please answer the q2 by using the words or excel, thank you!

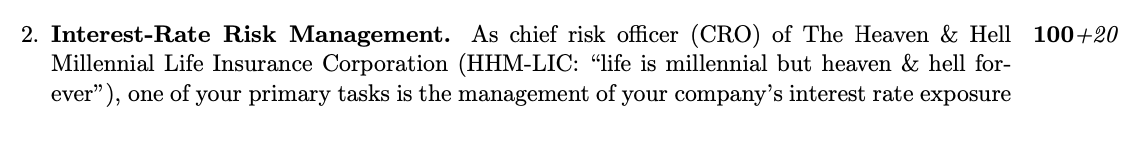

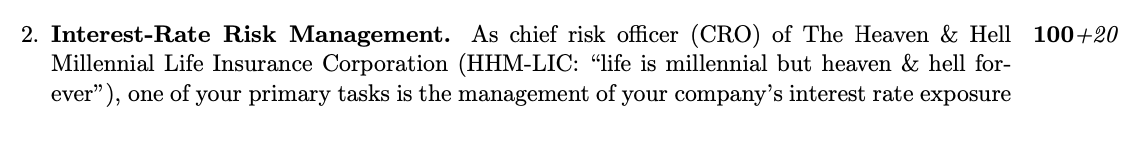

100+20 2. Interest-Rate Risk Management. As chief risk officer (CRO) of The Heaven & Hell Millennial Life Insurance Corporation (HHM-LIC: life is millennial but heaven & hell for- ever), one of your primary tasks is the management of your company's interest rate exposure together with other risks and their interaction. Following best industry practices, you are cur- rently trying to convince your board to move beyond traditional approaches to interest-rate risk and actively manage your institution's rate exposure by relying less on external consul- tants but instead implement models based on tried and tested mathematical relations between fixed-income prices and yields (rates). (a) State a formula which relates changes in fixed-income price to interest-rate variability (i.e., changes in yields) using at least one if not two different measures of yield sensitivity. Illustrate how bond prices are related to yields on the basis of this formula and a diagram. Why or why not is this approach valid? (b) Currently, the modified duration of your investment portfolio is 23.504 years whereas the modified duration of your liabilities (life-insurance policies, variable rate annuities, and savings products) comes to 26 years. You may assume that the average yield on assets and liabilities for a company of HH-LIC's credit quality is around 4.00%. You expect interest-rates to increase by 10 bps over the next quarter. Calculate HH-LIC's net rate exposure and propose a strategy to neutralize the effect of interest-rate changes on your balance sheet which is as follows (market as opposed to book value in billion USD): HH-LIC Simplified Balance Sheet Assets Liabilities Fixed-income portfolio 100 Equity Cash and cash equivalent 10 Annuities, policies, saving plans Total 110 Total 15 95 110 (c) From mid December 2020 to the end of February 2021, yields on 10Y Treasuries have risen by about 40 bps and analyze the impact of further rate hikes on your assets. You just bought $100m of the on-the-run 30Y Treasury STRIP which is currently yielding 2.34%. Note that the convexity of a zero is very close to the sqaure of its maturity; you can ignore slight maturity mismatches. Compute its price and the dollar amounts by which you would you expect its price to change for an additional 60 bps rise in interest rates over the next 12 months. (d) At a meeting of HH-LIC's board you propose to update current A&L management prac- tices focusing more on interest-rate exposure given the shifting monetary environment. Formulate an appropriate objective in terms of a measure of interest-rate sensitivity. One of your board members, a retired bank CFO, claims that your approach to interest-rate exposure measurement and management is fundamentally flawed. What problems might she referring to? Do you agree with her assessment? (e) Optional. What are typical other risks which life-insurance companies face? Dis- 20 tinguish between financial and nonfinancial risks and explain how they might interact (correlation) to increase the overall business and financial risk of the company. 3. Commercial Banking. You are a corporate account officer with the Commercial & In- 100+20 3 100+20 2. Interest-Rate Risk Management. As chief risk officer (CRO) of The Heaven & Hell Millennial Life Insurance Corporation (HHM-LIC: life is millennial but heaven & hell for- ever), one of your primary tasks is the management of your company's interest rate exposure together with other risks and their interaction. Following best industry practices, you are cur- rently trying to convince your board to move beyond traditional approaches to interest-rate risk and actively manage your institution's rate exposure by relying less on external consul- tants but instead implement models based on tried and tested mathematical relations between fixed-income prices and yields (rates). (a) State a formula which relates changes in fixed-income price to interest-rate variability (i.e., changes in yields) using at least one if not two different measures of yield sensitivity. Illustrate how bond prices are related to yields on the basis of this formula and a diagram. Why or why not is this approach valid? (b) Currently, the modified duration of your investment portfolio is 23.504 years whereas the modified duration of your liabilities (life-insurance policies, variable rate annuities, and savings products) comes to 26 years. You may assume that the average yield on assets and liabilities for a company of HH-LIC's credit quality is around 4.00%. You expect interest-rates to increase by 10 bps over the next quarter. Calculate HH-LIC's net rate exposure and propose a strategy to neutralize the effect of interest-rate changes on your balance sheet which is as follows (market as opposed to book value in billion USD): HH-LIC Simplified Balance Sheet Assets Liabilities Fixed-income portfolio 100 Equity Cash and cash equivalent 10 Annuities, policies, saving plans Total 110 Total 15 95 110 (c) From mid December 2020 to the end of February 2021, yields on 10Y Treasuries have risen by about 40 bps and analyze the impact of further rate hikes on your assets. You just bought $100m of the on-the-run 30Y Treasury STRIP which is currently yielding 2.34%. Note that the convexity of a zero is very close to the sqaure of its maturity; you can ignore slight maturity mismatches. Compute its price and the dollar amounts by which you would you expect its price to change for an additional 60 bps rise in interest rates over the next 12 months. (d) At a meeting of HH-LIC's board you propose to update current A&L management prac- tices focusing more on interest-rate exposure given the shifting monetary environment. Formulate an appropriate objective in terms of a measure of interest-rate sensitivity. One of your board members, a retired bank CFO, claims that your approach to interest-rate exposure measurement and management is fundamentally flawed. What problems might she referring to? Do you agree with her assessment? (e) Optional. What are typical other risks which life-insurance companies face? Dis- 20 tinguish between financial and nonfinancial risks and explain how they might interact (correlation) to increase the overall business and financial risk of the company. 3. Commercial Banking. You are a corporate account officer with the Commercial & In- 100+20 3