Answered step by step

Verified Expert Solution

Question

1 Approved Answer

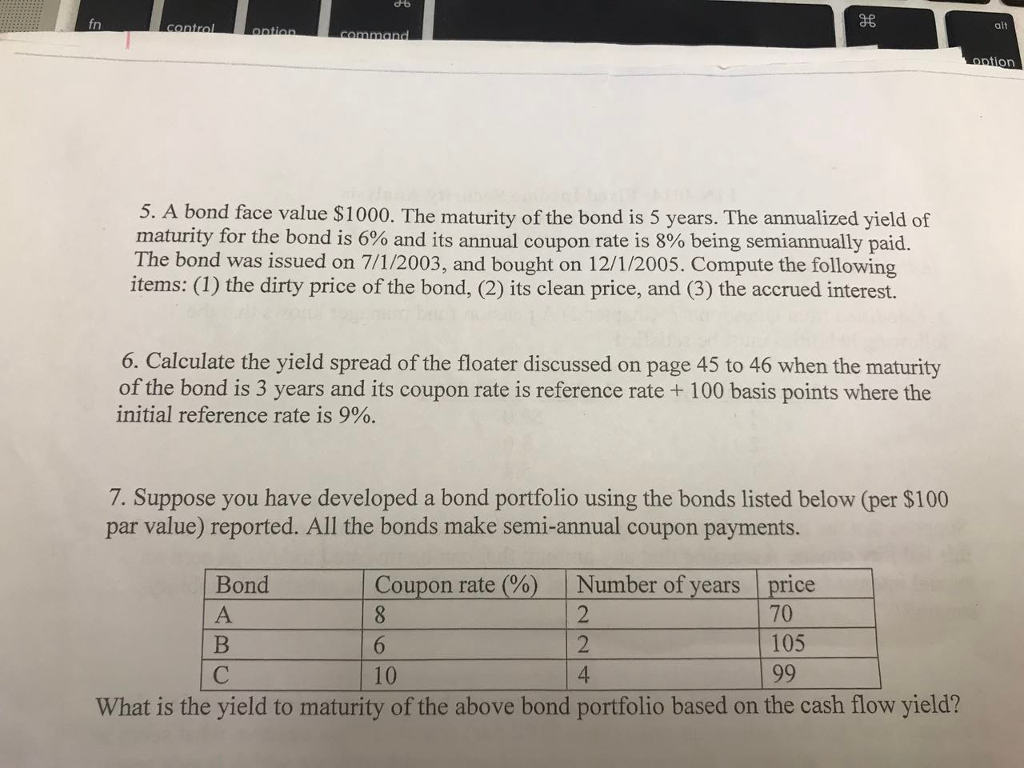

please answer the question 6 and 7 A bond face value $1000. The maturity of the bond is 5 years. The annualized yield of maturity

please answer the question 6 and 7

A bond face value $1000. The maturity of the bond is 5 years. The annualized yield of maturity for the bond is 6% and its annual coupon rate is 8% being semiannually paid. The bond was issued on 7/1/2003, and bought on 12/1/2005. Compute the following items: (1) the dirty price of the bond, (2) its clean price, and (3) the accrued interest. Calculate the yield spread of the floater discussed on page 45 to 46 when the maturity of the bond is 3 years and its coupon rate is reference rate + 100 basis points where the initial reference rate is 9%. Suppose you have developed a bond portfolio using the bonds listed below (per $100 par value) reported. All the bonds make semi-annual coupon payments. What is the yield to maturity of the above bond portfolio based on the cash flow yieldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started