Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the question and if possible post the calculation as well. Juicers Inc. is thinking of acquiring Fast Fruit Company. Fast Fruit currently has

Please answer the question and if possible post the calculation as well.

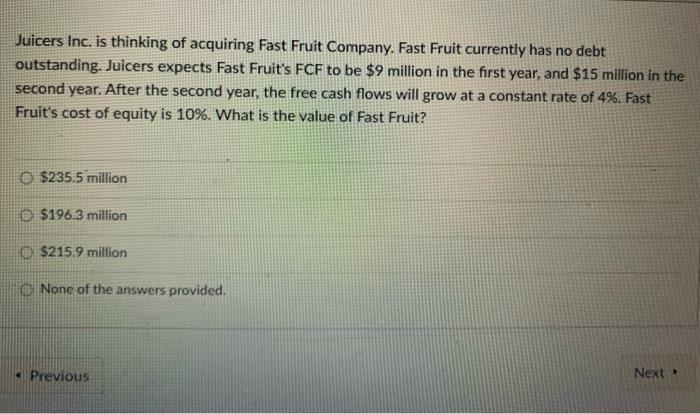

Juicers Inc. is thinking of acquiring Fast Fruit Company. Fast Fruit currently has no debt outstanding. Juicers expects Fast Fruit's FCF to be $9 million in the first year, and $15 million in the second year. After the second year, the free cash flows will grow at a constant rate of 4%. Fast Fruit's cost of equity is 10%. What is the value of Fast Fruit? $235.5 million $196.3 million $215.9 million None of the answers provided. Previous Next Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started