Answered step by step

Verified Expert Solution

Question

1 Approved Answer

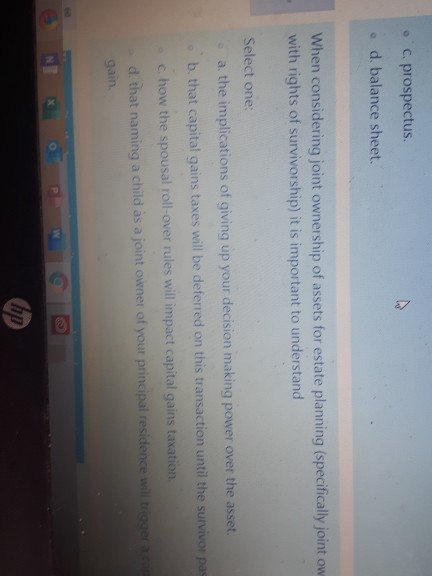

please answer the queation C. prospectus. d. balance sheet. When considering joint ownership of assets for estate planning (specifically joint with rights of survivorship) it

please answer the queation

C. prospectus. d. balance sheet. When considering joint ownership of assets for estate planning (specifically joint with rights of survivorship) it is important to understand OW Select one: a. the implications of giving up your decision making power over the asset. b. that capital gains taxes will be deferred on this transaction until the survivor pas c. how the spousal roll-over rules will impact capital gains taxation d. that naming a child as a joint owner of your principal residence will trigger aca gain hpStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started