please answer the q1 rich-cheap analysis and treasury arbitrage by word or excel, thank you!

undefined

undefined

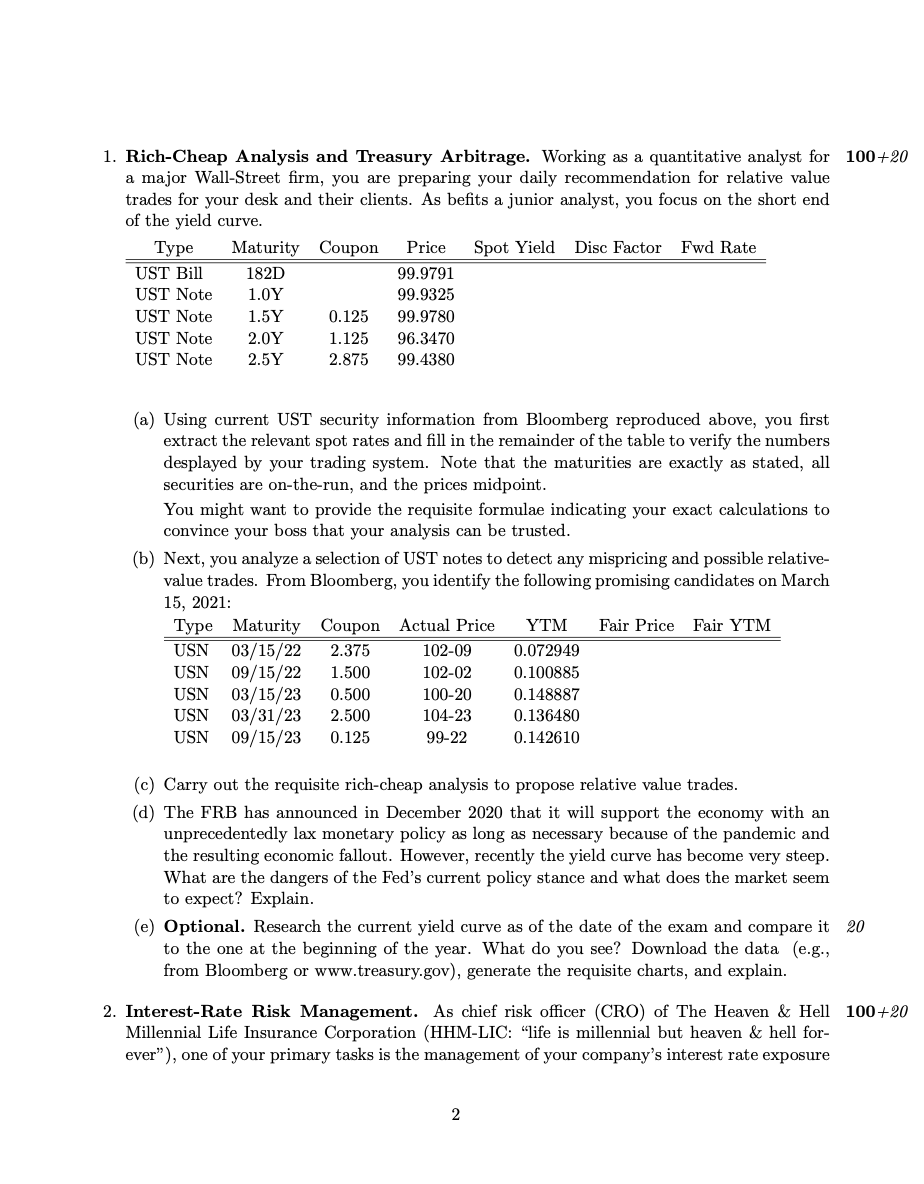

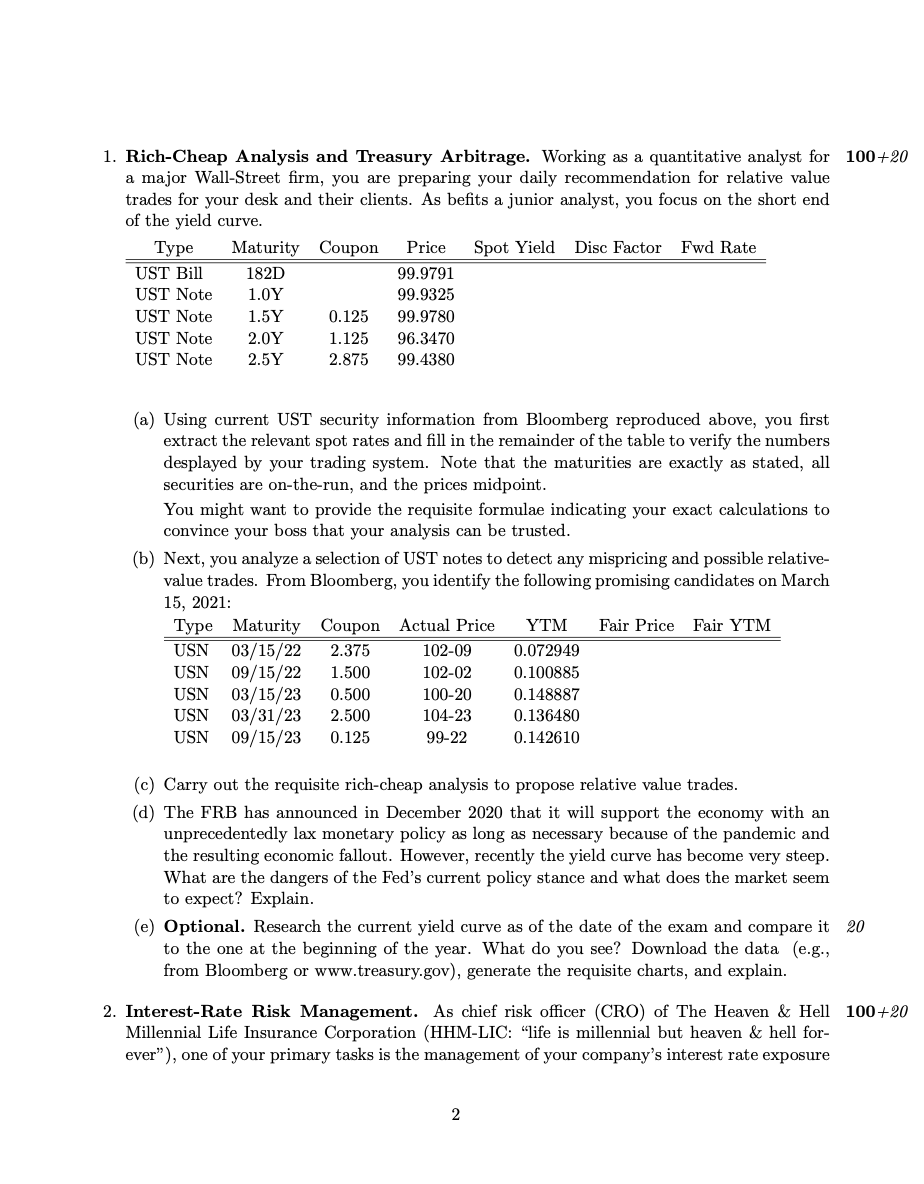

1. Rich-Cheap Analysis and Treasury Arbitrage. Working as a quantitative analyst for 100+20 a major Wall-Street firm, you are preparing your daily recommendation for relative value trades for your desk and their clients. As befits a junior analyst, you focus on the short end of the yield curve. Type Maturity Coupon Price Spot Yield Disc Factor Fwd Rate UST Bill 182D 99.9791 UST Note 1.0Y 99.9325 UST Note 1.5Y 0.125 99.9780 UST Note 2.0Y 1.125 96.3470 UST Note 2.5Y 2.875 99.4380 (a) Using current UST security information from Bloomberg reproduced above, you first extract the relevant spot rates and fill in the remainder of the table to verify the numbers desplayed by your trading system. Note that the maturities are exactly as stated all securities are on-the-run, and the prices midpoint. You might want to provide the requisite formulae indicating your exact calculations to convince your boss that your analysis can be trusted. (b) Next, you analyze a selection of UST notes to detect any mispricing and possible relative- value trades. From Bloomberg, you identify the following promising candidates on March 15, 2021: Type Maturity Coupon Actual Price YTM Fair Price Fair YTM USN 03/15/22 2.375 102-09 0.072949 USN 09/15/22 1.500 102-02 0.100885 USN 03/15/23 0.500 100-20 0.148887 USN 03/31/23 2.500 104-23 0.136480 USN 09/15/23 0.125 99-22 0.142610 (c) Carry out the requisite rich-cheap analysis to propose relative value trades. (d) The FRB has announced in December 2020 that it will support the economy with an unprecedentedly lax monetary policy as long as necessary because of the pandemic and the resulting economic fallout. However, recently the yield curve has become very steep. What are the dangers of the Fed's current policy stance and what does the market seem to expect? Explain. (e) Optional. Research the current yield curve as of the date of the exam and compare it 20 to the one at the beginning of the year. What do you see? Download the data (e.g., from Bloomberg or www.treasury.gov), generate the requisite charts, and explain. 2. Interest Rate Risk Management. As chief risk officer (CRO) of The Heaven & Hell 100+20 Millennial Life Insurance Corporation (HHM-LIC: "life is millennial but heaven & hell for- ever"), one of your primary tasks is the management of your company's interest rate exposure 2 1. Rich-Cheap Analysis and Treasury Arbitrage. Working as a quantitative analyst for 100+20 a major Wall-Street firm, you are preparing your daily recommendation for relative value trades for your desk and their clients. As befits a junior analyst, you focus on the short end of the yield curve. Type Maturity Coupon Price Spot Yield Disc Factor Fwd Rate UST Bill 182D 99.9791 UST Note 1.0Y 99.9325 UST Note 1.5Y 0.125 99.9780 UST Note 2.0Y 1.125 96.3470 UST Note 2.5Y 2.875 99.4380 (a) Using current UST security information from Bloomberg reproduced above, you first extract the relevant spot rates and fill in the remainder of the table to verify the numbers desplayed by your trading system. Note that the maturities are exactly as stated all securities are on-the-run, and the prices midpoint. You might want to provide the requisite formulae indicating your exact calculations to convince your boss that your analysis can be trusted. (b) Next, you analyze a selection of UST notes to detect any mispricing and possible relative- value trades. From Bloomberg, you identify the following promising candidates on March 15, 2021: Type Maturity Coupon Actual Price YTM Fair Price Fair YTM USN 03/15/22 2.375 102-09 0.072949 USN 09/15/22 1.500 102-02 0.100885 USN 03/15/23 0.500 100-20 0.148887 USN 03/31/23 2.500 104-23 0.136480 USN 09/15/23 0.125 99-22 0.142610 (c) Carry out the requisite rich-cheap analysis to propose relative value trades. (d) The FRB has announced in December 2020 that it will support the economy with an unprecedentedly lax monetary policy as long as necessary because of the pandemic and the resulting economic fallout. However, recently the yield curve has become very steep. What are the dangers of the Fed's current policy stance and what does the market seem to expect? Explain. (e) Optional. Research the current yield curve as of the date of the exam and compare it 20 to the one at the beginning of the year. What do you see? Download the data (e.g., from Bloomberg or www.treasury.gov), generate the requisite charts, and explain. 2. Interest Rate Risk Management. As chief risk officer (CRO) of The Heaven & Hell 100+20 Millennial Life Insurance Corporation (HHM-LIC: "life is millennial but heaven & hell for- ever"), one of your primary tasks is the management of your company's interest rate exposure 2

undefined

undefined