Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the Question B A hedge fund has created a portfolio using just two stocks. It has shorted $35,000,000 worth of Oracle stock and

Please answer the Question B

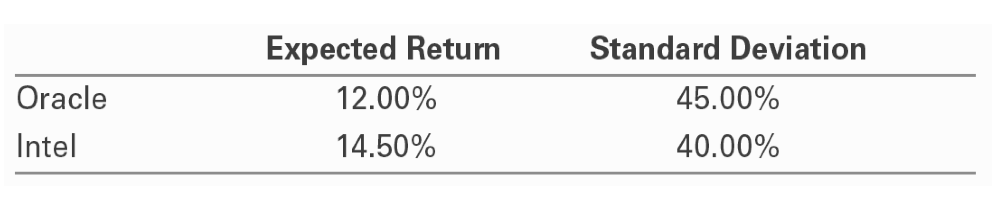

A hedge fund has created a portfolio using just two stocks. It has shorted $35,000,000 worth of Oracle stock and has purchased $85,000,000 of Intel stock. The correlation between Oracles and Intels returns is 0.65. The expected returns and standard deviations of the two stocks are given in the table below:

Question (B): Suppose the correlation between Intel and Oracles stock increases, but nothing else changes. Would the portfolio become more or less risky with this change? Why? (Please show the specific progress)

\begin{tabular}{lcc} & Expected Return & Standard Deviation \\ \hline Oracle & 12.00% & 45.00% \\ Intel & 14.50% & 40.00% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started