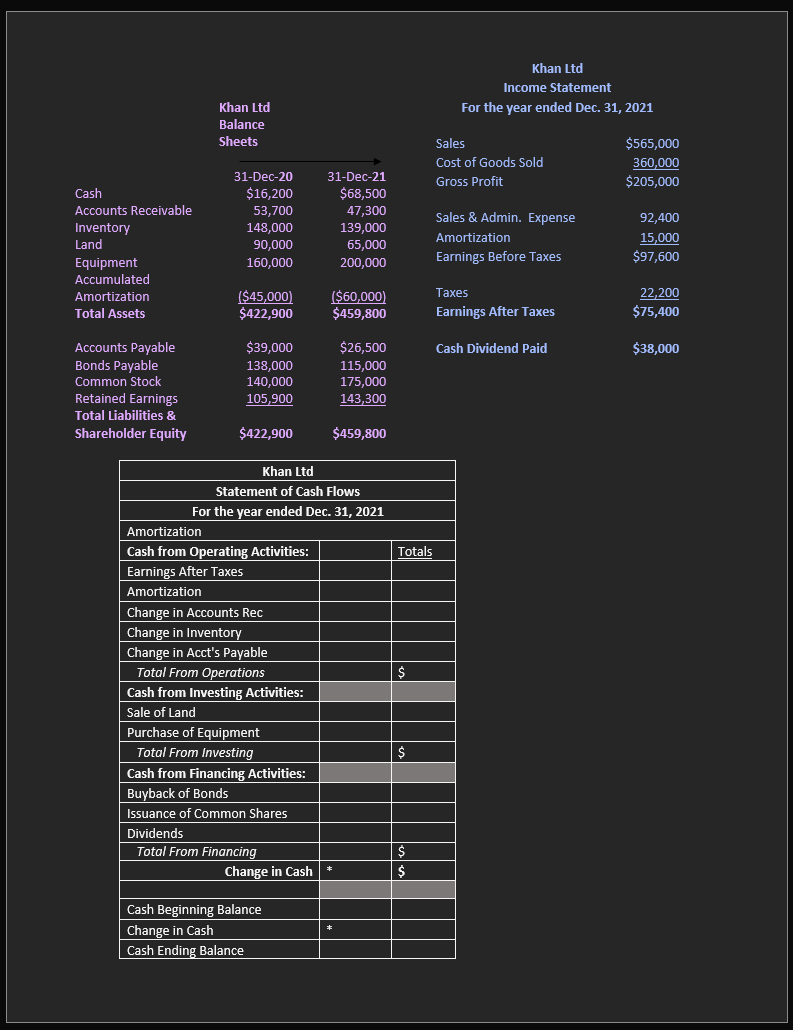

PLEASE ANSWER THE MISSING BLANKS IN THE TABLE :) THANK YOU :) Khan Ltd Income Statement For the year ended Dec. 31, 2021 Khan Ltd

PLEASE ANSWER THE MISSING BLANKS IN THE TABLE :) THANK YOU :)

Khan Ltd Income Statement For the year ended Dec. 31, 2021 Khan Ltd Balance Sheets Sales Cost of Goods Sold Gross Profit $565,000 360,000 $205,000 Cash Accounts Receivable Inventory Land Equipment Accumulated Amortization Total Assets 31-Dec-20 $16,200 53,700 148,000 90,000 160,000 31-Dec-21 $68,500 47,300 139,000 65,000 200,000 Sales & Admin. Expense Amortization Earnings Before Taxes 92,400 15,000 $97,600 ($45,000) $422,900 ($60,000) $459,800 Taxes Earnings After Taxes 22,200 $75,400 Cash Dividend Paid $38,000 Accounts Payable Bonds Payable Common Stock Retained Earnings Total Liabilities & Shareholder Equity $39,000 138,000 140,000 105,900 $26,500 115,000 175,000 143,300 $422,900 $459,800 Totals Khan Ltd Statement of Cash Flows For the year ended Dec. 31, 2021 Amortization Cash from Operating Activities: Earnings After Taxes Amortization Change in Accounts Rec Change in Inventory Change in Acct's Payable Total From Operations Cash from Investing Activities: Sale of Land Purchase of Equipment Total From Investing Cash from Financing Activities: Buyback of Bonds Issuance of Common Shares Dividends Total From Financing Change in Cash $ $ $ $ * Cash Beginning Balance Change in Cash Cash Ending BalanceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started