Answered step by step

Verified Expert Solution

Question

1 Approved Answer

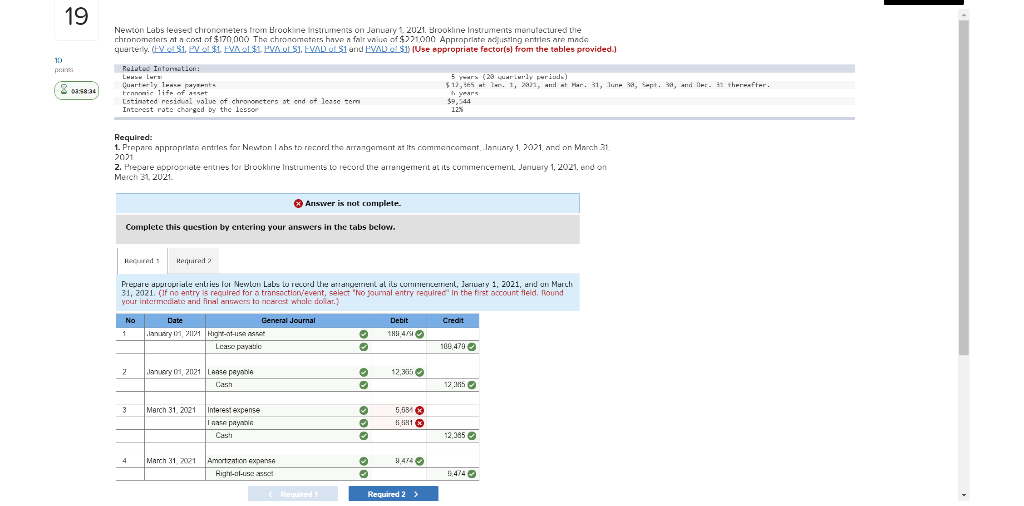

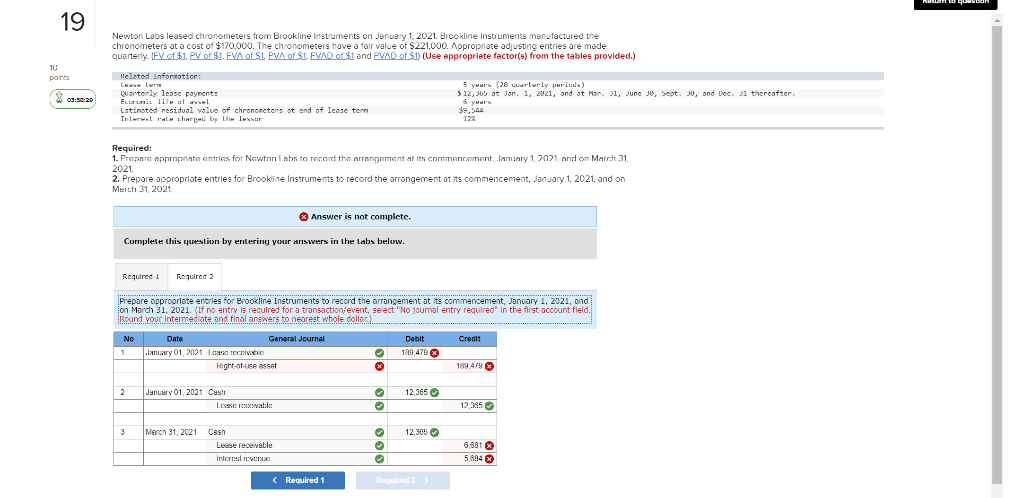

PLEASE ANSWER THE ONES I GOT WRONG QUESTIONS IN RED 19 Newton Labs leased chronometers from Brookline Instruments on January 1 2021. Brookline Instruments manufectured

PLEASE ANSWER THE ONES I GOT WRONG QUESTIONS IN RED

19 Newton Labs leased chronometers from Brookline Instruments on January 1 2021. Brookline Instruments manufectured the chronometers at a cost of $170.000 The chronometers have a fair value of $221000 Appropriate adjusting entries are made querterly. (EV $1. PV L$1. EVA 1 PVA OL51. EVAD OLS1 and PVAD O $11 (Use appropriate factor(s) from the tables provided.) 1D Related Information Lwww Lure Quarterly le parents Fronie life of Estinted residual value of chrononeters at end of lesse tem Interest rate charged by the lesson 5 years (28 vururly periods) $ 12,965 tlen, 1, 221, Ant Mar. 31, 3, Sept., and . 31 thereafter 3 18:30 12% Required: 1. Prepare appropriate entries for Newton labs to record the arrangement at its commancamant. January 1, 2021, and on March 31, 2011 2. Prepare appropnale entries for Brookline Instruments to record the arrengement at its commencement Jenuery 1, 2021, end on Merch 31, 2021 * Answer is not complete. Complete this question by entering your answers in the tabs below. Required Prepare appropriale entries for Newlon Labs lu record the atlangeminal ils commercenen, der dty 1, 2021, and on March 31, 2021 (If no entry is required for a transaction event, select "No journal entry required in the first account field. Round your intermediate and final answers to nearest whole dollar.) No Debit Credit 1. Date General Journal lawary in 71124 Rigit-at-IISA ASP Les py 1914/41 100479 12,35 January 01, 2021 Lease payable Cash 12385 3 March 31, 2021 Interest expense Inace payable Casti 5,584 IN 12,385 4 March 31 2001 9,474 Amortization expansa Righ-alusest 474 en aqaian 19 Newton Labs leased chronometers from Brookline Instruments on January 1, 2021. Brookline Instruments manufactured the chronometers at a cost of $170.000. The chronometers have a fair value of $221,000. Appropriate adjusting entries are made quarterly. (FV of $1. PV of $1. FVA of S1. PVA of S1 FVAD of $i and PVAD of S1) (Use appropriate factor(s) from the tables provided.) 10 points Itelated information La Luna Quarterly lease payments Ecru lilul Latinated residual value of chrononctors at end of losse tem Inwall har by the lussur 5 yrs (20 Lurly prius) $ 12,365 at Jan. 1, 2021, and at Ms. 31, June Ju, Sept. 30, and Dec. 31 thereafter 6 HP $9,544 Required: 1. Prepare appropriate entries for Newton Inhs to record the arrangement at its commencement, January 1, 2021, and on March 31 2021 2. Prepare appropriate entries for Brookline Instruments to record the arrangement at its commencement, January 1, 2021, and on March 31, 2021 Answer is not complete. Complete this question by erilering your answers in the labs below. Required! Required 2 Prepare appropriate entries for Brookline Instruments to record the arrangement at its commencement, January 1, 2021, and on March 31, 2021. (If no entry is required for a transaction/event, select 'No journal entry required in the first account field. Round your intermediate and final answers to nearest whole dollar Credit No 1 Date General Journal nary 01, 2021 crewsle Hoght-ot-useassat Debit 129,479 x 189,479 2 January 01, 2021 Cash Lex 12,365 12385 3 March 31, 2021 Cash 12,365 Lease receivable Interest 8,601x 5 804 x en aqaian 19 Newton Labs leased chronometers from Brookline Instruments on January 1, 2021. Brookline Instruments manufactured the chronometers at a cost of $170.000. The chronometers have a fair value of $221,000. Appropriate adjusting entries are made quarterly. (FV of $1. PV of $1. FVA of S1. PVA of S1 FVAD of $i and PVAD of S1) (Use appropriate factor(s) from the tables provided.) 10 points Itelated information La Luna Quarterly lease payments Ecru lilul Latinated residual value of chrononctors at end of losse tem Inwall har by the lussur 5 yrs (20 Lurly prius) $ 12,365 at Jan. 1, 2021, and at Ms. 31, June Ju, Sept. 30, and Dec. 31 thereafter 6 HP $9,544 Required: 1. Prepare appropriate entries for Newton Inhs to record the arrangement at its commencement, January 1, 2021, and on March 31 2021 2. Prepare appropriate entries for Brookline Instruments to record the arrangement at its commencement, January 1, 2021, and on March 31, 2021 Answer is not complete. Complete this question by erilering your answers in the labs below. Required! Required 2 Prepare appropriate entries for Brookline Instruments to record the arrangement at its commencement, January 1, 2021, and on March 31, 2021. (If no entry is required for a transaction/event, select 'No journal entry required in the first account field. Round your intermediate and final answers to nearest whole dollar Credit No 1 Date General Journal nary 01, 2021 crewsle Hoght-ot-useassat Debit 129,479 x 189,479 2 January 01, 2021 Cash Lex 12,365 12385 3 March 31, 2021 Cash 12,365 Lease receivable Interest 8,601x 5 804 xStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started