Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the please answer the 2 questions below A company producing cell phone cases uses either rubber (x1) or plastic (x2) with the following

please answer the

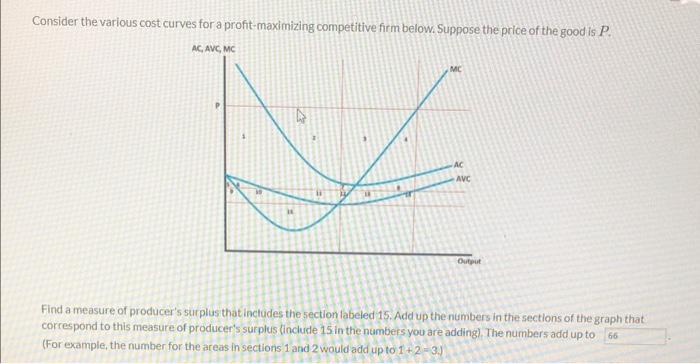

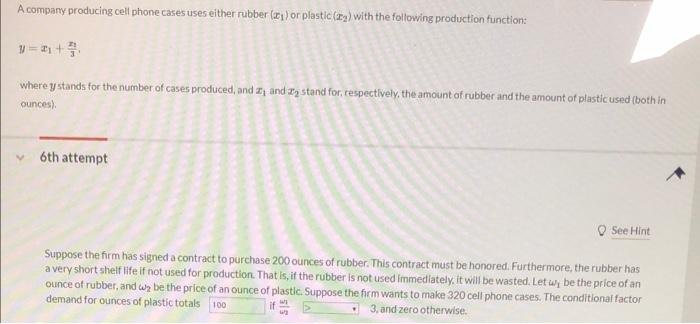

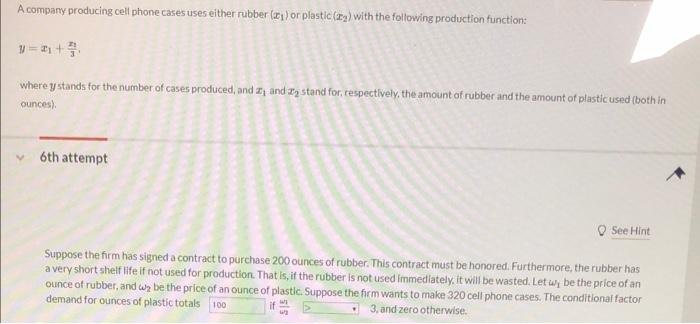

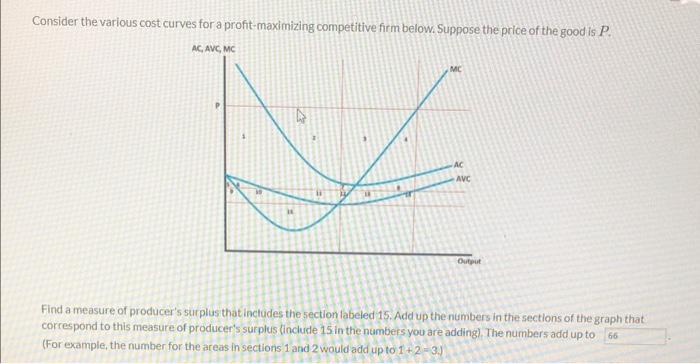

A company producing cell phone cases uses either rubber (x1) or plastic (x2) with the following production function: y=x1+xx1 where y stands for the number of cases produced, and x1 and x2 stand for, respectively, the amount of rubber and the amount of plastic used (both in ounces). 6 th attempt See Hint Suppose the firm has signed a contract to purchase 200 ounces of rubber. This contract must be honored. Furthermore, the rubber has a very short shelf life if not used for production. That is, if the rubber is not used immediately. it will be wasted. Let 1 be the price of an ounce of rubber, and 2 be the price of an ounce of plastic. Suppose the firm wants to make 320 cell phone cases. The conditional factor demand for ounces of plastic totals if 42wh 3. and zero otherwise. Consider the various cost curves for a profit-maximizing competitive firm below. Suppose the price of the good is P. Find a measure of producer's surplus that inctudes the section labeled 15. Add up the numbers in the sections of the graph that correspond to this measure of producer's surplus (include 15 in the numbets you are adding). The numbers add up to (For example, the number for the areas in sections 1 and 2 would add up to 1+2=3 ) please answer the 2 questions below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started