Answered step by step

Verified Expert Solution

Question

1 Approved Answer

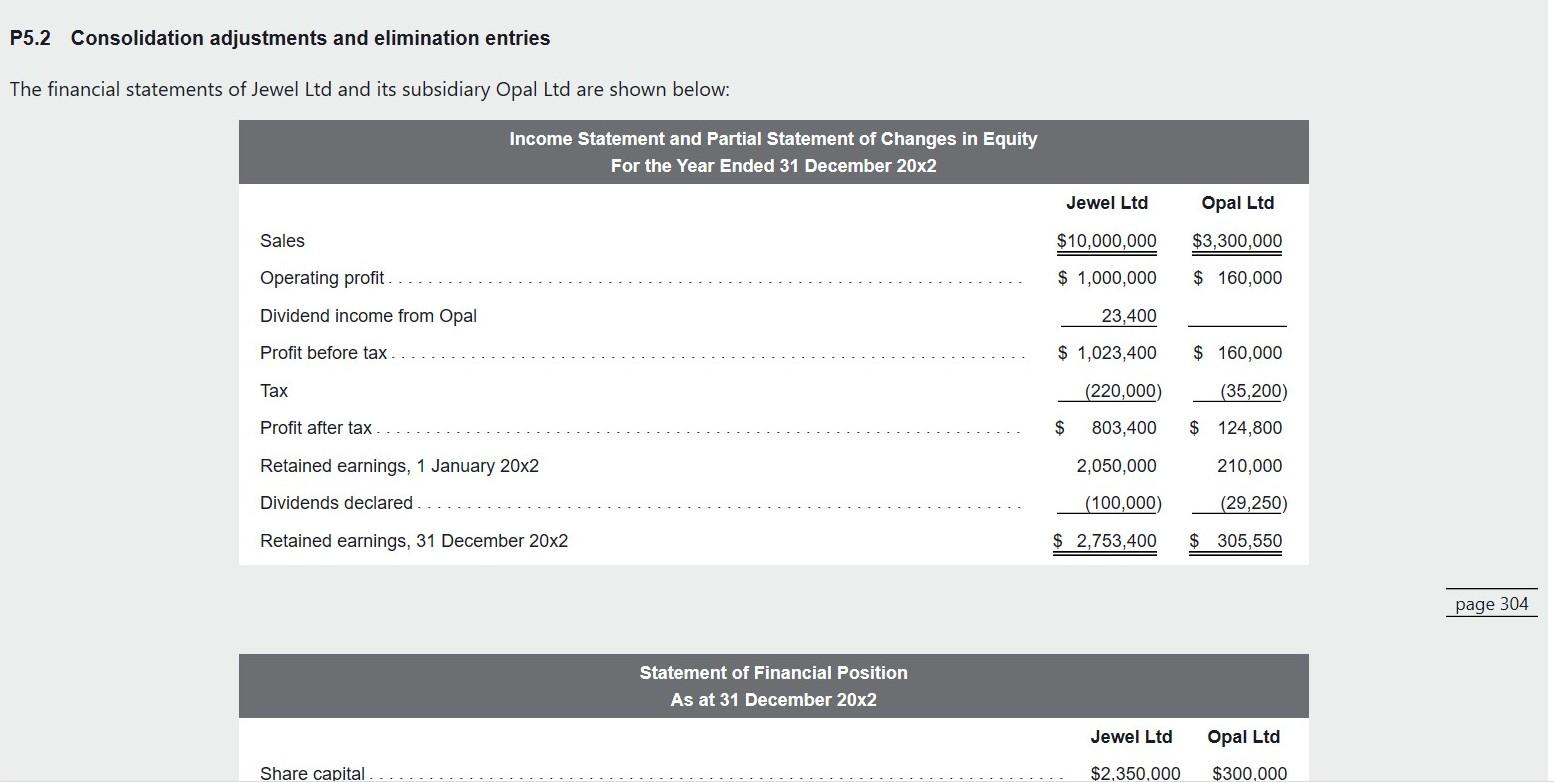

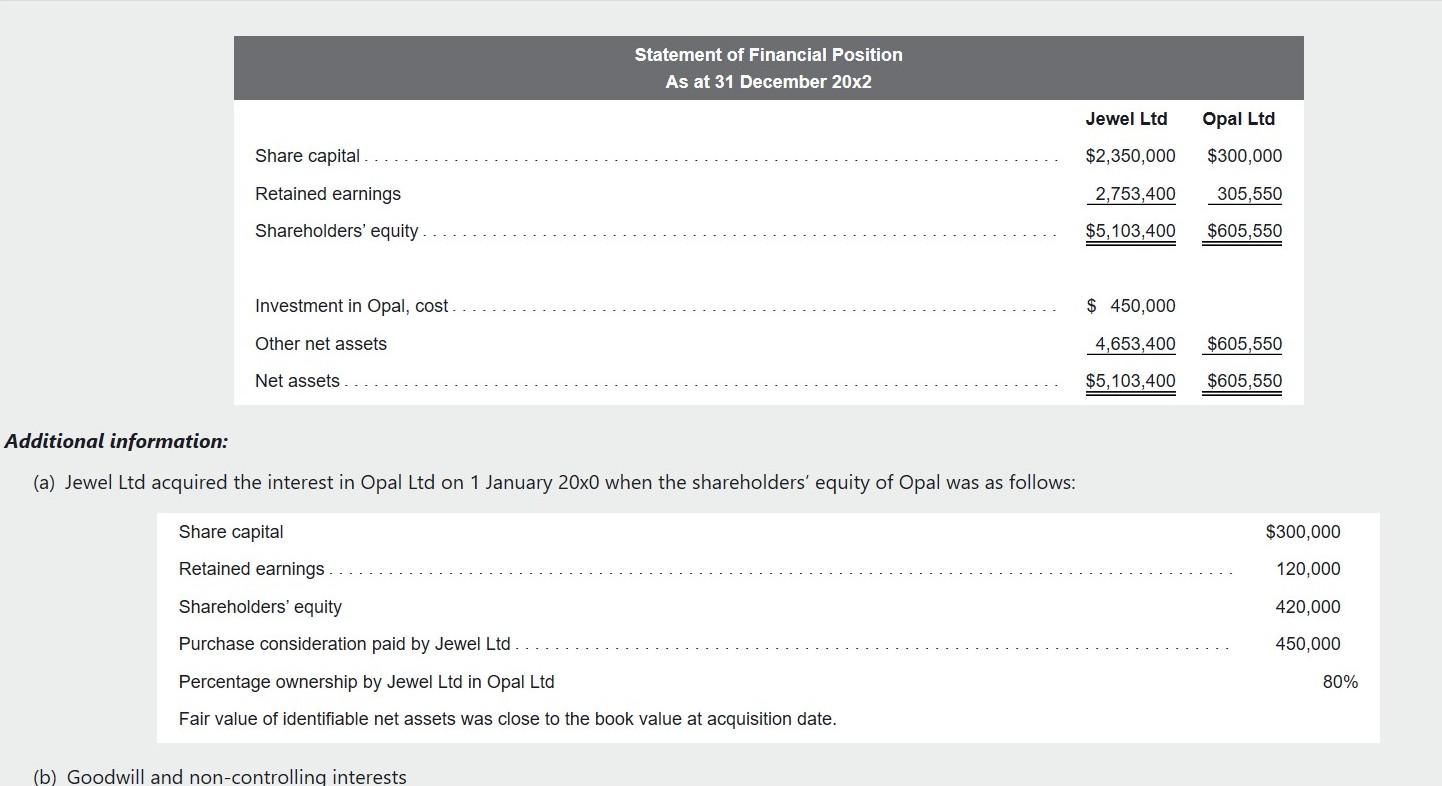

Please answer the question above P5.2 Consolidation adjustments and elimination entries The financial statements of Jewel Ltd and its subsidiary Opal Ltd are shown below:

Please answer the question above

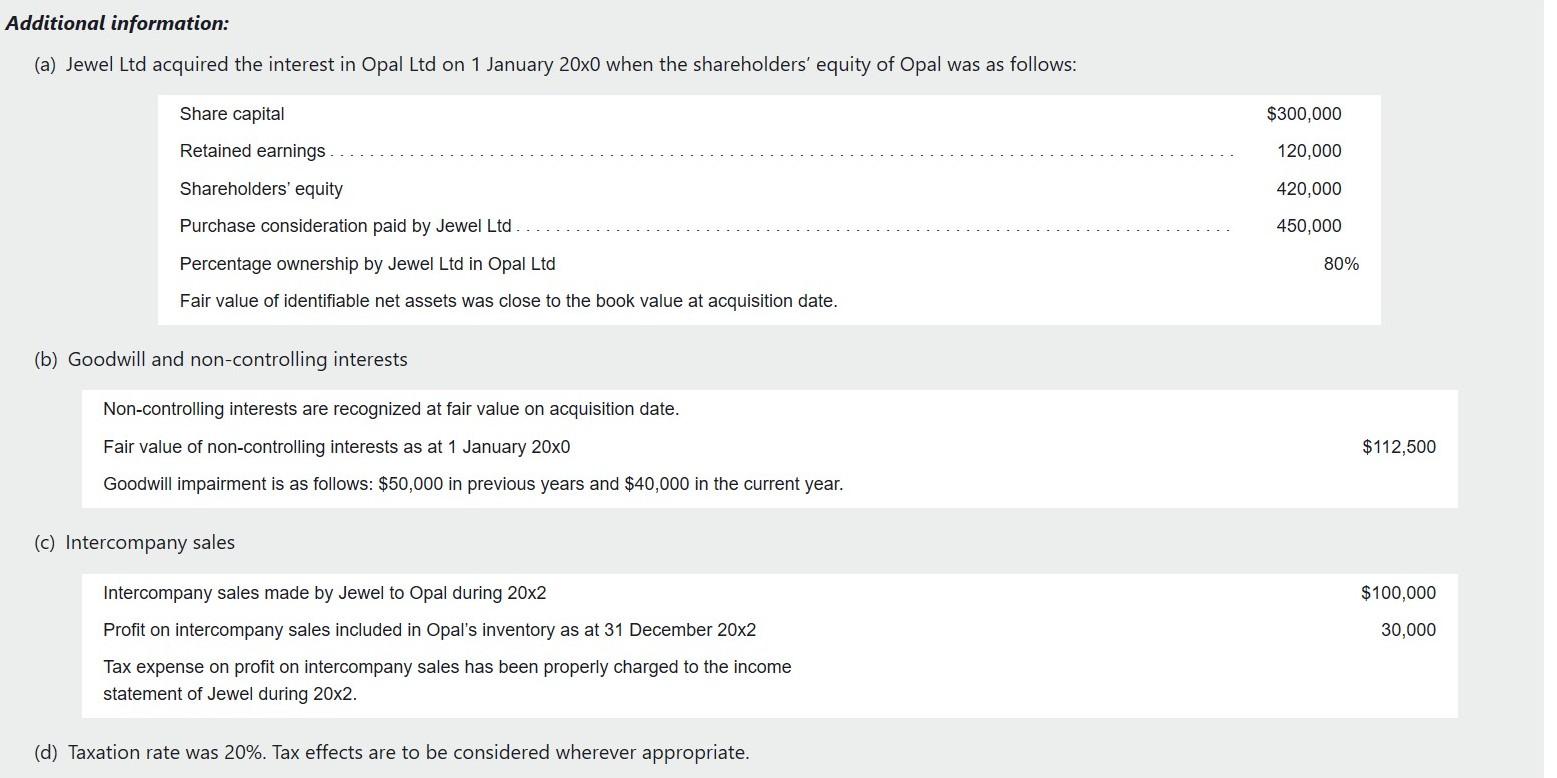

P5.2 Consolidation adjustments and elimination entries The financial statements of Jewel Ltd and its subsidiary Opal Ltd are shown below: Additional information: (a) Jewel Ltd acquired the interest in Opal Ltd on 1 January 20x0 when the shareholders' equity of Opal was as follows: (b) Goodwill and non-controlling interests Additional information: (a) Jewel Ltd acquired the interest in Opal Ltd on 1 January 200 when the shareholders' equity of Opal was as follows: (b) Goodwill and non-controlling interests Non-controlling interests are recognized at fair value on acquisition date. Fair value of non-controlling interests as at 1 January 200 Goodwill impairment is as follows: $50,000 in previous years and $40,000 in the current year. (c) Intercompany sales Intercompany sales made by Jewel to Opal during 202 Profit on intercompany sales included in Opal's inventory as at 31 December 202 Tax expense on profit on intercompany sales has been properly the income statement of Jewel during 202. (d) Taxation rate was 20%. Tax effects are to be considered wherever appropriate. equired: 3. Perform an analytical check on consolidated retained earnings as at 31 December 202. P5.2 Consolidation adjustments and elimination entries The financial statements of Jewel Ltd and its subsidiary Opal Ltd are shown below: Additional information: (a) Jewel Ltd acquired the interest in Opal Ltd on 1 January 20x0 when the shareholders' equity of Opal was as follows: (b) Goodwill and non-controlling interests Additional information: (a) Jewel Ltd acquired the interest in Opal Ltd on 1 January 200 when the shareholders' equity of Opal was as follows: (b) Goodwill and non-controlling interests Non-controlling interests are recognized at fair value on acquisition date. Fair value of non-controlling interests as at 1 January 200 Goodwill impairment is as follows: $50,000 in previous years and $40,000 in the current year. (c) Intercompany sales Intercompany sales made by Jewel to Opal during 202 Profit on intercompany sales included in Opal's inventory as at 31 December 202 Tax expense on profit on intercompany sales has been properly the income statement of Jewel during 202. (d) Taxation rate was 20%. Tax effects are to be considered wherever appropriate. equired: 3. Perform an analytical check on consolidated retained earnings as at 31 December 202

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started